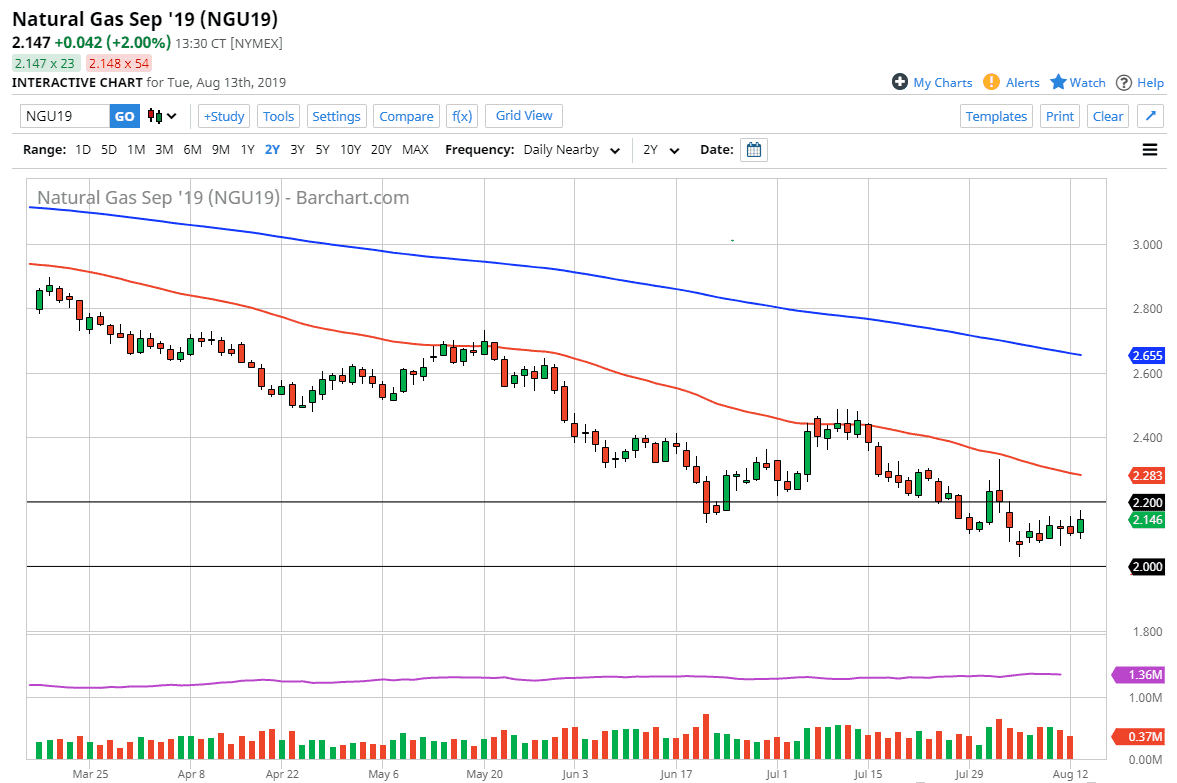

Natural gas markets went back and forth on Tuesday, as we continue to see volatility. However, we have a significant amount of resistance above and therefore it’s likely that we will see a selling opportunity rather soon. At the first signs of exhaustion near the $2.20 level, I’d be a seller as the natural gas markets have been suffering due to the overextension of supply for this market. At this point, there are plenty of signs of resistance above that will continue to weigh upon value.

I think that the natural gas markets will continue to respect the 50 day EMA which is pictured in red on the chart. That’s an area that is near the $2.25 level, so any type of exhaustion in that area should be a nice selling opportunity. With all of that being said, it seems that there is about a $0.05 range of resistance that we can take advantage of in order to start shorting again. Ultimately, the $2.00 level is a large, round, psychologically significant figure that people will be paying attention to. I believe at this point the market is looking for the level to be tested, because there is a significant amount of interest with these large, round, psychologically significant figure.

If we were to break down below the $2.00 level, then the market could probably go down to the $1.75 handle. I don’t know that we can break down below there, but I certainly think that we need to at least touch that figure for longer-term sellers to feel good about life. Ultimately, this is a market that will turn around and rally significantly, but we need cold temperatures in order to do that. At this point, I think that we are going to continue to see weakness going forward but eventually we will get a nice turnaround. That will be when we are trading cold temperature futures contract, but right now we are a couple of months away from that. At this point, I think you continue to sell this market every time there are signs of exhaustion after a quick bounce. As far as buying is concerned, if we were to turn around and break above the 50 day EMA on a daily close, then that could lead to an attempt at the $2.50 level, but I still believe in shorting overall.