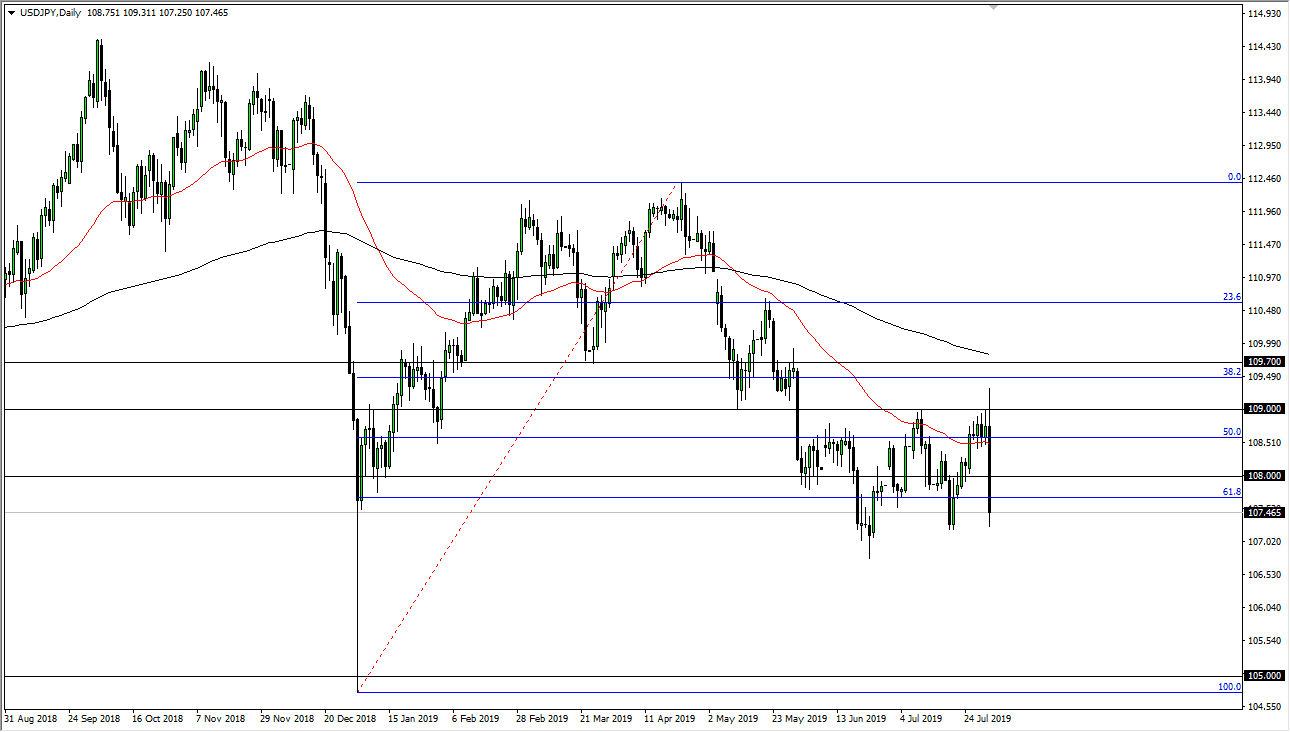

The US dollar has pulled back significantly after initially trying to rally during the Thursday session. We actually broke above the ¥109 level, an area that I had been paying attention to, and breaking above it was a good sign. However, we have completely rolled over since then, which has been exacerbated by the President of the United States informing the new tariffs were going to be levied upon Chinese goods.

Safety currency

The Japanese yen is a safety currency, so it does make sense that people would have been running toward it in the shakeup that occurred after the announcement of further tariffs against the Chinese. As I write this article, we are presently testing the ¥107 level. The next question of course is where we go from here? It looks very unlikely to be a scenario that’s going to be easy to deal with, and with the jobs number coming out on Friday there is high potential for severe volatility.

The jobs number

The jobs number will be crucial, so therefore we need to pay attention to how the market reacts to it. We are in a weird situation yet again, fighting now that the Federal Reserve may not be as loose with monetary policy as people had hoped, so therefore the question then becomes “Is bad news is good?” I think that is going to be the case, although we may initially selloff in the pair if we get a poor jobs figure. However, I anticipate that people are going to look at that as a potential “risk on” move, therefore sending this market higher based upon risk appetite.

Technical analysis

The candlestick is horrifically negative, but at the end of the day the question then has to be asked whether or not it is a bit overdone. I suspect it may be, but at this point it’s obvious that the market is rattled. If we break down below the ¥107 level for a couple of levels, I suspect at that point we will go looking towards the ¥105 level after that. That would essentially be the 100% Fibonacci retracement level, and now that we have broken through the 61.8% Fibonacci retracement level, that movie is rather typical. However, we could also turn right back around after that number comes out. If it does, then we could be heading back towards the ¥109 level. Either way, this is a market that is going to have a lot of choppiness.