The S&P 500 cratered initially during the trading session on Tuesday as the Americans announced that that they were labeling the Chinese as “currency manipulators”, and that of course is a very bearish turn of events. This had people selling the S&P 500 E-mini contract during the Asian session, but let’s keep things in perspective: the real volume doesn’t happen until the Americans jumped on board, and they promptly turned everything around. In the end, it really doesn’t matter what Asia and the Middle East does, because they are small players in this market and therefore turned around quite easily.

This was exacerbated as the Chinese stepped into stabilize their currency, signaling that they weren’t necessarily ready to escalate the currency war. This makes quite a bit of sense, because most Chinese debt is denominated in US dollars, and of course China is up to its neck in debt. With that in mind, there is probably somewhat of a limit as to what the PBOC and the Chinese government will do.

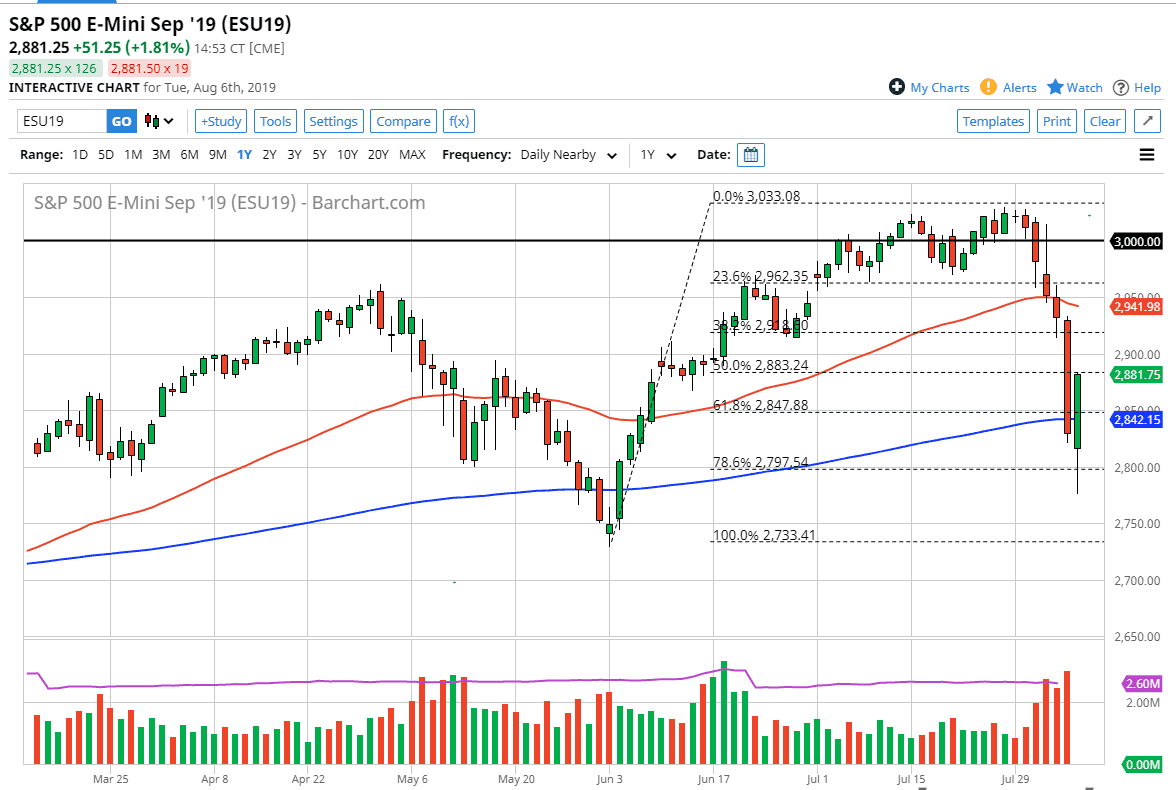

However, we are probably just one tweet or headline away from seeing this thing roll over again. There has been a massive amount of damage done from a technical standpoint matter, but the one thing that I think you can look at is that the candlestick is closing at the very top of the range, which of course is a very bullish sign. Beyond that, the 200 day EMA has been defended, which is something that longer-term traders in algorithmic investors pay quite a bit of attention to. Because of this, I think the next target is probably going to end up being the red EMA, the 50 day EMA.

While I do believe that this market is going to go higher, I think that it’s very difficult to put a lot of money to this work. I think that we will continue to see a lot of volatility and sudden moves like this, probably in both directions. Remember, bear market rallies are just as violent as selloff can be. If we can break above the 50 day EMA on a daily close, then we may make another attempt at the highs. All positions should be small, but I suspect that the next 24 hours might produce another green candle stick. This is of course unless somebody in Beijing or Washington DC says something stupid, which can never truly be ruled out.