The US dollar has rallied a bit during the trading session on Wednesday, as the Federal Reserve of course has gotten very much in the spotlight due to the fact that the interest rate announcement had come out. They did of course cut interest rates by 25 basis points, perhaps trying to lift the stock market. However, it appears that the statement wasn’t quite dovish enough to get so much of a “risk on” attitude. With that being the case it’s very likely that we will continue to grind sideways but it certainly looks as if we are stubbornly bullish.

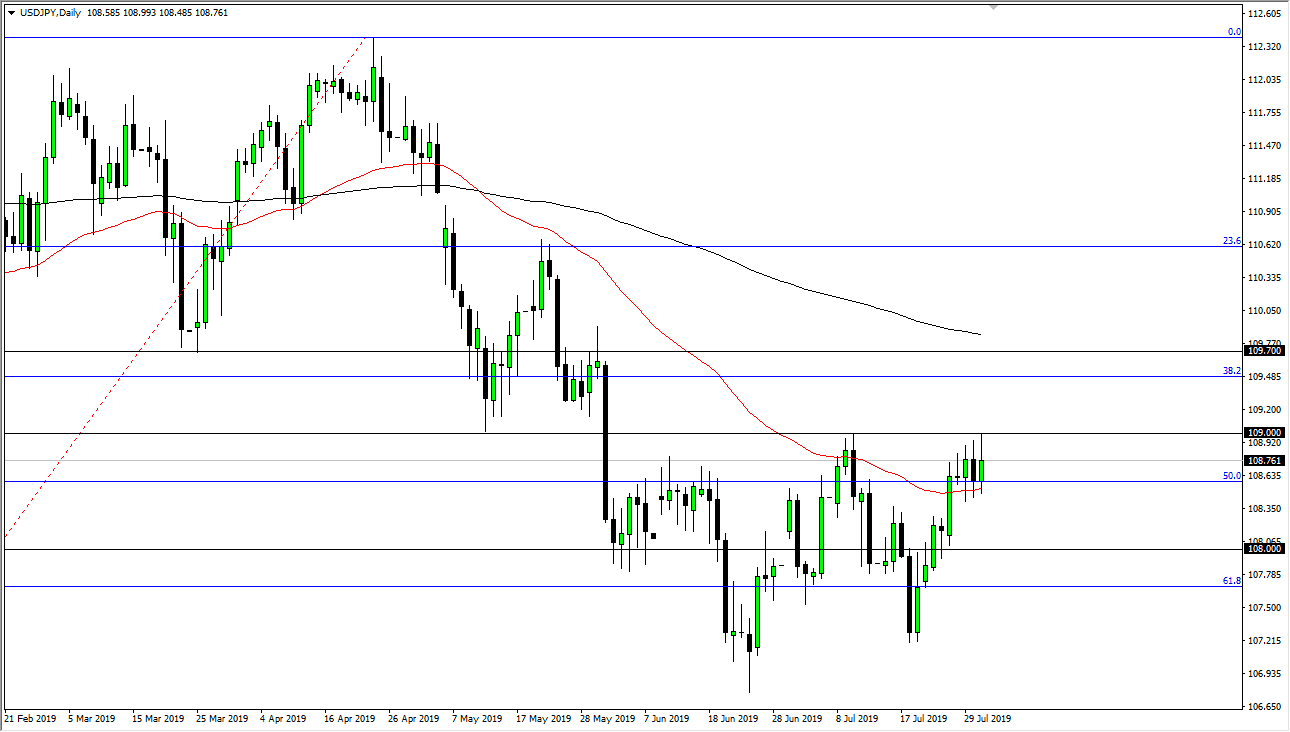

The 50 day EMA is curling higher just below, and that should continue to attract a certain amount of attention. Ultimately, I do believe that we break out above the ¥109 level, which is the gateway to much higher pricing. Once we do, I think the market probably goes looking towards the ¥109.70 level, where we had broken down from rather extensively. Beyond that, we also have the 200 day EMA sitting just above that level, pictured in black on the chart.

Looking at the chart, if we were to break down below the 50 day EMA and the last couple of sessions, then it would make quite a bit of sense that we go down to the ¥108 level, an area that has been rather important more than once. I believe at that point there would be enough buyers to jump into this marketplace and perhaps send this market to the upside. A break down below there opens up the possibility of a move down to the ¥107 level. All things being equal though, I do believe it’s only a matter time before the buyers return as we have made a “higher low” as of late. I think we are trying to form some type of bottoming pattern, but this is a pair that is extraordinarily choppy in these scenarios.

Looking at this chart, I believe that we are trying to find that base to go higher, reaching from the 61.8% Fibonacci retracement level. Overall, this is a market that I think probably has the proclivity to go higher, but we need to have the stock market to move right along with it. With seems very unlikely to do so in the short term, at least not in any great manner. Because of this I like buying short-term pullbacks, but I’m also relatively quick to take profit.