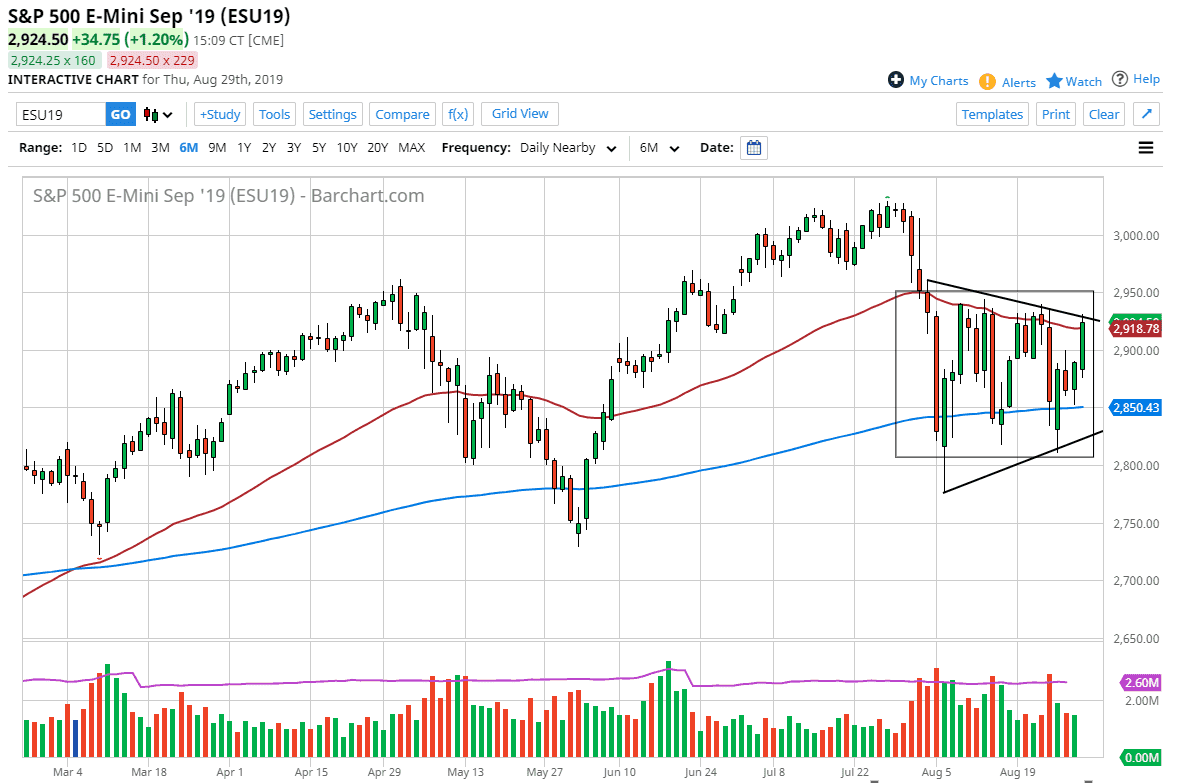

The S&P 500 has rallied quite stringently during the trading session on Thursday, heading towards the top of the consolidation area that we been in for some time based upon the idea that the Chinese are not going to continue retaliating in the trade war. That being said though, I think it’s only a matter time before we see some type of bad news that throws this market back down. There’s also the possibility that people will be concerned about holding futures contracts going into the three-day weekend and therefore a bit of profit taking or perhaps just simple safety coming into play.

The 2950 level above continues to be massive resistance and I think it’s not until we break above there that you can become bullish of this market. At that point, the market then goes towards the 3000 level next. Otherwise, we will probably pull back into the deepening wedge and therefore the market would continue back to the mean of the action. All that being said, the downside has plenty of support near the 2800 level, and that of course the 200 day EMA closer to the 2850 level. At this point, I think it’s only a matter of time before we would have some buyers in that area.

Ultimately though, I think that this market is going to be very busy and very noisy, as we are getting close to the end of summer, and therefore it’s likely that the volume coming back into the market will probably throw this market around and we could have quite a few of bounces and pullbacks quite frankly over the next several weeks. Eventually though, we should see quite a bit of noise coming in and blowing through one of these levels. All things being equal, I think we probably won’t have a true “buy-and-hold” or “sell and forget” situation until after we get the jobs figure next Friday. Once that happens though, we should see plenty of momentum and know where we are going for the fall. In the meantime, keep your position size very small as the choppiness and the uncertainty will only increase, because of this I suspect that we are more than likely going to see sellers than buyers longer term but I have to react to the market that I’m giving which of course changes every day.