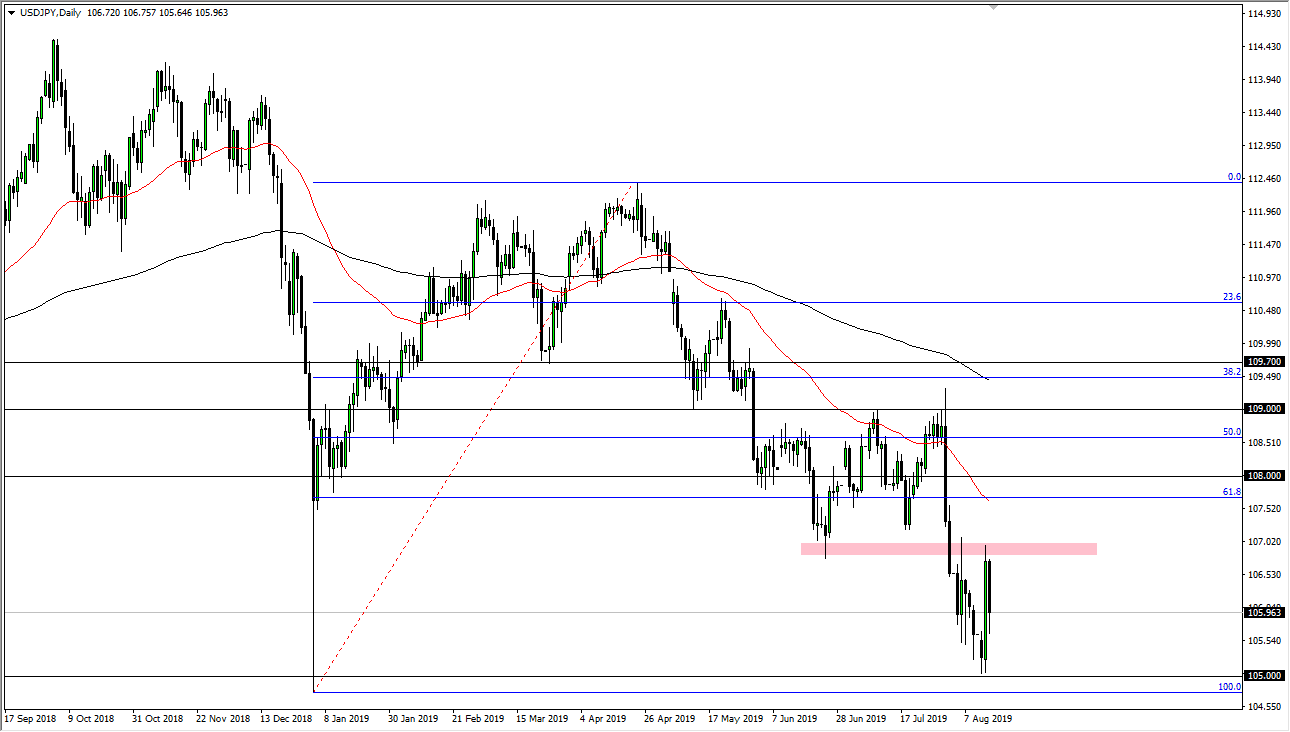

The US dollar has fallen hard against the Japanese yen during the trading session on Wednesday and it looks like it’s ready to continue the downtrend. The US dollar has tested the ¥107 level before rolling over, and it’s likely that we are going to continue to see this market reach down towards the ¥105 level. At that being the case, I would expect a lot of support to keep this market afloat, but I do believe that eventually the ¥105 level gets broken. If it does, then the market goes down to the ¥102.50 level, and then eventually the ¥100 level.

With the markets looking to be very sensitive to the possibility of a recession, and of course a lot of the global tensions around the world, it makes sense that a lot of people are going to be looking towards the Japanese yen for safety. If we can break down below that level I think that the market will collapse to the downside rather quickly.

Rallies at this point I think are selling opportunities that signs of exhaustion. At this point, I believe that the ¥107 level should be a significant “ceiling” in this market. At this point, the 50 day EMA above should continue to push this market lower as well, so I think rallies will have that to contend with also. With the US/China trade situation causing issues, I think that it’s likely we will continue to see a lot of people looking toward the Japanese yen for safety. I think fading rallies continues to work, although you may have to do it often short-term charts as I believe the 200 pips that we are trading and right now should continue to cause issues.

If we did somehow break above the 50 day EMA, we probably then have a lot of trouble at the ¥108 level, which of course is a large, round, psychologically significant figure as well. All things being equal though, I do believe that we break down because we are below the 61.8% Fibonacci retracement level which is almost always a very poor sign. With the yield curve inverting, there is a flush of money heading toward the US dollar, but this pair is probably one of the lone exceptions as people look for shelter. I believe that we are in the beginning of something rather nasty.