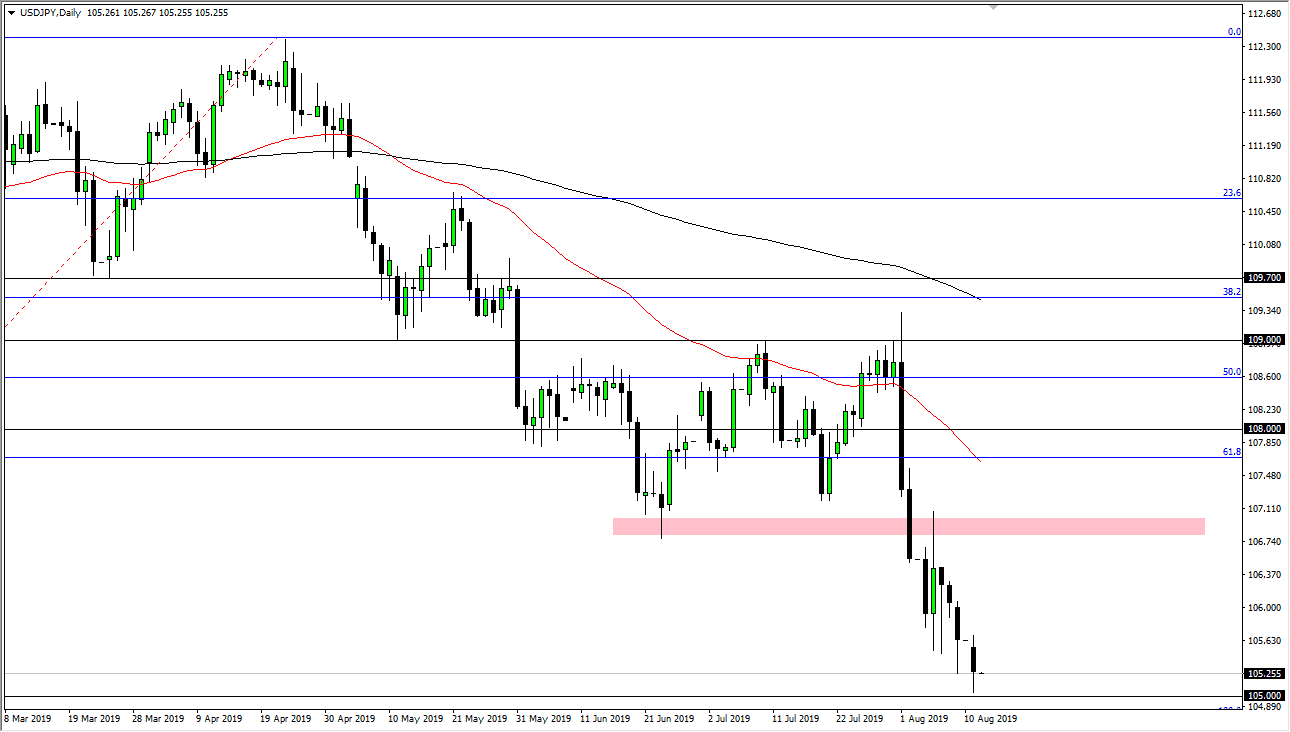

The US dollar has fallen during most of the trading session on Monday, testing the crucial and psychologically important ¥105 level. Ultimately, this is a market that will continue to show signs of interest in that area due to the fact that it is a large, round, psychologically significant figure, and an area where we have seen buyers previously. Because of this, I’m looking for some type of rally that I can sell on signs of exhaustion. That being said, we may not even get that opportunity as things have gotten so ugly.

Remember, this is a market that typically will fall with risk appetite shrinking. The Japanese yen is a safety currency, and that cannot be forgotten. It looks very likely that we will continue to see downward pressure, but more importantly I think it’s more likely that we see sellers coming into the rally. I think that the ¥107 level above is major resistance, and therefore it’s not until we get above there that I would be impressed with any rally. In fact, my favorite trade in this pair is to simply let it bounce from here and short as soon as it gets a bit exhausted.

If we do break down below the ¥105 level, then we could go down to the ¥102.50 level. That opens up the door to the ¥100 level, which will attract the Bank of Japan. I think at this point we are going to see a lot of choppiness, so therefore we can take advantage of those short-term rallies that give us opportunities to sell. The Japanese yen is probably one of the favorite currency is right now, and then unless of course we get some type of “risk on rally” around the world, it’s very likely that this market does eventually break to the downside.

You will probably continue to have a lot of bouncing, and then eventually we will continue to see pressure as the trend is so strong. If we did close above the 50 day EMA which is pictured in red on the chart, then I could possibly be convinced to try to buy this pair. That would also have to be accompanied by interest rates rising in the United States, at least in the treasury markets. We can also be better served by an S&P 500 that is ready to rally as well. Until then this is a negative market.