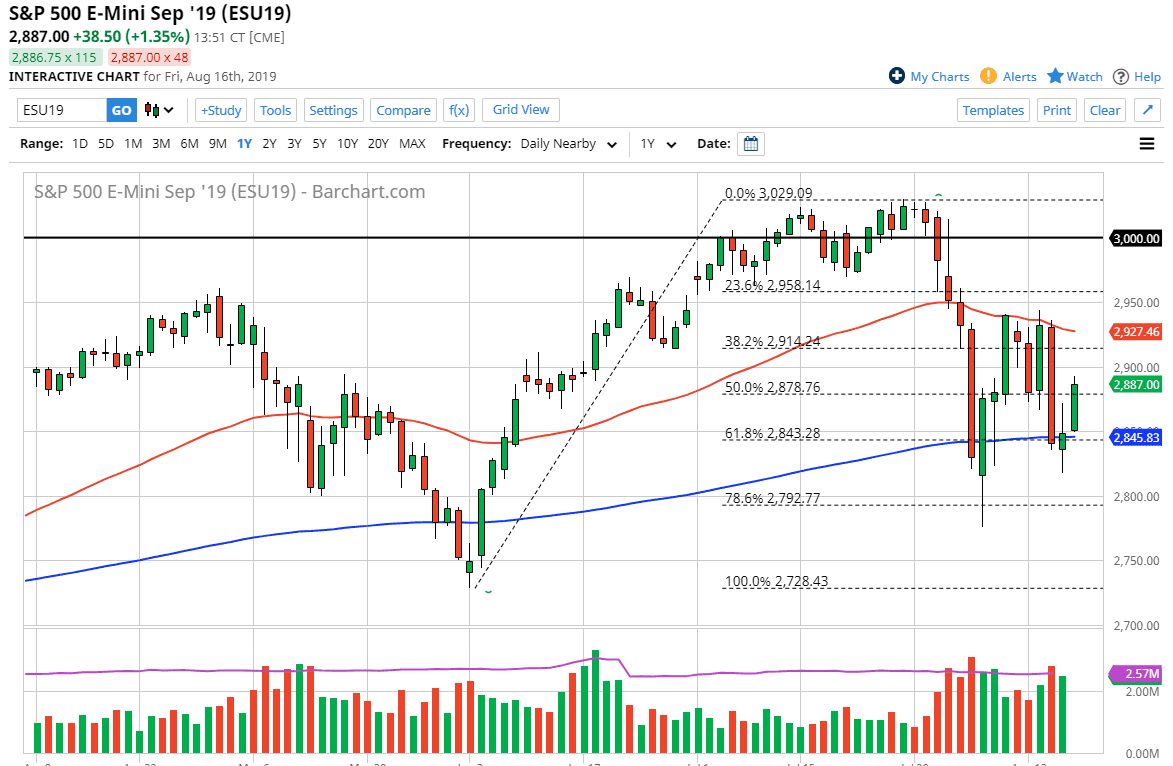

The S&P 500 rallied a bit during Friday’s New York session, breaking above the top of the Thursday candle stick which of course is bullish. We have used the 200-day EMA as support, and now it looks as if we will probably go looking towards the 50 day EMA as resistance. Ultimately, this is a market that I think will continue to bounce around between these two areas, and at this point I think we should expect to continue seeing a lot of volatility. Because of this, I think that the Monday session will probably be somewhat bullish, but the question now is whether or not we can break above the recent highs. If we can’t, then that would be very negative.

That being said, if we can break above the 2950 handle, then it’s likely that the market should then go to the 3000 handle, perhaps even higher than that. At this point, short-term pullbacks would then become buying opportunities. All things being equal though, I think that you are going to have a lot of concerns at this point, and you should keep your position size rather small. I do believe that the market should continue to show lots of skittishness when it comes to the global economy and the occasional headline. Overall, the market has had a lot of technical damage done to it, but if we did break above the 50 day EMA, then it could give us a bit of a “W pattern” so that could be another reason to go long. That being said, I think you need to stay out of these markets unless of course you have a good range-bound system that you can take advantage of on short-term charts.

I believe that Monday’s New York session should be positive, probably followed by some selling pressure closer to the 2925 level. If we do get that move higher above the 2950 level, it will probably show this market launching itself higher. We still have all those headlines involving the US and China, and of course we also have the bond markets on fire as well. In other words, I think there’s probably more negative than positive news out there and that’s why I don’t think that we will see a sustained rally but as usual, I am open to the idea of the market can do anything.