The US dollar has initially plunged lower during the trading session on Monday, as traders reacted to the new tariffs imposed on the Chinese by the Americans after the markets closed on Friday. At this point, the market looks as if it has completely brushed that to the side though, as the headlines are a mix and a back and forth as to whether or not the Americans and the Chinese are still speaking. It looks as if the market is completely confused as it probably should be.

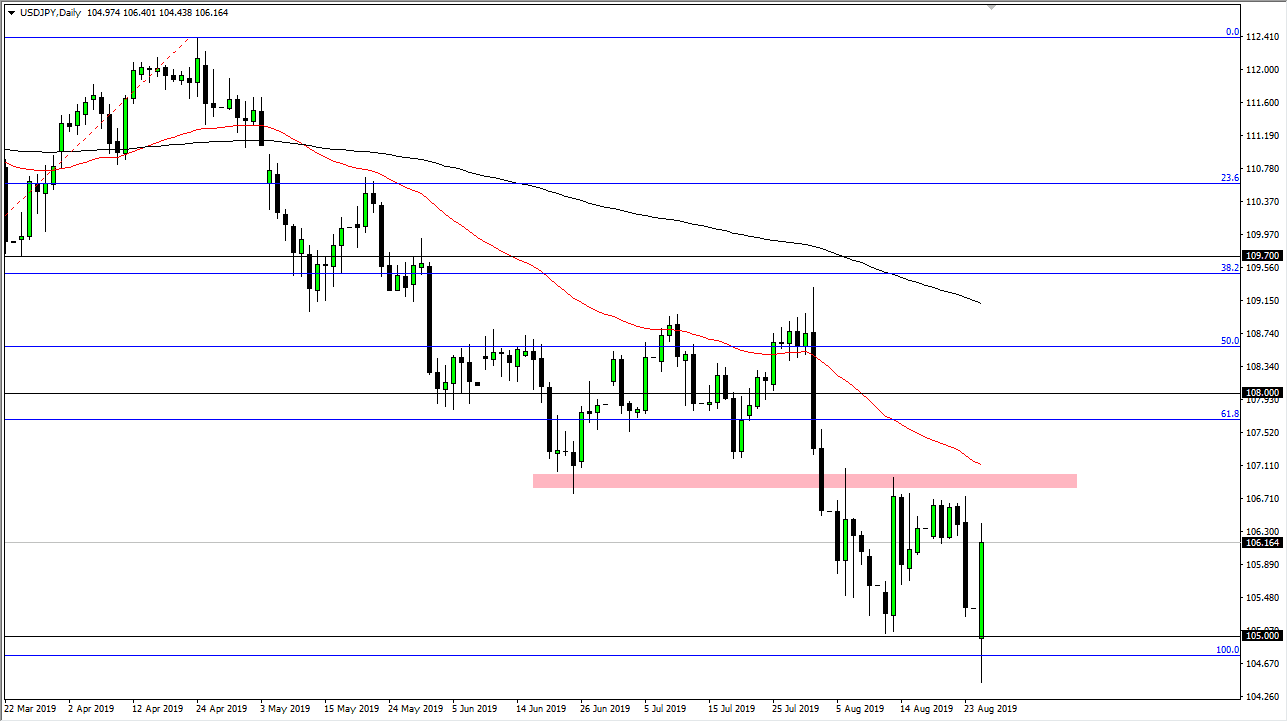

The US dollar has rallied significantly after there were comments about Chinese officials calling Americans about wanting to continue to finish trading. At this point, the market reenters the previous consolidation area as it was probably the only thing you can do. At this point, the ¥107 level continues offer significant resistance, and now that the 50 day EMA is reaching towards that level, it becomes even more resistive.

At the other side of the consolidation area, the ¥105 level offers massive support. It’s not only a large, round, psychologically significant figure, but it’s also where the 100% Fibonacci retracement level is. We did break down through that level initially during the trading session, but it has now offered quite a bit of support. The question is whether or not we can finally break out of this range now that it’s shown this area underneath the be so supportive. Looking at this chart, I think we continue to bounce around in this area, as the market is screaming for a range bound system. However, I do favor the downside overall because this is so sensitive to risk and therefore if we get some type of major problem out there, it will continue to drop. I think it’s easier to simply fade rallies, but I also realize that until we can break down below the lows of the trading session from Monday, one has to think that you still bounce occasionally but then fade.