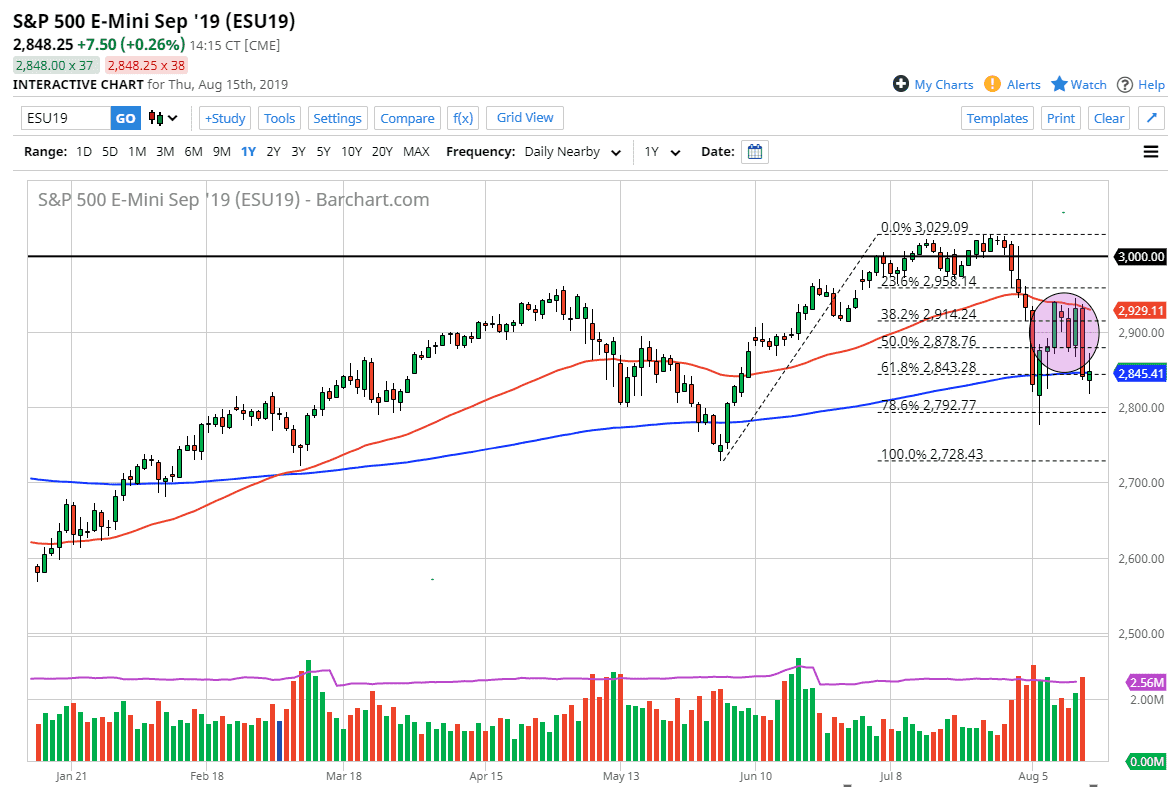

The S&P 500 stabilized a bit during the trading session on Thursday at the 200 day EMA which is essentially the market trying to save itself. That being said, we have seen a lot of technical damage done as of late so we probably need some type of exterior influence to pick this market up significantly. If that does in fact happen, it’s very likely that we could run into a bit of trouble at the 50 day EMA which is pictured at the 2929 area. I think at this point it’s only a matter time before we get some type of selling if we do rally from there.

The markets will continue to be very noisy of course as the US/China trade relations and so many other things are causing major issues. Ultimately, we are hanging around the 200 day EMA in that is a good sign. I think that the market could probably find a bit of trouble in this area but the 2800 level underneath would be massive support as well. A break down below there opens up the door down to the 100% Fibonacci retracement level which means the 2725 region.

The fact that it’s Friday a lot of short traders will probably try to cover their position so I would expect a bit of profit taking. After all, nobody wants to go into the weekend short of the market in case some type of tweet or statement comes out that’s suddenly bullish. Obviously he can work in both directions, so I think that the prudent trader is probably going to take advantage of the opportunity to get out of the market with some type of gain. After all, the futures market doesn’t open up until Monday morning in Asia, and the last thing somebody wants is to be stuck in some type of massive gap against them.

If we can get some type of positivity out of the President of the US, or China, then we could get a pop. Donald Trump likes to tweet something positive on Friday to jolt the marketplace, so that’s another reason why I think that perhaps we may see a little bit of a bounce in this region. The effectiveness of these good news tweets have died down quite a bit, so that’s another reason why I think that most professionals will be looking to fade those rallies.