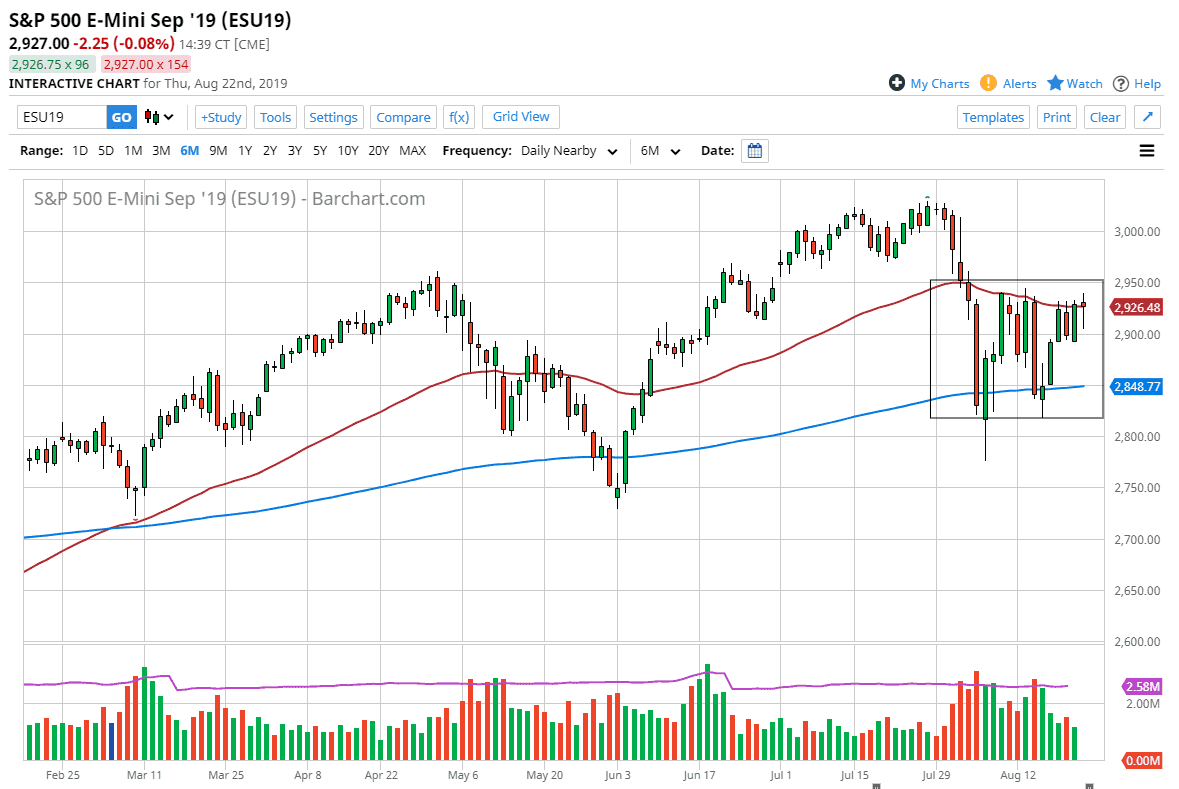

The S&P 500 pulled back a bit during the trading session on Thursday but has also found quite a bit of support to turn things right back around to form a hammer. This hammer does suggest that we could go higher, testing the 2950 level. Ultimately, it’ll be interesting to see if we can get above there, and if we do in fact close above there on the daily candle stick for Friday, that could send this market towards the highs again. The alternate scenario of course is that we break down below the bottom of the candle stick for the day, and perhaps even clear the lows of the Thursday session which could open the door to the 200 day EMA underneath.

Jerome Powell is speaking at 10 a.m. EST on Friday. You should keep that in mind as he may or may not disappoint the market, so that could throw stock markets into a complete tizzy. That being said, this is a market that continues the chop around between now and then, and I suspect it will be very quiet and simply waiting for some type of clarity coming out of the Federal Reserve to decide whether or not the markets will continue to get that “sugar high” that Wall Street has become so accustomed to. With that, I think that short-term pullbacks could be buying opportunities but if we were to break down below the last 48 hours, then we could be looking at a move down to 2850.

At this point, it looks as if the market is trying to set up for a move higher, so it’s really all up to Jerome Powell now and whether or not he sounds like he’s going to be dovish enough for stock traders. I would anticipate a lot of volatility right around the speech, and then some type of resolution to reach for either higher levels, which the technical analysis suggests at the moment, or some type of pullback in order to clear out a lot of those who try to get ahead of the speech. Ultimately, this is a market that is ready to make a move, as the waiting will finally be over with. In the meantime, we simply sit in this square trying to decide which direction to go. By the time Friday ends, we should have some clarity for a longer-term move. Between now and then it’s going to be very difficult.