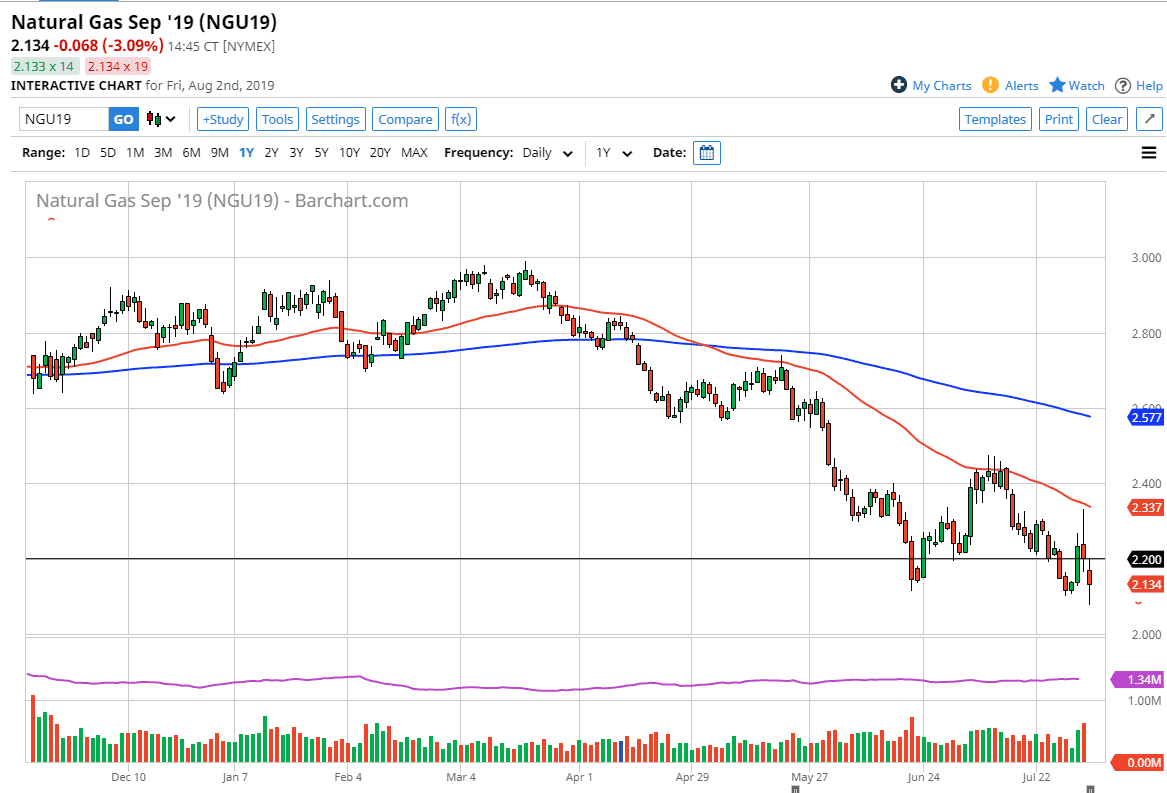

The natural gas markets gapped lower to kick off the Friday session and then continued to fall from there. As you can see though, we did turn around to show signs of life but I think a lot of that is going to be due to the weekend coming and people looking to cover their short positions. After all, with the markets likely to continue to be volatile, it’s difficult to be short and holding over the weekend.

Looking at this chart, I recognize that the shooting star from Thursday was essentially a perfect set up, as we are in a downtrend and we did struggle at the 50 day EMA which of course has been very crucial when it comes to keep this market down. In fact, for the last several months all you had to do with sell every time we got close to the 50 day EMA and you made profit. This of course makes sense considering that the market is so oversupplied, and it’s very difficult to imagine a scenario where we wipe out all of that supply, at least not until we get into the colder months. Beyond that though, even if we wipe out the supply due to a cold snap later this year, it will be temporary at best.

Speaking of which, we are not quite ready to do cyclical trading at, so we need to follow the trend. The fact that the hammer for the Friday session formed isn’t so much of a concern to me, just because like I said I think a lot of people were trying to cover short positions heading into the weekend. The $2.20 level will cause a bit of resistance, and most certainly the $2.35 level will which is right around the 50 day EMA and the top of that shooting star from the previous session as well.

I do believe that the market will continue to reach towards the $2.00 level underneath which has a certain amount of psychological importance tied to it. I do think that eventually there will be buyers in that area, causing a bit of a bounce. At this point, that bounce should be a nice selling opportunity but you may get a couple of days of positivity. I anticipate in the meantime though we are simply going to fade short-term rallies and take advantage of what has been an extraordinarily negative market.