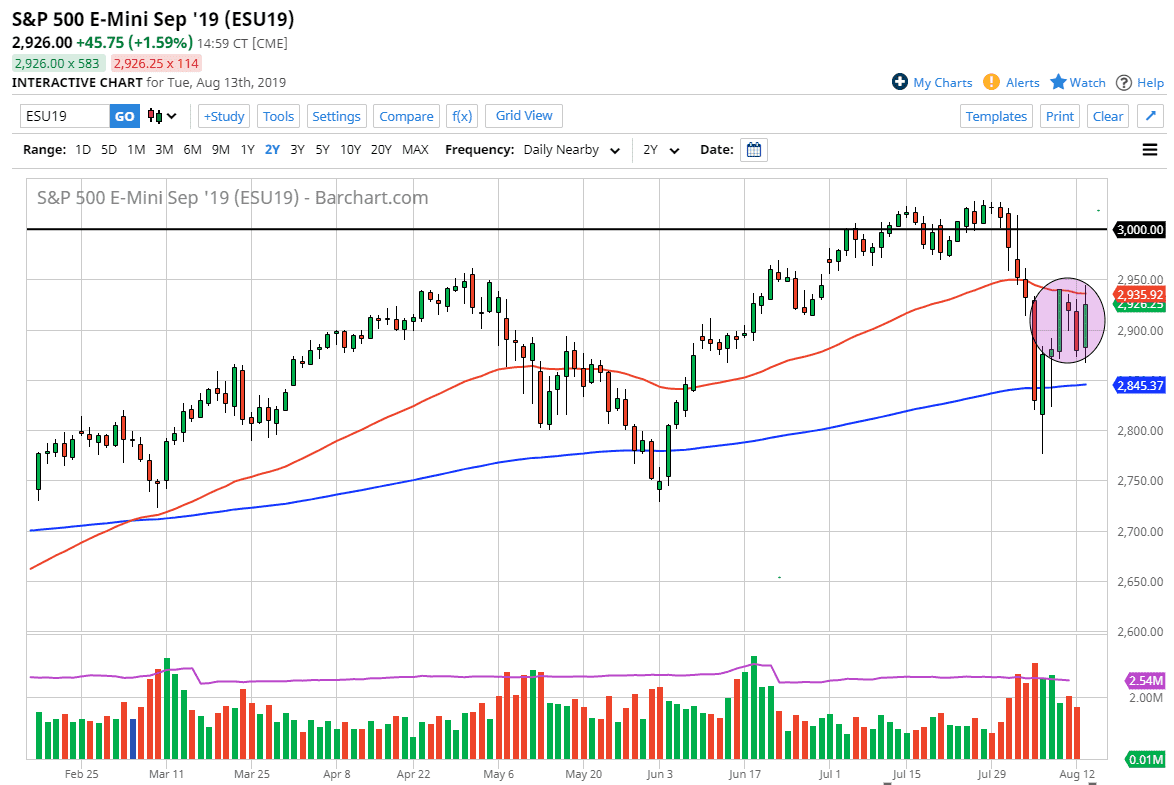

The S&P 500 rallied significantly during the trading session on Tuesday as word got out that the Americans were going to delay the tariffs on the Chinese. Because of this, there was more of a “risk on” move, and therefore we broke above the 50 day EMA. We did pull back from there though, so now I think it sets up an interesting attempt to break out if we can get above the 2950 handle. If we can break above there, it’s very likely that the market will then go to the 3000 handle, perhaps even the 3050 level.

At this point, the market is still consolidating, and as a result it’s very likely that we are going to continue to see a lot of back-and-forth. Ultimately, this is a market that has been going back and forth, and I think we will continue to see that going forward. At this point one would have to think that we are favoring the upside, lease for the short term. However, if we were to turn around and break down below the 200 day EMA it’s likely that this market could break down rather significantly. The 2800 level would be the initial target, followed by the 2750 level.

As the market is very choppy and difficult, it makes sense that we are a bit confused. Overall though, I think that the market probably will need to make some type of significant impulsive candle to get more money involved. Remember, we are in the midst of the vacation season for a lot of traders out there, so one would have to worry about liquidity, volume, and of course whether or not any real longer-term money is flowing into the market.

All things being equal, I think we are essentially grinding sideways with a slightly upward tilt, and therefore I think it’s only a matter of time before buyers try to take over, but I also recognize that we have a lot of work ahead of ourselves. The 3000 level above is significant from a psychological and structural standpoint. All things being equal, I believe that the buyers have the upper hand but only slightly. This is a market that could turn around at any moment though, so at this point I favor buying short-term dips in small increments meaning that short-term traders can get involved for quick moves only.