The USD / JPY pair did not celebrate much with its recent gains, reaching the 106.97 resistance level, as the decline returned to 105.64 support before settling around 105.95 at the time of writing, and before the release of a batch of important US economic data. The recent and temporary gains were due to the US decision, which surprised everyone, by postponing further tariffs on Chinese products, which were scheduled for Sept. 1, to a new date on Dec. 15. Investors have grasped the impact of the decision amid fears it could be a Trump maneuver, especially after China's recent decision to devalue the Yuan against the dollar to an 11-year low to hit the competitiveness of US exports in world markets.

The US dollar is still negatively affected by the recent expectations of the global financial institutions that the US economy may entre recession in the near future, and therefore the Federal Reserve may not have an option but to ease its monetary policy and reduce interest rates sooner rather than later to face the consequences of this slowdown, especially since the trade dispute with China is still standing, and there are no signs of an agreement between the two sides soon. The results of the US economic data will remain the focus of investors' attention as Jerome Powell and his colleagues monitor the economic developments to determine the appropriate course of the Bank's policy, not taking into account the policy differences of the Trump administration.

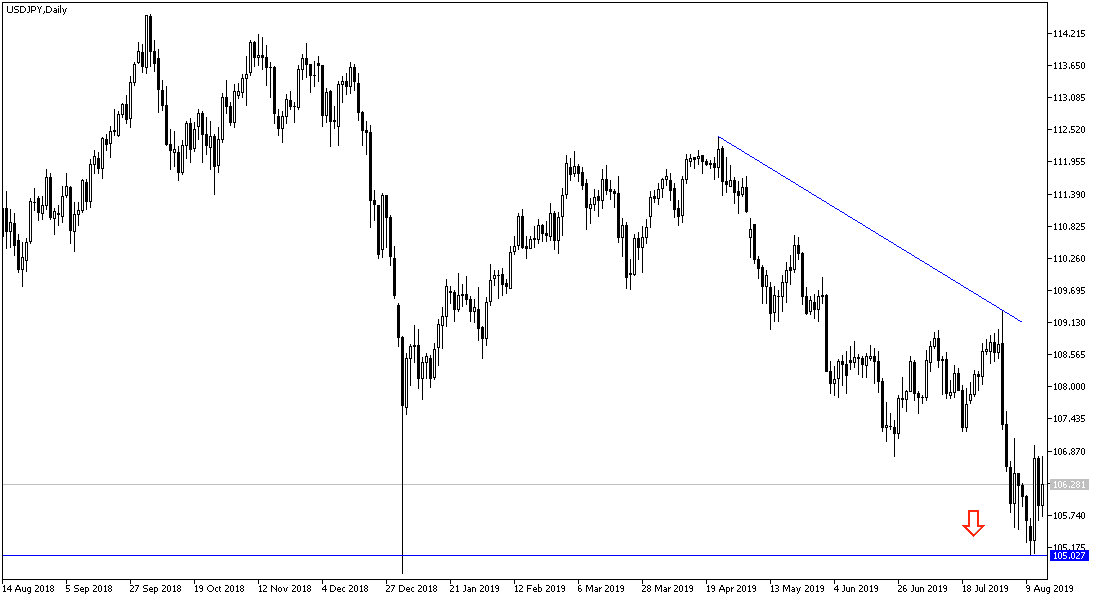

According to the technical analysis, the break of the bearish trend for USD / JPY has not been confirmed yet despite recent gains. Moving around and below the 105.00 psychological support will increase the selling, and the closest support levels are currently at 105.45, 104.80 and 103.70 respectively. In case of an upwards correction, the resistance areas will be 106.75, 107.30 and 108.00, which are the closest to the pair's performance at the moment. As mentioned before, we confirm now that the 110.00 psychological top remains the strongest indicator of breaking the trend and starting the upward journey. Technical indicators confirm the pair reaching strong oversold areas.

On the economic data front today: after the release of Japanese industrial production, the pair will focus on the release of US economic data; retail sales, the Philadelphia Industrial Index, non-farm productivity, weekly jobless claims and industrial production.