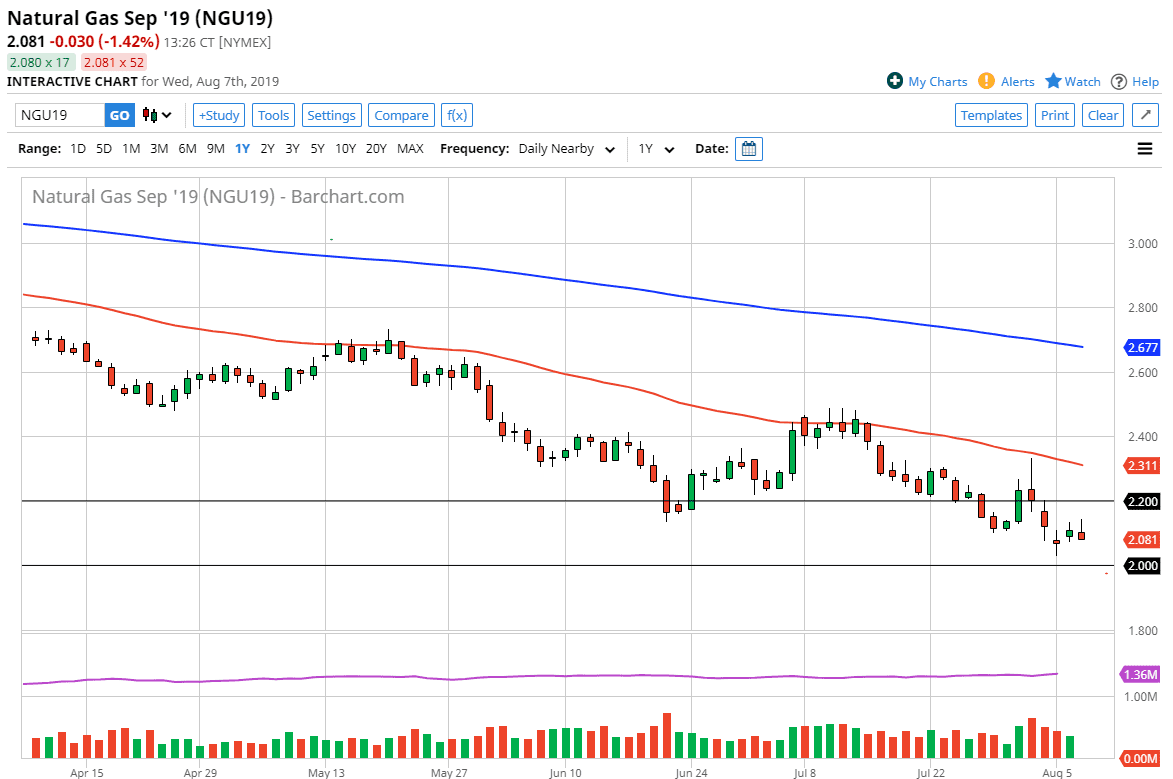

Natural gas markets initially tried to rally during the trading session on Wednesday but found enough resistance to roll over yet again. This market has no interest in trying to grind higher, as the oversupply issue continues to be a major issue. The $2.20 level above continues to be massive resistance, so until we can break above there I think short-term rallies are to be sold in what has been an extraordinarily bearish market.

Looking at the chart, it’s obvious that the $2.00 level underneath is massive support, and it’s a waste of time to think of anything other than that from a technical analysis standpoint for a target in the short term. As you can see on the chart, we have been falling for some time and there’s not much on this chart that suggests anything other than falling prices. Beyond the levels that I’ve already mentioned, the 50 day EMA is currently at the $2.30 region and is also a bit of a ceiling in this market. In fact, one of the things that I like so much about the 50 day EMA is that it has been so reliable for quite some time.

Natural gas is oversupplied. That’s really all you need to know. It’s also far too warm for natural gas to pick up a lot of bullish momentum, as we are trading the September futures contract. At this point, it’s not until we tray colder months that people will start to pick up the natural gas markets. That being said, it is also possible that the $2.00 level will offer a bit of a bounce due to the psychology involved. Ultimately though, if we were to break down below that level then the market will probably fall apart and go much lower. That would be a bit of a “trapdoor.”

Going forward, I think it’s very easy to short this market on Little Pops higher, on signs of exhaustion. I believe that this is a short-term opportunity set up that you are looking for, simply selling signs of exhaustion as they appear. As far as buying is concerned, it’s really not until we break above the $2.50 level that I could be convinced otherwise, at least as long as we are trading relatively warm months. Adding more fuel to the fire, at least to the downside, is the fact that global demand is probably going to drop as global growth is shrinking.