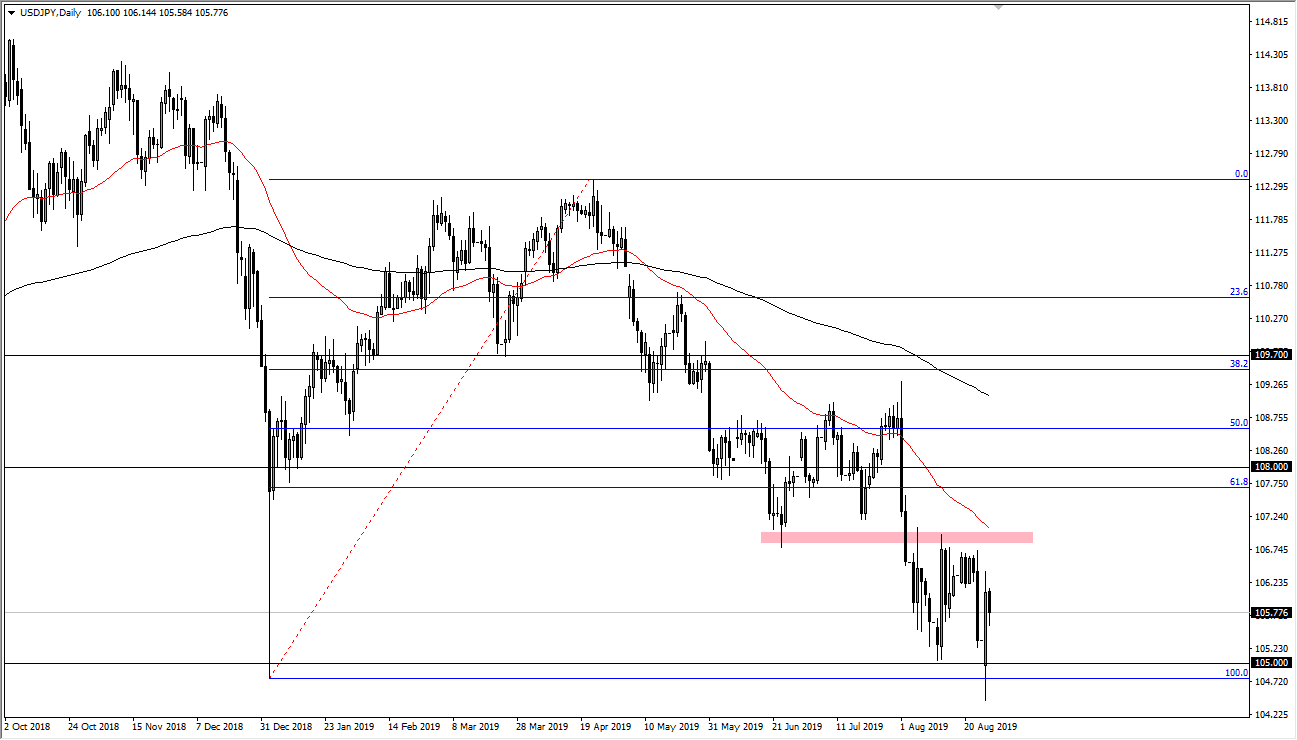

The US dollar fell a bit during the trading session on Tuesday, reaching below the ¥106 level. This is an area that has essentially focused as “fair value” in the consolidation area that we have been in for some time. The ¥107 level should continue to function as massive resistance, just as the ¥105 level has offered massive support. The 50 day EMA is reaching towards the ¥107 level above, further solidifying that resistance barrier.

At this point, there is a certain negativity to the market that should continue, but I think in the meantime we are going to consolidate overall. This is because there has been some structural damage done to the bottom on Monday early, breaking well below the ¥105 level before turning right back around. That being said, it is possible that the Bank of Japan got involved but I don’t think it was a major operation. There’s also the possibility that we simply saw the market react to the large, round, psychologically significant figure. It’s also the 100% Fibonacci retracement level, so it makes sense that it could come into play as well.

Either way, breaking down below the bottom of the candle stick from the Monday session would be a major continuation of the bearish pressure that has come into play. Keep in mind that this pair is highly sensitive to global risk appetite, which of course has been very weak for some time. We continue to see a lot of problems between the Americans and the Chinese, and that does not seem to be getting any better. Yes, there have been some nice words exchanged over the last 24 hours, but not enough to actually substantially changed anything. As long as that’s going to be the case it makes sense that the Japanese yen continues to strengthen as people look for safety in general.

If and when we break down below the candle stick from the Monday session, I think we go looking towards the ¥102.50 level. Underneath there, we could be looking at a move down to the ¥100 level. Alternately, if something changes and we get a daily close above the 50 day EMA, it’s likely that we could then go looking towards the ¥108 level, and then possibly the ¥108.75 level after that. That being said, I think it’s much less likely than a break down. In the short term I think you are probably better off playing the consolidation with a downward slant.