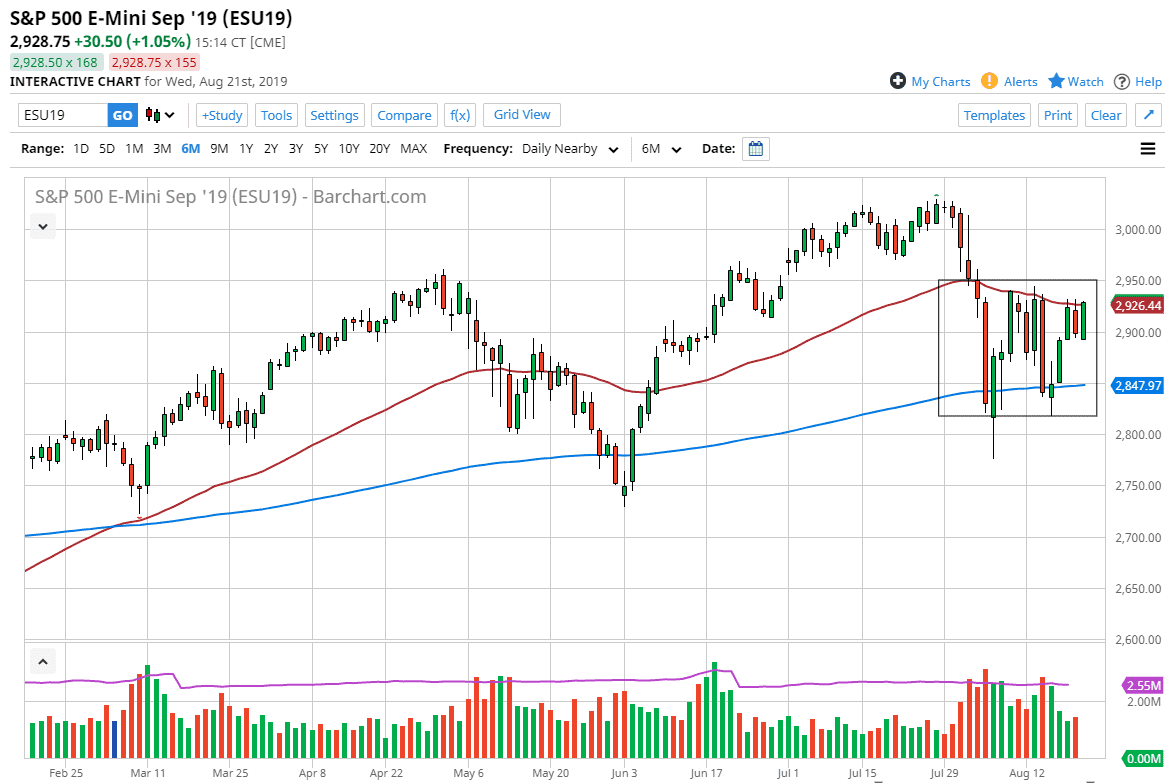

The S&P 500 rallied quite nicely during the New York trading session on Wednesday as we continued to see a lot of bullish pressure. However, there’s also a lot of selling pressure just underneath the 2950 handle, not only in the form of that round figure, but also in the form of the 50 day EMA. The 50 day EMA has been relatively reliable at this point, and therefore I think it will attract a lot of attention by algorithms and longer-term traders. That being said though, if we were to break above the 2950 handle it’s likely that this market will continue to reach towards the 3000 handle, albeit climbing a “wall of worry.”

All things being equal though, I think it’s probably easier to pull back from here towards the 2900 level as we wait to see what happens with the central bank meetings and Jackson Hole. The Jackson Hole Symposium is one of the biggest meetings of the year between central bankers, so we will have to see how they play the global situation right now. As central banks “race to the bottom”, the question then becomes whether or not the stimulus will take hold. It could, and that could be the reason why we finally break through the 2950 handle based upon statements or anything like that.

All of that being said we have been bouncing around between the 200 day and the 50 day EMA for some time now, and as I mentioned yesterday you could make an argument for a symmetrical triangle, and that is something that should be paid attention to as well. All things being equal I think Thursday’s Wall Street trading session will be a tough day for the S&P 500, although I don’t necessarily think that there will be a significant meltdown. It’s highly possible that short-term sellers might be the winners in Thursday’s trading, as we wait for some type of clarity, specifically the speech from Federal Reserve Chairman Jerome Powell on Friday afternoon. With that being the case, we may not have a clear and concise move until Monday morning as we continue to just kind of hang around in this general vicinity. I do believe that the 3000 level will be massive resistance, just as I believe the 2750 level could be massive support. Those might be your targets once we finally break out, but I think Thursday won’t be the day to make either one of those moves.