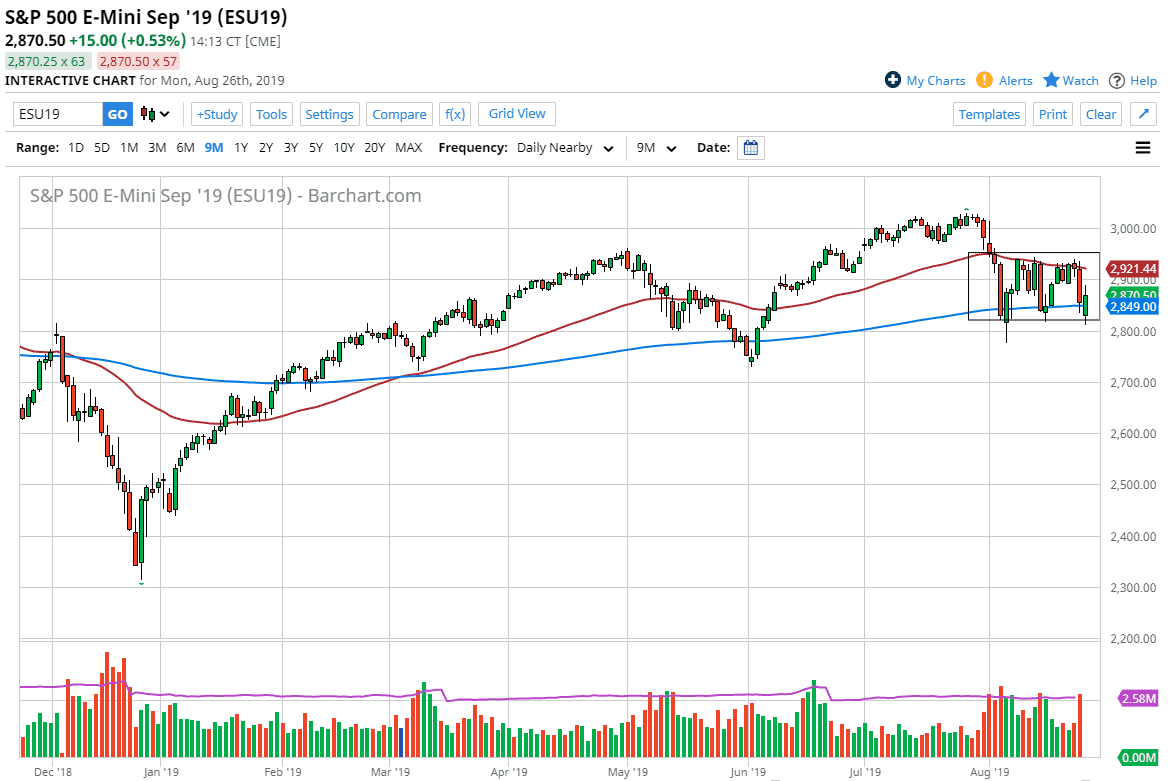

The S&P 500 initially gapped lower to kick off the week, as we have seen a lot of concern when it comes to global trade after Donald Trump added more tariffs on the Chinese. As traders came back to work on Monday, they initially started selling immediately. Having said that, we have found support at the 2800 level again, and it’s very likely that we will continue to see significant support at that area. To the upside, I believe the 2950 level will continue to cause a bit of resistance above. You can see that the two moving averages on the chart are starting to converge, with the blue one being the 200 day EMA and the red one being the 50 day EMA.

At this point, we are still consolidating and I think we will continue to see a lot of noise in this general vicinity. All things being equal I think that the market is more likely to break lower than higher, as we have so many headline risks out there. That being said, we need to see this rectangle broken in order to put a lot of money into the market.

Keep an eye on the bond market, because if it continues to scream to the upside, that will continue to cause a lot of concerns in the stock market as it is a run to safety. At this point, this is a market that is simply measuring the risk appetite of global traders in general. I think everything is starting to move in the same direction and based upon the trade war more than anything else. In the short term, I expect a lot of back and forth and the Tuesday session will probably be more simple consolidation as we have seen for a couple of weeks.