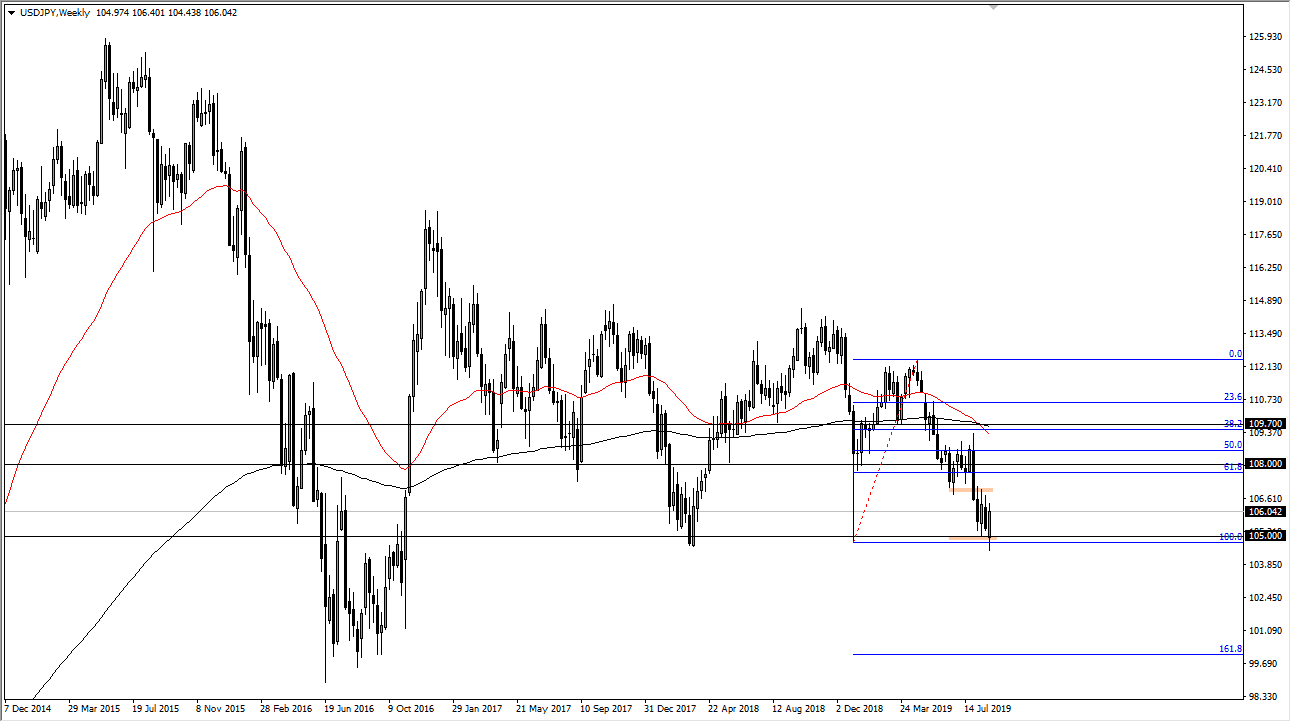

The US dollar has been wilting against the Japanese yen for some time, starting the latest push lower at the end of the July month. At this point, you can see that we have been testing a 200 point range, as marked by the pink lines on the chart. At this point, I think it’s only a matter time before we have to make a significant move. Currently, it’s very likely that negative headlines continue to be a major problem with the marketplace, and that of course sends this market in one particular direction.

The United States and China continue to trade barbs in the trade war negotiations and on Twitter and of course news outlets. As long as that’s going to be the case, and let’s be honest here, it looks very likely to be - this is a market that will be very sensitive. The Japanese yen is considered to be a safety currency, so it picks up value as people start to worry. Yes, the US dollar is also a safety currency but at this point it’s likely that might be negated by the fact that the Japanese yen will continue to strengthen overall. The US dollar will probably gain against most currencies while this market continues to drop.

I believe that if we break down below the lows of the month of August, which is essentially the ¥104.75 level, this market is probably going to unwind quite drastically. In fact, I think the first target would be the ¥102.50 level, followed by the ¥100 level where I believe that the Bank of Japan would start to jawbone the markets. There is the possibility of a turnaround to the upside, but I think we need to see some type of real move in sentiment and of course the trade negotiations to send this market higher. We would need to clear the ¥107 level on a weekly chart, perhaps reaching towards the ¥108 level. Currently, it looks as if the downside is much more likely than not, so I look to short-term charts to fade any type of strength in the US dollar against the Japanese yen. Expect extreme volatility, but it only takes one or two bad headlines to send this market falling quite drastically. We are currently trading at the 100% Fibonacci retracement level, so if we do wipe out below there, it’s very negative.