The US dollar got hammered during the trading session on Monday, as we had a major “risk off” move in both Forex markets and of course the equity markets. With the Chinese devaluing the yuan, the question now is whether or not the Chinese are going to continue to weaponize the currency. If they do, we should see quite a bit more in the way of bearishness.

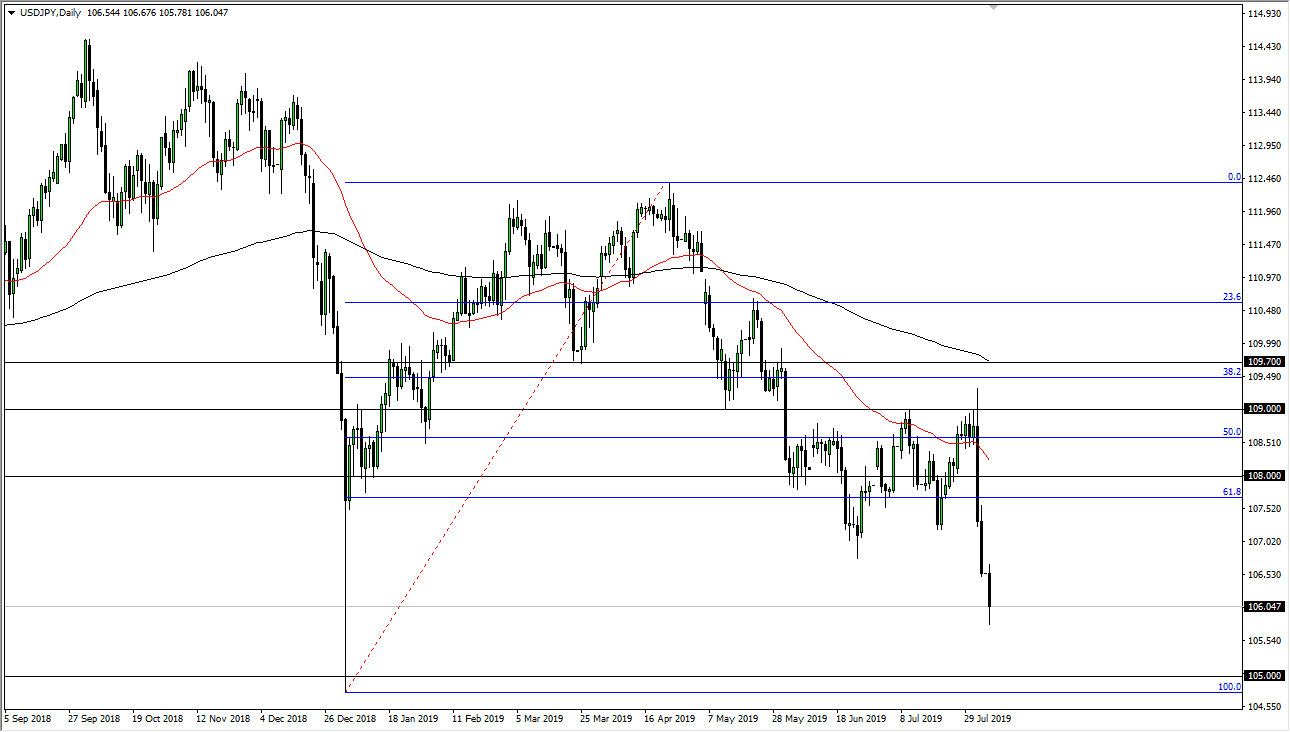

Remember, the Japanese yen is without a doubt one of the “safest currencies” out there, and I think what we are going to see is a scenario that rallies will be sold in this pair, as I had suggested on Friday, but I had anticipated a little bit of a bounce. The Chinese have changed this situation, and it now looks as if we are going to see an accelerated move down towards the 100% Fibonacci retracement level. At this point in time, any time we rally I would be looking for a selling opportunity until we can break above the 50 day EMA which of course is in red.

I do believe that the ¥105 level is going to offer a bit of support, but the question now is whether or not we are going to hold there. It’s very possible that we continue to go lower but I would anticipate at least a bit of a “dead cat bounce” in that general vicinity. Overall, if we were to break down below the 100% Fibonacci retracement level, which of course is just below the ¥105 level, then we could be looking at a significant attempt to reach the ¥102.50 level.

If somehow we were to see a reconciliation between the Americans and the Chinese, there’s probably going to be a bit of a bullish bounce in this market, but at this point I think traders have come to look at any type of positive news with a bit of skepticism, and with good reason. After the last three candlesticks, it’s obvious that we have a lot of selling pressure, so therefore I would essentially ignore anything that looks bullish, without some type of underlying reason to be so. At this point I think it’s only a matter time before the sellers would reenter at the first signs of exhaustion after that bounce. I believe that the market is hell-bent on going down to the ¥105 level.