Immediately after the US announcement of the postponement of further tariffs on Chinese products, which was scheduled for September 1, investors increased risk appetite and temporarily abandoned safe havens led by the Japanese yen, which prompted the USD / JPY pair to launch strongly. It reached the 106.97 resistance level after testing the 105.06 support level, the lowest for more than seven months. Yesterday's session was the pair's best daily performance since the beginning of 2019 trading.

The United States suddenly decided to postpone tariffs on Chinese-made mobile phones, laptops and other items, and removed other Chinese imports from its wholly targeted list, in a move that pushed US stocks higher on Wall Street. The tariffs were postponed to December 15. This came as China announced coordination with the US side to revive their trade talks soon.

The US dollar suffered a setback from the recent expectations of a number of international banks and financial institutions that the US economy is on the way to recession in the coming months, which forces the US central bank to cut interest rates at a faster pace to revive the US economy. Especially if the US-China trade dispute continues beyond the US presidential election in 2020.

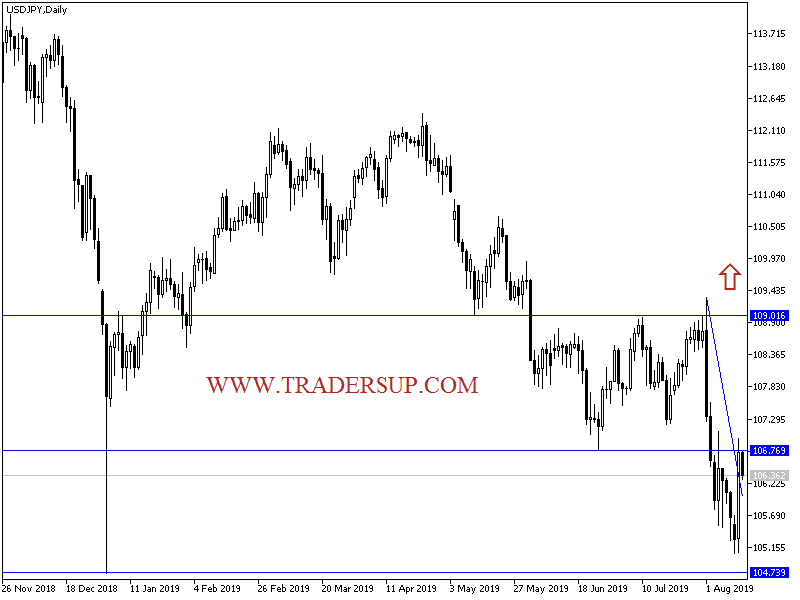

According to the technical analysis: The recent break of the USD / JPY bearish channel still needs to confirm the strength of this correction, and this will happen if the pair moves to test the resistance areas at 107.30 and 108.45 and 110.00psychological top respectively. Otherwise, falling will remain the strongest performance for the pair, and hopes for a correction may be higher if the pair returns to test the 105.75 and 104.90 support areas and 104.00 psychological support respectively. The USD / JPY is near oversold areas based on technical indicators direction.

On the economic data front today: The main focus will be on the release of Chinese industrial production, fixed asset investment and retail sales data. Then German GDP, British inflation, economic growth and industrial production in the Eurozone. From the U.S, import price index and crude oil inventories data.