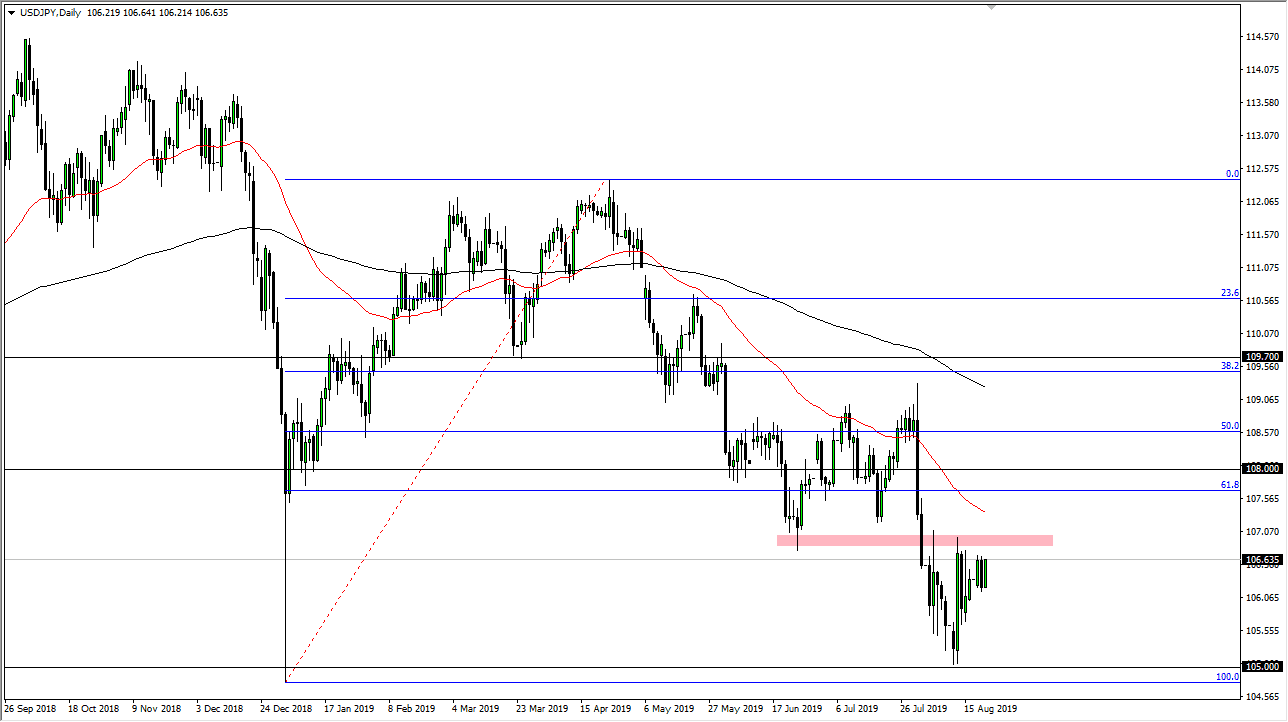

The US dollar rallied a bit during the New York trading session on Wednesday, reaching towards the ¥107 level yet again. Looking at the big picture, I think that the market could eventually break out above there, but we would need some type of good news to facilitate that to happen. From my vantage point, it looks likely that we continue to consolidate in general, with the ¥105 level underneath being massive support and of course that ¥107 level causing resistance.

Keep in mind that this pair is highly sensitive to risk appetite so it would make quite a bit of sense to see the market move back and forth with stock markets in general, which of course are on the precipice of trying to decide where to go. With central bankers meeting in Wyoming this week, it’s very likely that we are going to continue to hang on every word that the central bank leaders say. Ultimately, the question now is who is stimulating and how much?

If we did break above the ¥107 level, we also have to deal with the red 50 day EMA, so it will likely be very difficult for this market to continue to rally under those conditions. Having said that, there is likely going to be a bit of fight left in the US dollar, especially if the S&P 500 rallies. If we break down from here there will probably going to be a scenario where the stock markets are also selling off. Ultimately, that could send this pair to lower levels.

I think it’s only a matter of time before we get some type of major move and I still believe that the downtrend is very possible. If we were to break down below the ¥105 level, it opens up the door down to the ¥102.50 level, and then eventually the ¥100 level. I do favor the downside in general, but obviously there is a lot of noise and I think that the US dollar will continue to at least try to rally. In other words, we are going to see a lot of back-and-forth and confusion as this pair is a good proxy for stock markets in general which of course have no idea what to do at this point either. A lot of this is going to come down to whether or not the market is happy about statements coming out of Jackson Hole or not. If risk goes higher, this pair does. If risk fails, so as this pair.