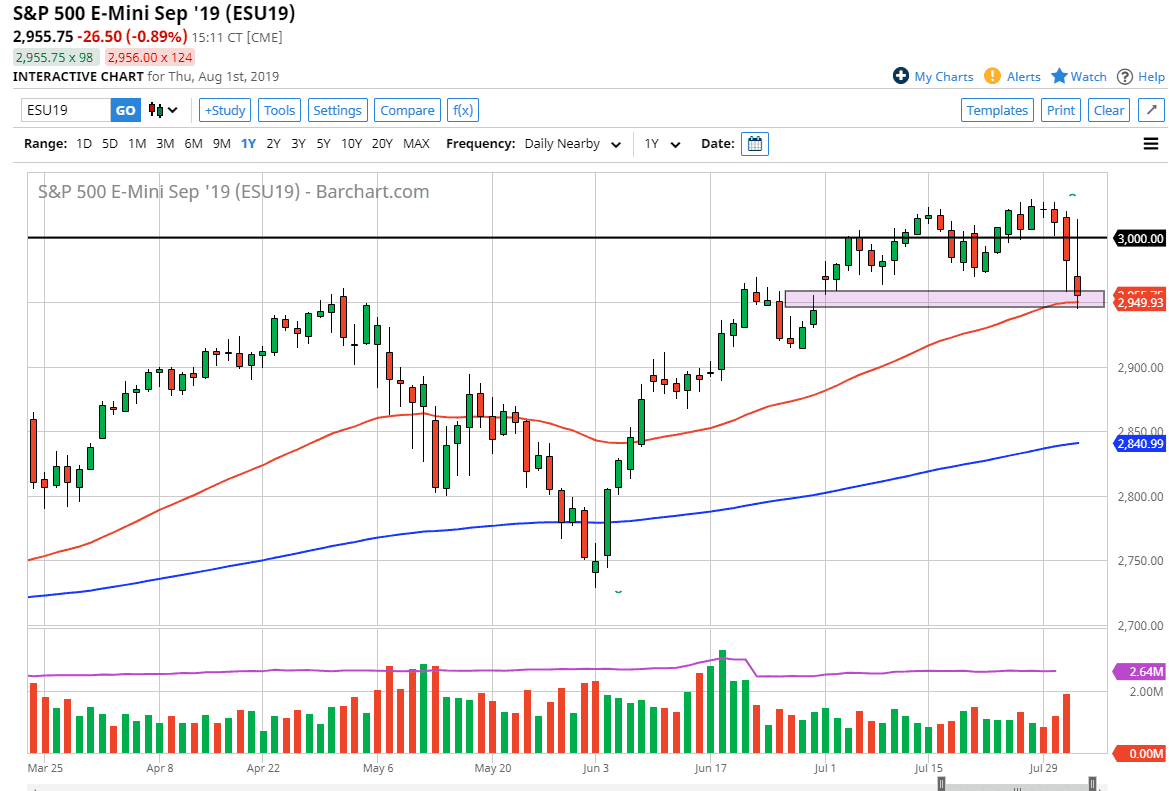

The S&P 500 gapped a bit lower during the trading session on Thursday to kick everything off, found buyers to turn around and break above the 3000 handle, and then broke down rather massively. In the end, this candlestick looks terrific, it is sitting right on crucial support. In other words, hang onto your hats, this could be a very bumpy session because after all, we also get the jobs figure.

Jobs number

The jobs number of course comes out on Friday, because we just don’t have enough noise and headaches to deal with when it comes to being a trader of the S&P 500 E-mini contract. That being said, we are waiting to see the results of the jobs number to decide where we go next. At this point, the market looks very likely to favor the downside, and possibly the jobs number could throw more fuel on the fire.

At this point, the jobs number needs to be poor so that people will start to bet on lower interest rates. It’s going to be interesting to see how this plays out, because the added pressure of more tariffs have suddenly reared their head as well.

Technical analysis

The technical analysis for this market is rather straightforward, we have plenty of negativity out there, and quite frankly I don’t know how things change in the short term. That being said though, if the jobs number is poor enough we may have people betting on a “looser Fed.” If that’s going to be the case we may get a sudden reversal. However, if the jobs number is strong that might actually be negative for this market, as counterintuitive as it may seem.

The candle stick for the trading session on Thursday is horrific looking, a massive shooting star shaped candle stick that is sitting on the 50 day EMA. The 50 day EMA is of course a psychologically important technical indicator, that should offer support. If we were to break down below there it’s possible we might go down towards the 2900 level underneath. That’s an area that could cause a lot of interest, as it is a large, round, psychologically significant figure. All things being equal, at best we may be looking at a return to the consolidation. It is possible that the Friday session could determine where we go longer-term.