Natural gas markets gapped a bit during the trading session on Tuesday, then reached towards the $2.15 level before selling off again. We couldn’t even hang onto the gains into the end of the day, so that shows just how bearish this market is. After all, we have a lot of supply out there and we are in no danger of seeing it disappear. With that being the case, it’s very likely that we will continue to see sellers jump into this market every time they get an opportunity, as the overabundance of natural gas will continue to keep a bit of a lid on the market. That being said, we do have a seasonal opportunity to start buying natural gas as it tends to explode to the upside during the cold months in both North America and Europe. In the short term though, it’s very unlikely that we will see that happen.

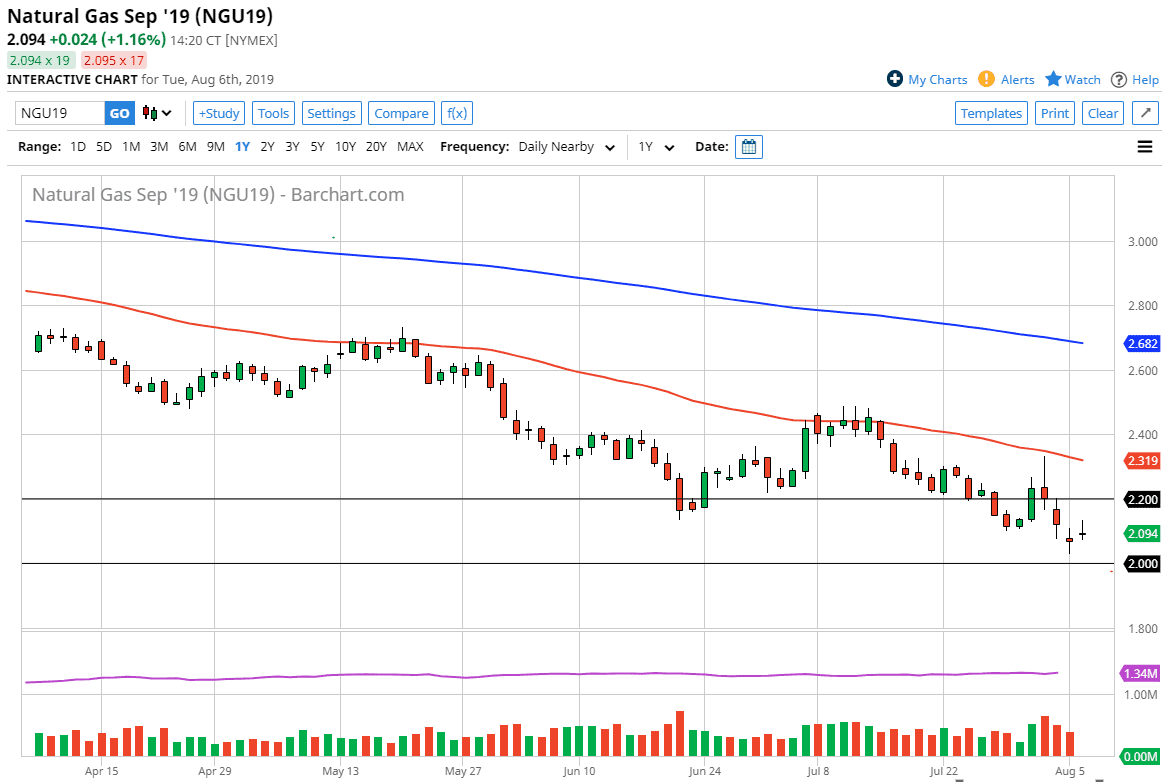

Looking at the chart you can see that the 50 day EMA which is painted in red on the chart is currently grinding much lower and has offered resistance. Ultimately, I do think that the 50 day EMA is going to continue to be major as far as importance is concerned, so I think at this point it’s likely that the market will continue to pull back from that level or time we approach it. To the downside, I think there are some obvious levels worth paying attention to.

The most obvious level is the $2.00 level, because quite frankly it is a large, round, psychologically significant figure. There is going to be a lot of interest paid to that level, as we certainly see a lot of reaction to the whole figure numbers that are based upon solid even dollar figures.

Ultimately, I think at this point if we rally, the first thought you should have is “How long before the sellers try to push this thing back towards the $2.00 level?” I think at this point it’s likely that we will continue to see a lot of volatility, but I do think that from a short-term traders perspective natural gas markets will continue to offer a lot of opportunities if you are willing to wait for selling positions. As far as buying is concerned, I think we are about six weeks from being able to even consider it, and it’s probably going to be longer than that.