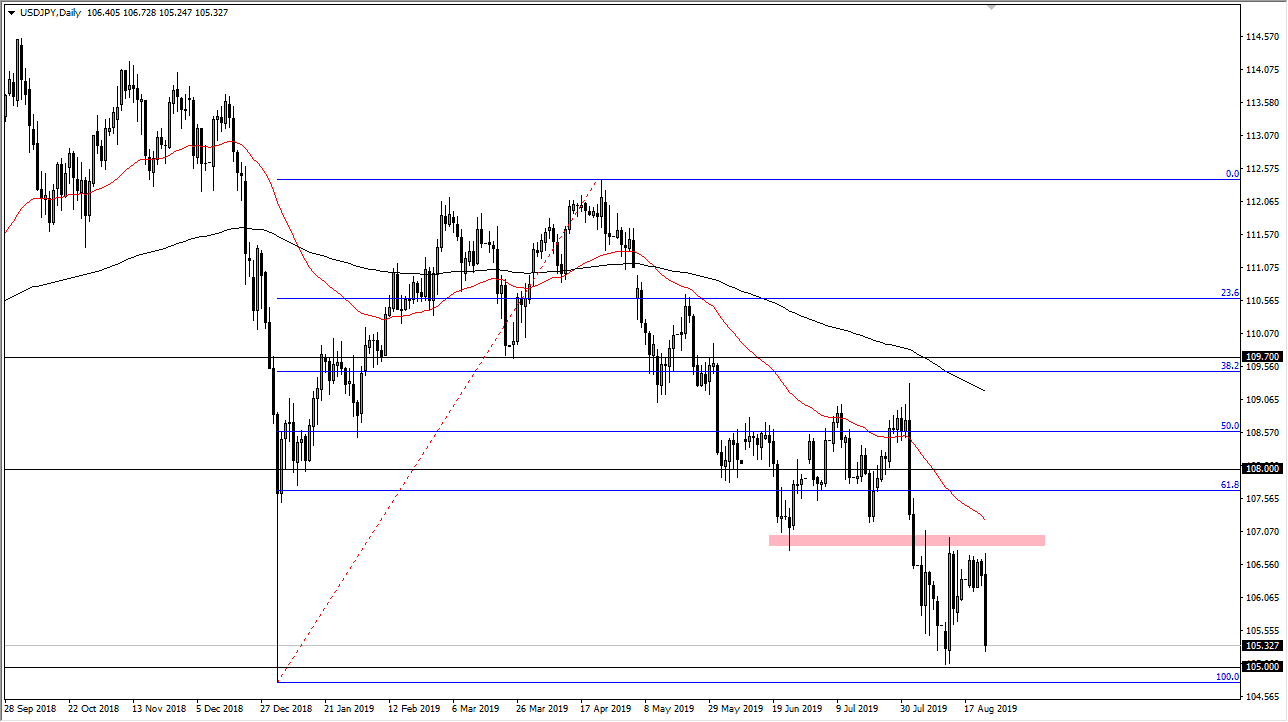

The US dollar looks likely to attempt to break down below the ¥105 level during the trading session on Monday, which of course has been a solid support level in the past. At this point, it’s very obvious that the market is going to continue to struggle and therefore I think it’s difficult to imagine a scenario where we can start to go long until we get some type of attitude change out there. If we do break down below the 100% Fibonacci retracement level which is just below the ¥105 level, then the market is likely to come undone.

Keep in mind that this pair is highly sensitive to the risk appetite around the world, and that of course is something that you should be paying attention to. With the Chinese retaliating in the tariff or it suggests that we are going to continue to have a lot of economic pressure globally, and that means people will be looking to pick up the Japanese yen for safety. We have recently been bouncing around between the ¥105 level and the ¥107 level, so I think so far things are okay but if we do break down below this level it will be a continuation of the negativity that we see.

Speaking of the ¥107 level above, the 50 day EMA is starting to reach down towards that level. That was previous support, and it should now be massive resistance. I think at this point any rally would have to be looked at with suspicion, because the break on Friday was so hard. It looks very likely that we are going to enter a very precarious stage in the marketplace, and that means that the Japanese yen should continue to do quite well. If we rally first thing Monday, I’ll simply be looking for short-term candlestick to start selling closer to the ¥107 level. If we break down below the ¥105 level, then it’s likely that we are going to go down to the ¥102.50 level. Ultimately, this is a market that looks extraordinarily negative, and quite frankly there aren’t too many good signs out there when it comes to economic growth, which should continue to favor safety market such as the Japanese yen. That being said, I am very bullish on the US dollar in general, just not in this market as it tends to work in an opposite direction as many others when it comes to dollar strength or weakness.