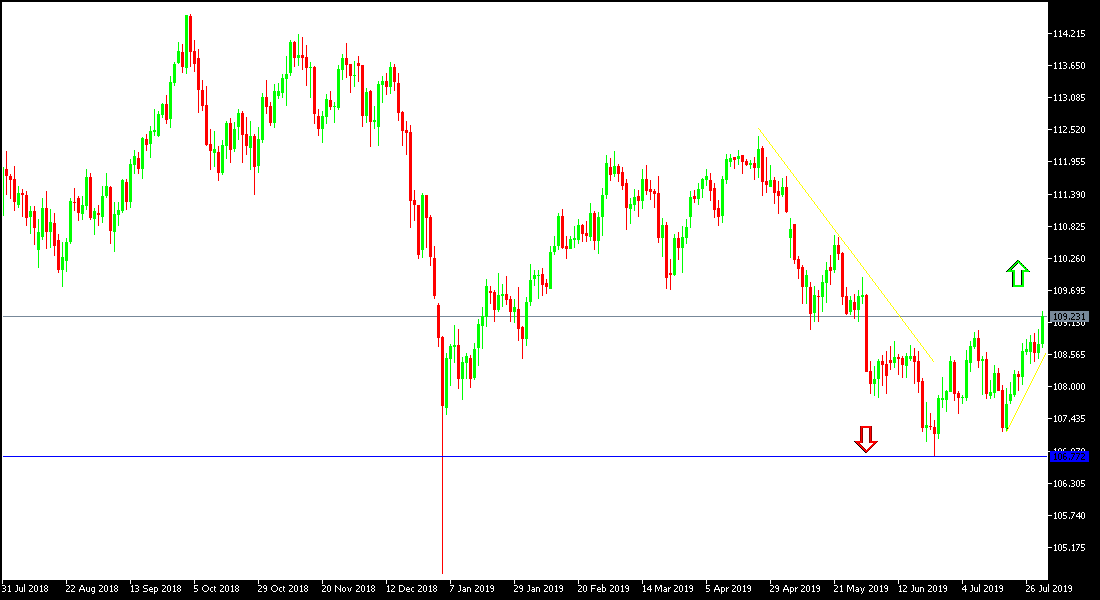

The US Federal Reserve, as expected, announced cutting US interest rates for the first time in 10 years by a quarter point, but indicated that the rate cut would not be the norm for the bank's future policy, and that what happened was just a mid-term adjustment for the bank’s policy. The bank's chairman stressed that cutting interest rates will not be the bank’s system from now on. The bank and its members renewed their confidence in the performance of the US economy. The data received since the last meeting indicate that the labor market remains strong and economic activity has risen at a moderate rate. At the same time, the Fed said it would continue to monitor the implications of the information on the economic outlook and reiterated that it would act "as appropriate to maintain expansion". The US dollar has moved strongly against other major currencies. The USD/JPY rose towards 109.31 resistance before settling around 109.11 at the time of writing, which is closer to the 110.00 psychological resistance, confirming the strength of the bullish correction.

Despite the pair's gains, fears of rising trade and geopolitical tensions will support the return of investors to buy safe havens, with the Japanese Yen being one of the most important. The recent round of negotiations between the United States and China failed to support investors' confidence that a deal would soon be reached. Focus will now be eyeing Trump's reaction, who has threatened that he may be forced to impose tariffs on all imports from China if negotiations fail.

Technically: The general trend of the USD / JPY pair has a new bullish momentum and the test of the 110.00 psychological level and the stability above that will confirm the strength of the new bullish trend. On the downside, if the pair moves towards the support levels of 108.80, 108.00 and 107.45 respectively, the chance of a bullish move will end. We prefer to sell the pair as investors' continued concerns will boost their appetite for safe haven.

On the economic data front: today's economic calendar will focus on the US Unemployment Claims, the ISM Manufacturing PMI and the Construction Spending Index data.