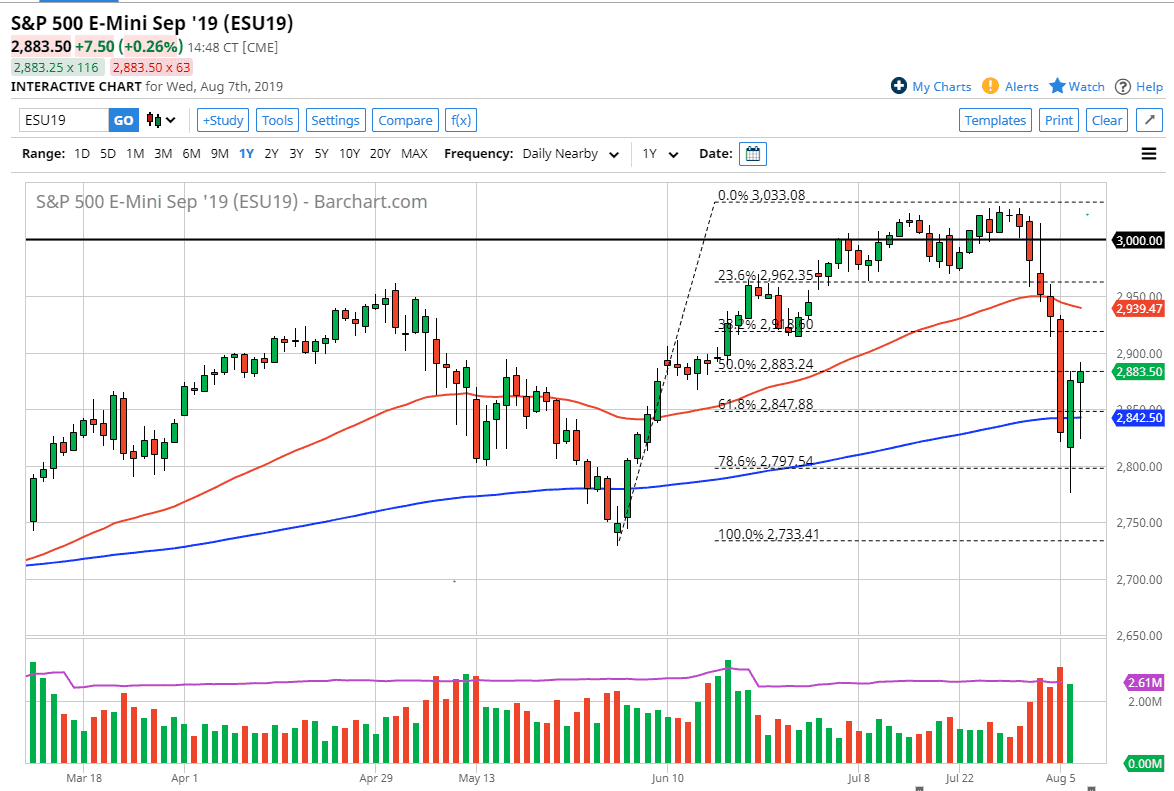

The S&P 500 initially fell during the trading session on Thursday, reaching down below the 2850 handle, in an attempt to break down through the supportive candle stick from the previous session. However, by the end of the day we ended up turning around to form a bit of a hammer. The hammer of course is a bullish sign and therefore we could rally from here. We would need to break above the top of the candle stick to show signs of momentum though, and essentially this point I think it’s the 2900 level that the market will react the most to. If we can break above there, then it’s likely we could go quite a bit higher.

To the downside, if we were to break down below the hammer from the trading session that would be an extraordinarily negative sign. That being the case, I think that would show a massive problem in the market, so at this point it’s very unlikely that we are going to see it happen unless of course something significant happens. That’s not to say that it won’t, just that it probably won’t. This doesn’t mean that the market needs to go higher, it just means that we need another catalyst to scare the market even further.

To the upside, I think the 3000 level would be a target, but I also recognize that the 2950 level is resistance as well. To the downside, if we break down below that hammer, then the market goes to the 2750 level given enough time. All things being equal, we have done a ton of technical damage to this market, so therefore it’s not a huge surprise to see that we struggled. Even with that struggle during the day, we have ended up forming a bullish candle stick as the Americans showed signs of recovering. For the short term, this means that we should be bullish, but this is probably more or less going to be a quick “smash and grab” type of scenario. I think at this point we continue to see trouble with the US/China trade tensions, but as we enter a period of relative quiet, we could get a slow creep higher. All things being equal, the stock markets are going to be extraordinarily difficult for the rest of the month and therefore I think you will need to be very cautious about your position size.