The US dollar has gone back and forth during the trading session on Wednesday, as we continue to see a lot of volatility in this pair. This is because this pair is highly levered to risk appetite, as this pair will rally when the stock market rallies and of course vice versa. With that in mind I believe that the fact that the stock market is trying to recover probably sends this market looking for higher levels. I don’t care though, because we are in a downtrend for a strong reason, and I think that every time we approached the ¥107 level, it’s a selling opportunity all the way up to the ¥108 level.

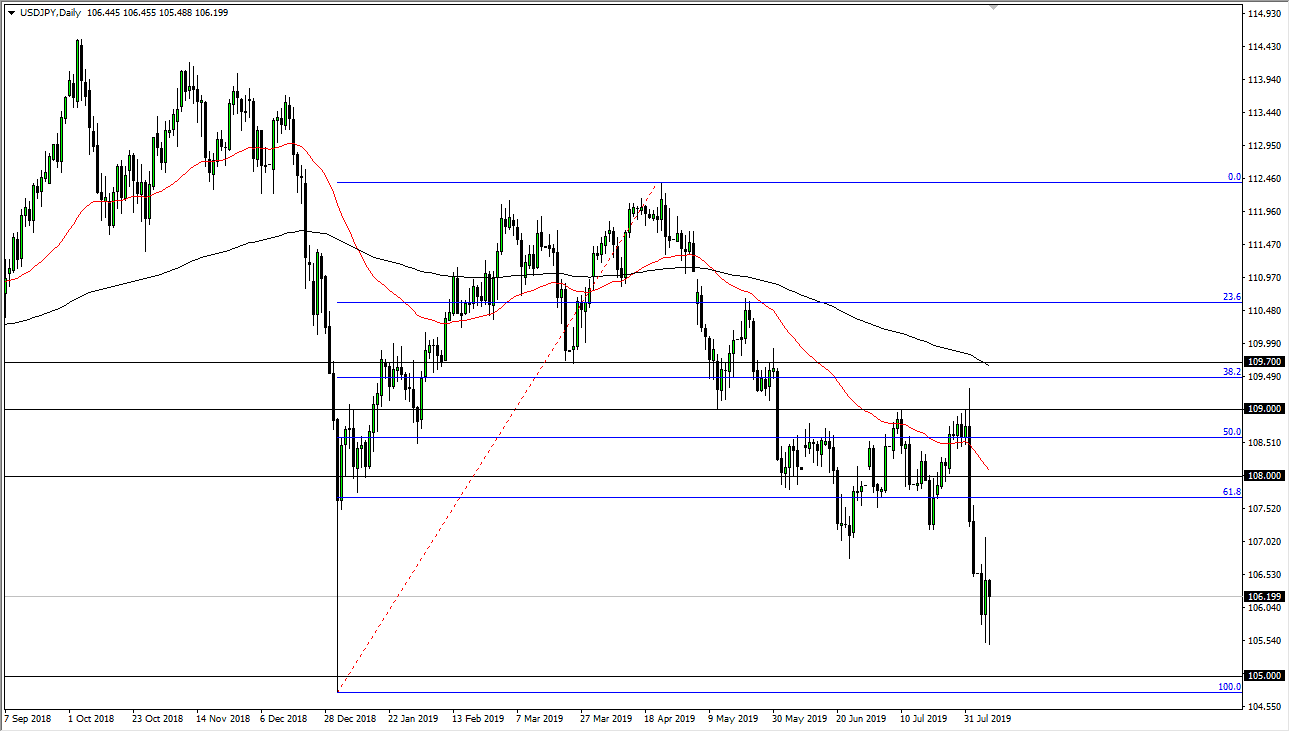

Looking at this chart I see a lot of consolidation over the last couple of days and I think that the market is simply trying to decide whether or not you can handle the idea of reaching down towards the 100% Fibonacci retracement level. The 61.8% Fibonacci retracement is in the rearview mirror, and that typically means that the market is going to go looking towards the 100% Fibonacci retracement level which is just below that ¥105 level.

If we were to break down below the ¥105 level and the 100% Fibonacci retracement level, it’s likely that we go much further to the downside, possibly a couple of handles. To the upside, I think that every 100 pips or so you should see plenty of resistance that will come into play. Although we could turn around we would need some type of reason to start getting bullish on the overall risk appetite of markets. The candlestick is of course a bit of a supportive looking hammer, which of course is a good sign. This could give us an opportunity to start selling on signs of exhaustion above, which happens to be my plan.

This pair is going to chop around overall, as it typically does. Beyond that, it’s August which is probably one of the worst times of year to trade, as we tend not to have a lot in the way of trending action. Looking at this, I believe that simple patience will be needed to take advantage of what we have seen over the last couple weeks. Simply wait for the Japanese yen to become “cheap”, and then take advantage of those value plays. As far as buying is concerned, I need to see some type of fundamental shift.