The US dollar has rallied slightly during the trading session on Wednesday, as we continue to consolidate against the Japanese yen. Ultimately, this is a market that I think is basically stuck in a range, but basically in the middle of it as I write this article. Because of this, there is in a whole lot to do until we can get to the outer edges of this obvious range.

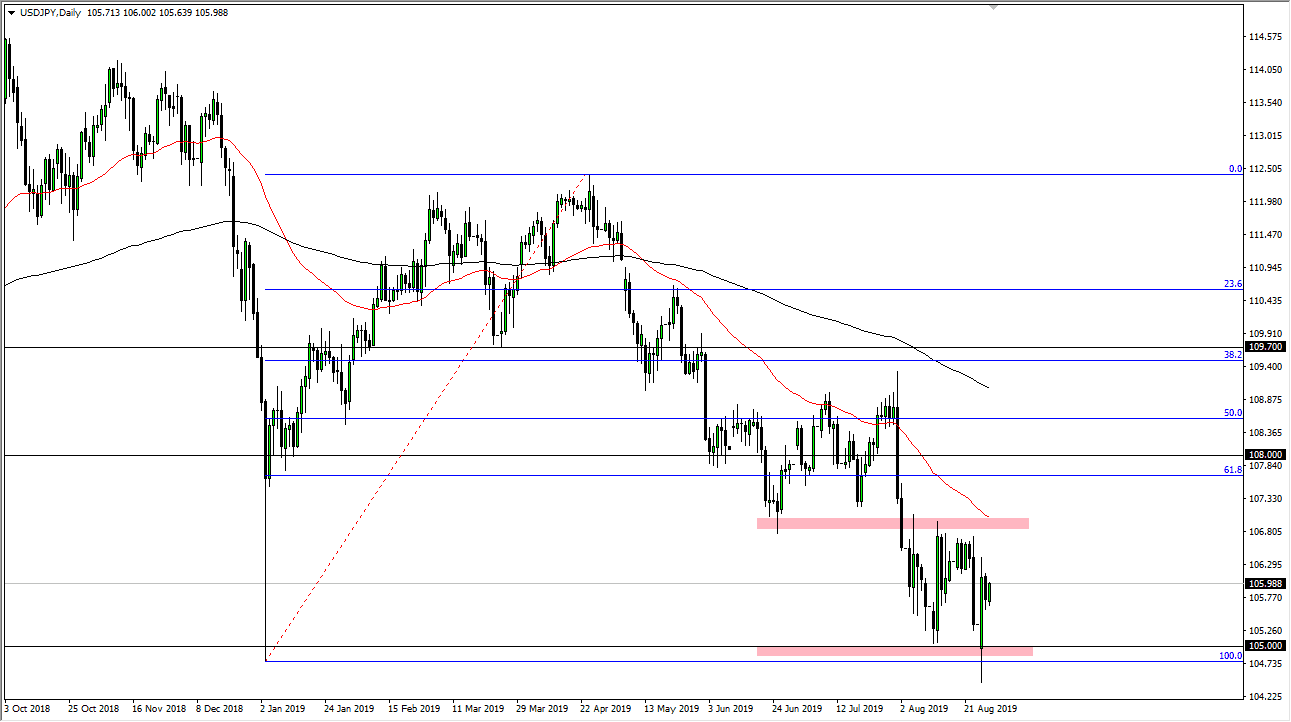

The range was pretty tight during the trading session on Wednesday, so it shows that the market isn’t ready to go in a particular direction for a big move. That makes sense, because there is a serious lack of volume right now as most traders are away at holiday. The ¥107 level above is massive resistance, just as the ¥105 level is underneath. Expect a lot of back-and-forth trading, and I think you should look at this as a scenario that is perfect for range bound systems. As we get closer to the ¥107 level, it’s time to start looking for selling opportunities. Ultimately, the ¥105 level underneath is an area you should be looking for buying opportunities. Having said that, it is only a matter of time before that breaks down if we get enough bad news.

If we were to break down below the candle stick from the Monday session, that would be an extraordinarily negative turn of events and it should unwind this pair down to the ¥102.50 level, perhaps followed by the ¥100 level. At that point, I think the Bank of Japan would probably step in and get involved. After all, they have done it down at that level in the past, and there’s nothing to think that they wouldn’t step in now.

Having said all of that, the Japanese yen is a safety currency, and therefore it makes sense that we continue to see the Japanese yen is favored against most currencies around the world in the short term. As long as there are problems with the US/China trade relations and of course the fear of global growth, I believe that the Japanese yen continues to strengthen in general, and therefore I like selling short-term rallies that show signs of exhaustion in this market. The ¥107 level has the 50 day EMA testing it right now, which of course only solidifies that massive resistance overhanging the market.