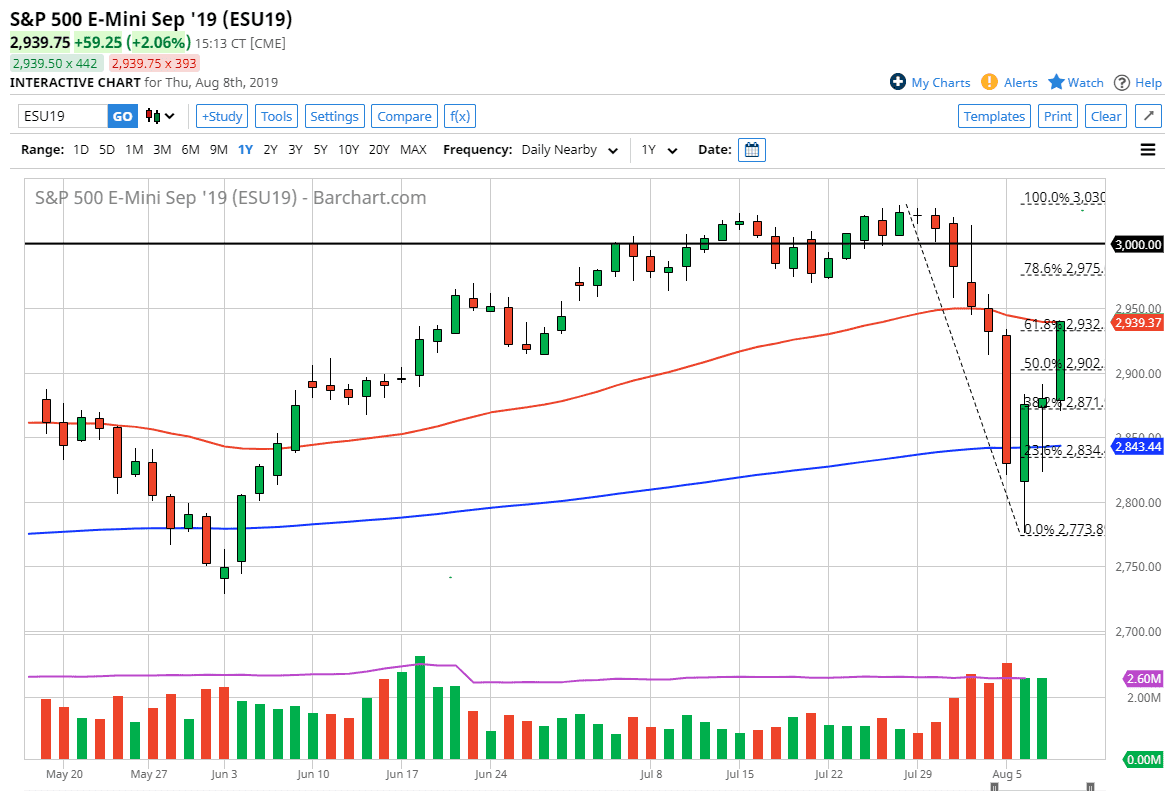

The S&P 500 rallied significantly during the trading session on Thursday again, slicing through the 61.8% Fibonacci retracement level from the massive selloff that we had seen recently. Beyond that, we have closed right at the top of the candle stick for the day, and a right at the 50 day EMA. These are a couple of things to pay attention to because it shows us just how bullish people are, but it also shows an area where we could get a little bit of trouble.

All things being equal though, it does look as if we may make a significant move higher given of time. I think that a pullback from here makes sense, because we have gone too far to the upside after seen so much in the way of a move to the upside. However, it would not surprise me at all to see this market sell off rather drastically, only to find support somewhere above the 2900 level. The alternate scenario of course is that we break above the 2950 handle, which probably leads this market to much higher levels, perhaps even as high as 3000 again. That would be very impressive, completely wiping out all of the selling pressure. Overall though, I think that heading into the weekend is probably going to be difficult to hang onto a lot of risk. It doesn’t take much imagination to think about the possibility of the marketplace being rocked by some type of announcement or statement over the weekend. The last thing you want is to be stuck in a futures position without any way to get out of it. That is a very real possibility Monday morning as things between the Americans and the Chinese simply aren’t good.

With that, I believe that the weekly candle stick is going to be crucial to determine where we should be putting our money on Monday. Short-term trading is possible on Friday, but I prefer short-term pullbacks show signs of support, perhaps a 15 minute hammer above the 2900 level or something of that ilk to get involved. All things being equal I believe that this market will find plenty of reasons to be volatile, but I think the next 24 hours will be crucial. Can we hang on to the gains heading into the weekend? With that I would only take small positions and would prefer the upside on support of candles. As far as putting bigger positions on, that will have to wait till next week.