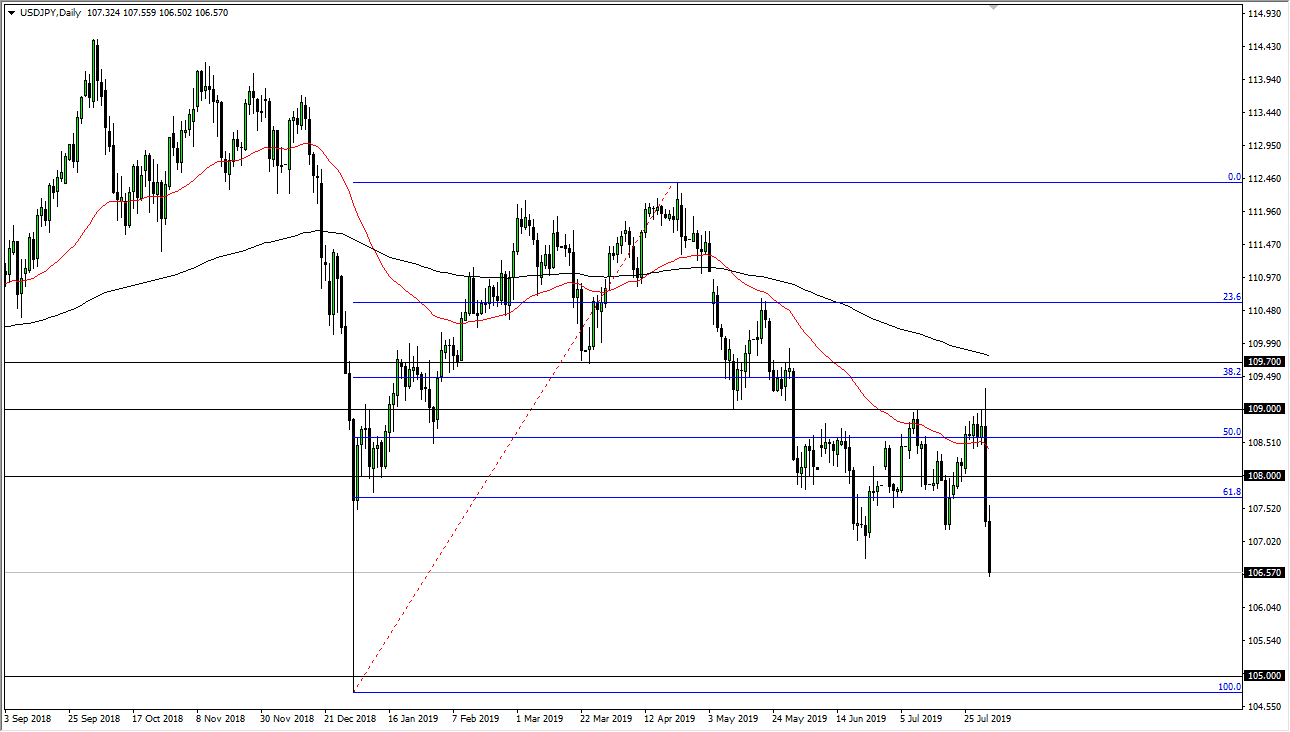

The US dollar initially tried to rally against the Japanese yen during trading on Friday but then fell apart as we have broken through the ¥107 level. For me, this was in fact a sell signal, and I will not hesitate to sell signs of exhaustion here. If we break down below the bottom of the candle stick then I think that this pair is free to go towards the ¥105 level to the downside, which is essentially the 100% Fibonacci retracement level.

We are well below the 61.8% Fibonacci retracement level, which was essentially the top of the trading session. As that rebuked price so strongly, it makes sense that we could continue to unwind which is quite typical with this type of move. I think at this point it’s likely that we are going to continue to see the Japanese yen be favored due to the fact that the markets are jittery and of course there are a multitude of problems out there that could come into play. I think at this point the President of the United States is likely to continue to tweet and therefore because the Japanese yen to pick up momentum as we get a lot of mixed signals when it comes to the US/China trade talks. There is a significant correlation between him announcing that there could be further tariffs against the Chinese and this market falling rather rapidly.

At this point, we have formed a couple of very bearish candle stick so it would not be out of the realm of possibility to see some type of bounce. That bounce should be sold into though, and I would love to see this market return closer to the ¥107 level where I can fade any type of exhaustion. That being the case though, if we break down below the bottom of the candle stick for the Friday session, then we could go down to the ¥105 level. That level I think will offer a significant amount of support as we have seen in the past, but for me it’s relatively obvious that the market is trying to reach down to that level now. Because of this, I am looking for opportunities but am hoping that they are going to be higher from here. That being said, I won’t hesitate to short on a break down below the daily candle stick as well.