The US dollar has had a very erratic trading session against the Japanese yen during the trading session on Tuesday, initially falling as the United States labeled the Chinese “currency manipulators”, which sent the Asian session on fire. However, the Chinese did not ratchet up the rhetoric, and essentially came in and stabilized the exchange rate of the Chinese yuan. With that, it’s likely that traders would have covered short positions, and as a result the market bounced all the way up to the ¥107 level. We also had more or less a “relief rally”, so having said that it’s not a huge surprise that it only lasted for a while.

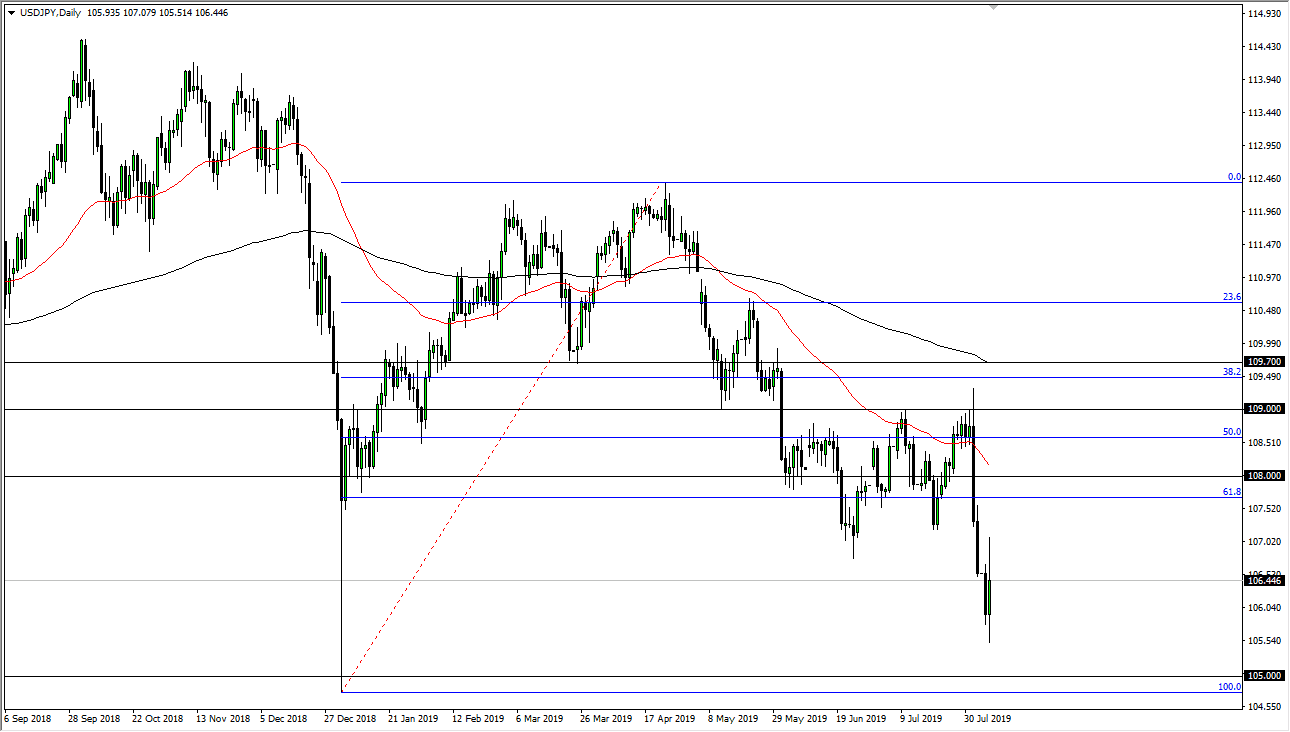

We have seen a lot of negativity near the ¥107 level, as we have dropped like a stone from there. The 60 pips given back is a very negative sign as it simply continues the overall downtrend. Ultimately, this is a market that was in a downtrend anyway, so the fact that we rallied and then found sellers isn’t much of a huge surprise. The ¥107 level is resistance, as it was massive support previously.

This is an area that of course is a large, round, psychologically significant figure, and therefore it makes quite a bit of sense that we had seen some proclivity to react to every 100 pips anyway. To the downside, the ¥105 level underneath is a support level, as it is a 100% Fibonacci retracement level from the original rally to the upside. We are well below the 61.8% Fibonacci retracement level so it makes sense that we go looking for that level. At this point I believe that we will have sellers come in every time we try to rally, at least until we get some type of stability in this market. This is a market that is going to continue to be negative, as there are so many geopolitical situations and of course negativity when it comes to global growth and trade tensions. I think it makes sense that the Japanese yen continues to get a lift, and even though the Bank of Japan said during the early Asian hours that they were monitoring the Forex markets, we know from previous actions that the Bank of Japan can come in and move the markets, but it is only temporarily.