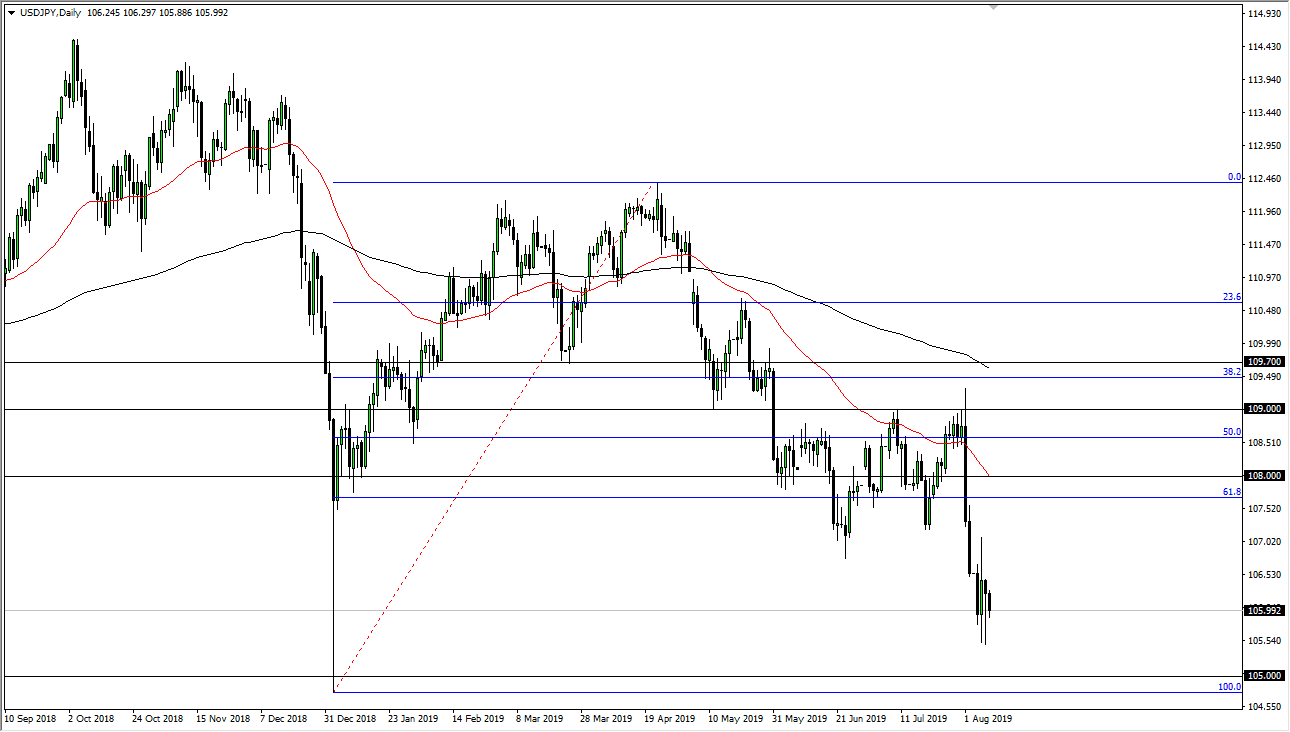

The US dollar has fallen a bit during trading on Thursday a bit of a “risk off” type of situation. Ultimately, I think that the market will probably show resiliency but a stubbornness to bounce. At this point, I believe that we are going to go looking towards the 100% Fibonacci retracement level underneath which also coincides with the ¥105 handle. All of that being said, keep in mind that this pair is highly sensitive to the risk appetite around the world, with that being the case it makes sense that we continue to drift lower as the Japanese yen should continue to attract monetary flows.

With that being said, I do believe that we will test the ¥105 level, and perhaps even break down through there. It doesn’t mean that we will do it easily, and then of course I think that the break down below there could lead to a major move lower. In fact, I believe that we will eventually have a “flush lower”, followed by the Bank of Japan getting involved. They do like to intervene when the market gets ahead of itself, and there is the possibility that we see that come back into play. They really don’t like the idea of ¥100.

That being said, believe it that if we do get a little bit of a bounce, the ¥107 level should be a massive opportunity for sellers to jump in and as soon as we see signs of exhaustion. At this point, I think that the market would be all over some type of exhaustive candle or a shooting star. At that juncture, I believe that the 50 day EMA starts to come into play, and that of course could push this market down as well. If we were to break above the ¥107.50 level, then we probably go looking towards the ¥108 level, and then possibly the ¥109 level. All things being equal though I am bearish of this market as I believe there are a lot of concerns out there. When there are concerns globally, quite often money will go running toward the Japanese yen. With that, I believe that it is only a matter time before we see that happen again. I look for those exhaustive candles above the take advantage of what has been a very strong and reliable trend, and will probably only continue.