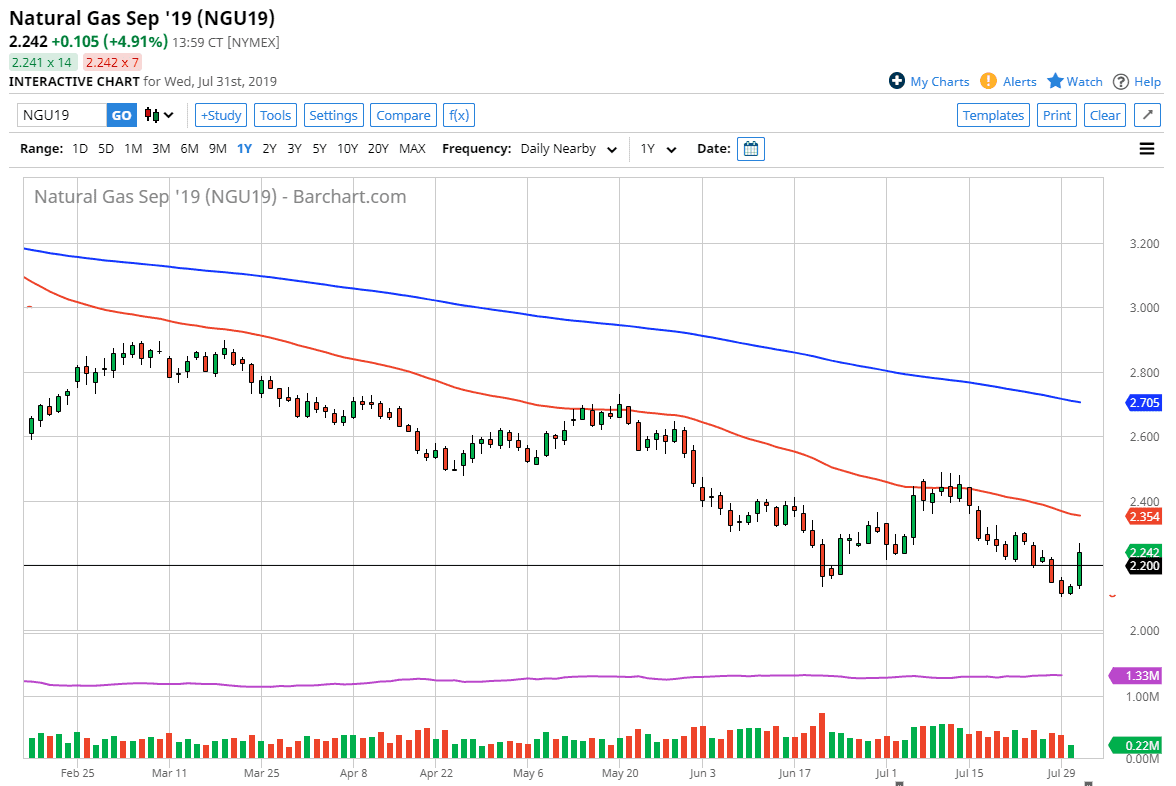

Natural gas markets rallied significantly during the trading session on Wednesday, breaking through the $2.20 level and reaching towards the $2.25 level after that. This of course is an area that could be somewhat resistive, and I do think that it is only a matter of time before we see a lot of sellers come back into the market. I believe at this point we are going to see the market form some type of long wick on a short-term chart that we can start selling into. With this, we have the 50 day EMA pictured in red above that should offer resistance as well, as we are in a massive downtrend.

We are trading the September contract right now, so at this point it has a way to go before we get involved in cold temperatures that could send natural gas markets much higher. I believe that we are more than likely going to see people trying to aim for the psychologically and visually impressive $2.00 level underneath. It’s at that point that I think you could see more of a bounce, but in the short term I take advantage of these little bounces as an opportunity to start shorting again, as this is a market that is far oversupplied and nowhere near having enough demand to take it out. Overall, this is a market that I think continues to offer plenty of opportunities if you are patient enough to wait for those bounces to come.

At this point, I believe that there is no reason to be buying this market until you can clear the $2.50 level, something that seems very unlikely to happen. Overall, if we did break above there it would be a significant enough turnaround that you would have to start to rethink the entire situation. That seems to be very unlikely, despite the fact that we did of course have a very nice candle stick for the trading session. We might have another day or so of strength, but as soon as we turn things around it’s time to start selling yet again.