The S&P 500 initially tried to rally during the trading session on Tuesday but gave back quite a bit of the gains as we reach towards the 2900 level. At this point, it’s likely that the market continues to show a lot of negativity as there are concerns around the world about the US/China trade situation. That being said, the market is likely to continue to show a lot of volatility. This market is likely to continue to be very noisy and difficult to manage, and that makes quite a bit of sense considering that the geopolitical situation is basically out of control.

Beyond that, currencies continue to weigh upon the strength of stock markets in general, and of course the bond markets have been absolutely on fire. That tells me that there’s more of a “risk off” attitude out there, and that of course works against the value of the S&P 500. Ultimately, this is a market that I think has gradually been building up quite a bit of momentum to the downside, and although we did bounce on Monday I think it was more of a “dead cat bounce” than anything else. The situation between the Americans and the Chinese seems to be getting worse, although the reaction on Monday to just the hint that something could be better shows just how focused the market is and how sensitive it is to that situation.

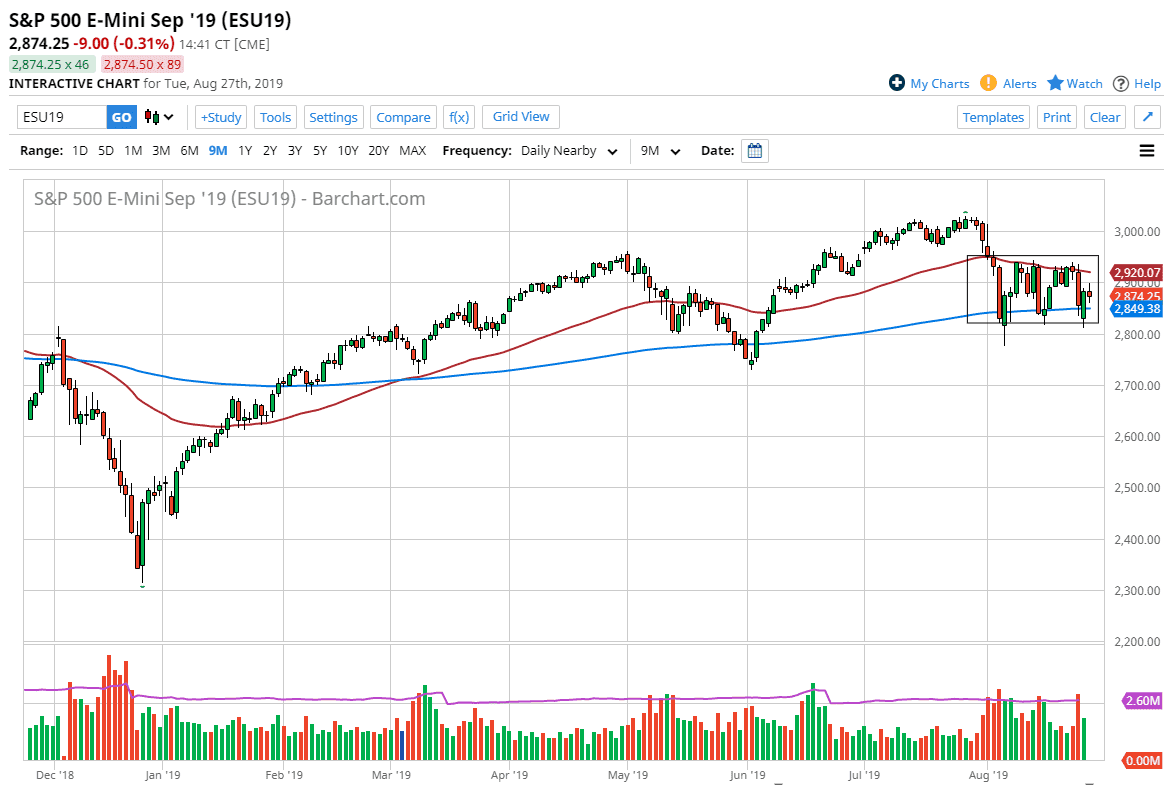

When I look at this chart, it’s relatively easy to see that the 2950 level above is major resistance but even before you get there you’d have to deal with the 50 day EMA, which of course gives us resistance. To the downside, the 2800 level looks to be massive support and if we were to break down below there, it would essentially be the trap door opening up for a move much lower. Overall, we have seen a very massive move lower, followed by a lot of volatility, we will get a resolution eventually, but keep in mind that this week is the last week of the vacation season for large traders. All things being equal, this is a market that I think will finally make a decision sometime next week, perhaps after the jobs number on Friday. Between now and then one would have to expect a lot of choppiness, but I suspect it’s probably easier to short this market than it is to buy it right now.