The S&P 500 has found quite a bit of volatility during the trading session on Wednesday, initially dropping down towards the 200 day EMA before rallying again. Ultimately, this is a market that continues to be very noisy, and that makes sense considering all of the trade headlines going on. As long as the US/China dark cloud overhangs the market I think it’s going to be difficult to hang onto a long position for any significant amount of time.

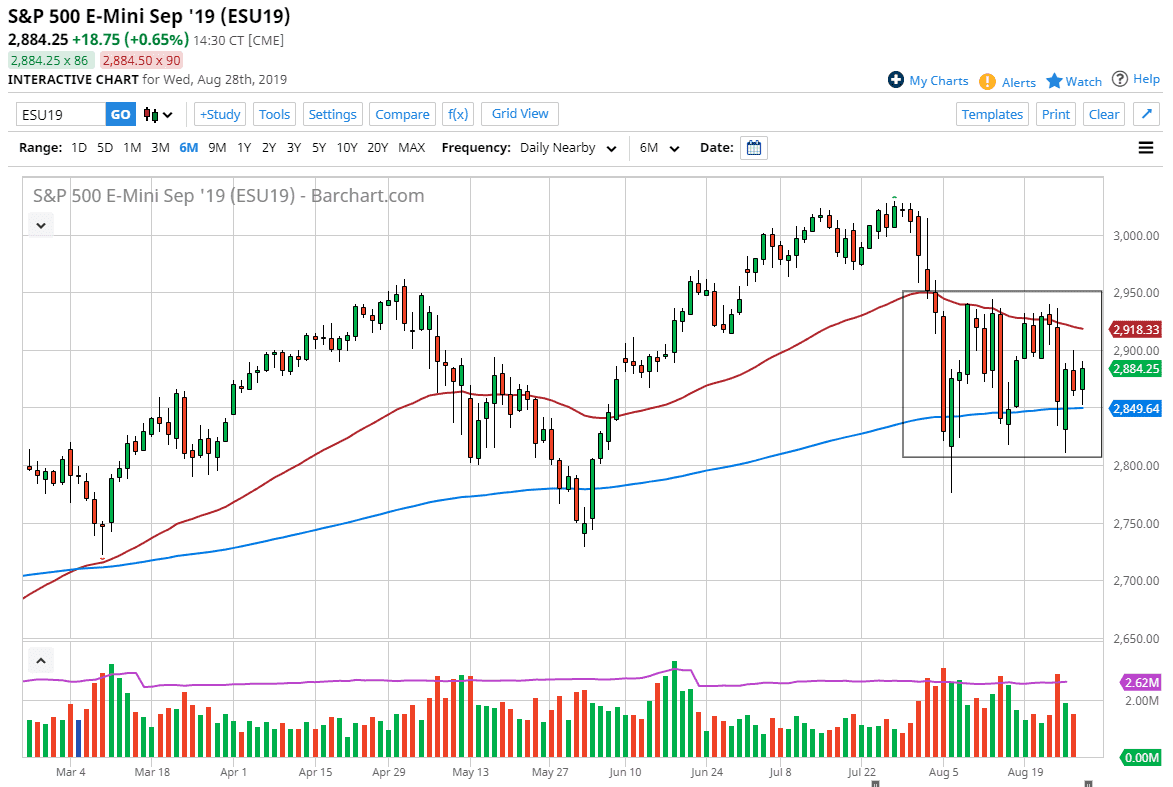

Looking at the chart, you can see I have a box drawn at the 2950 level above and the 2800 level underneath. Those are two areas that should continue to attract a lot of attention. I believe that the buyers will jump back into this market near the 2800 level, just as the sellers will at 2950. Looking at even shorter time frames, I believe that using the 200 day EMA as support and the 50 day EMA as resistance makes sense as well.

The candle is somewhat positive, especially considering that we recovered from a drop. Having said that though, it looks as if the range is starting to tighten and that makes quite a bit of sense considering that the volume is going to be a bit difficult as it is the end of summertime and most traders are more worried about their holiday than anything else. With that being the case I think that we will continue to see short term back and forth trading more than anything else. After the jobs number in September, which is next Friday, it’s very likely that we will see an impulsive candle that we can take advantage of.

To the upside, if we break out it’s the 3100 level that we will be looking at. To the downside, it could be 2750. Overall though, this is a market that I think continues to be very noisy and very troublesome to say the least. The S&P 500 will end up being very noisy over the next few weeks, at least until Wall Street decides what it’s going to do with the fall season. Once that happens, it will become much more clear as to which direction we will be trading. At this point it’s very easy to see that the downside probably outweighs the upside, unless of course something drastic happens globally.