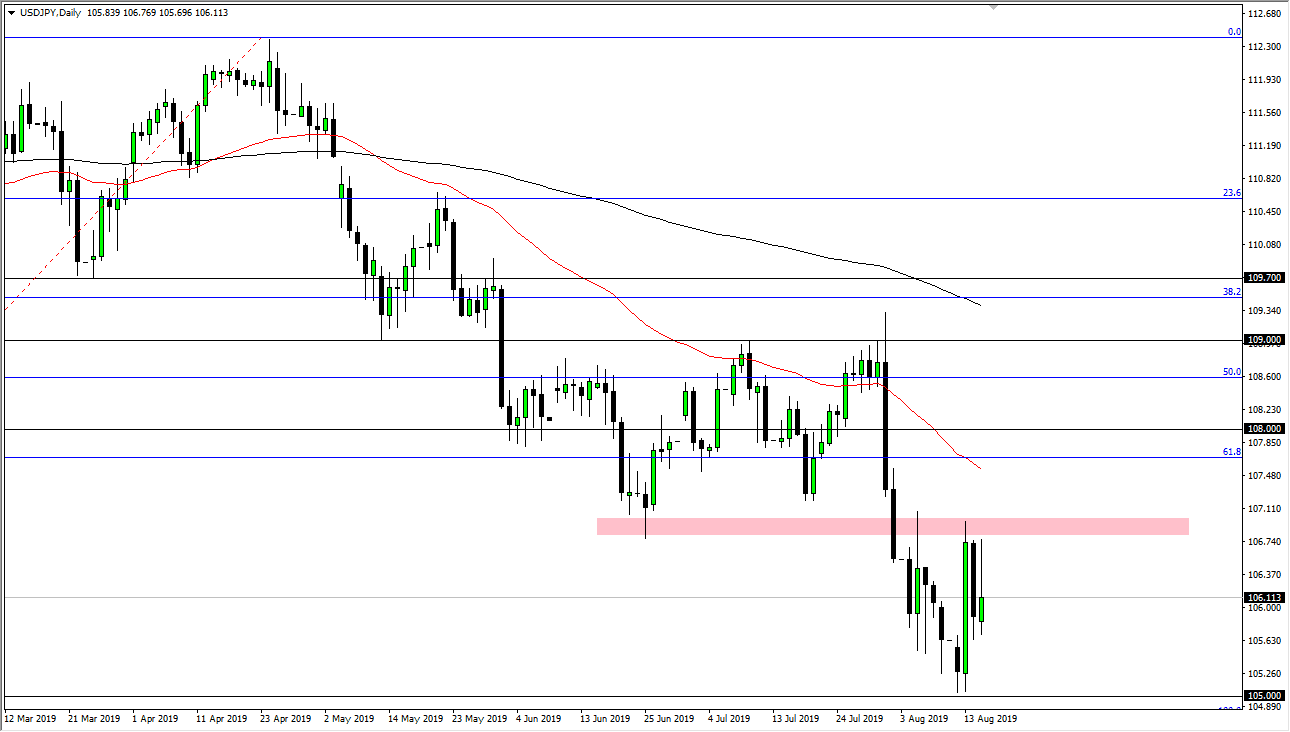

The US dollar has initially tried to rally during the trading session on Thursday but then turned around at the ¥107 level to fall rather precipitously. The candle stick from the trading session is starting to look very much like a shooting star, so I think we are going to continue to reach lower. The ¥105 level is an area that has offered a lot of support, so I think at this point we are going to retest that level.

Keep in mind that the 100% Fibonacci retracement area is just below there, and as we are well below the 61.8% Fibonacci retracement level, it makes sense that we would then go down to the 100% Fibonacci retracement level as per usual. If we can break down below it which is just below the ¥105 level, then this market is ready to go much lower. I think at that point we would probably target the ¥102.50 level.

If we can break down below there I think that the market goes to the ¥100 level. At that point I suspect that the Bank of Japan will probably continue to monitor markets and perhaps try to intervene at one point or another. Because of this I believe that the ¥100 level is essentially going to be the beginning of the end of the downtrend, but we aren’t there yet. In the short term I like the idea of fading rallies as they occur, because we just can’t keep gains in this pair right now. As long as that’s going to be the case then I think people will continue to look for safety in the form of the Japanese yen, as we have seen on this chart.

The alternate scenario of course is that we break out to the upside. I don’t think that’s going to happen but if we do see some type of US/China trade relations positive momentum, then this pair could rally rather significantly. We would need to clear the ¥107 level decidedly in order to take advantage of that. Until then, I would assume that rallies are to be faded, but if we do make that break out it could send this market much higher as it would have been a combination of a massive bullish candle in that a breakout above it. Expect volatility with a slightly negative tilt.