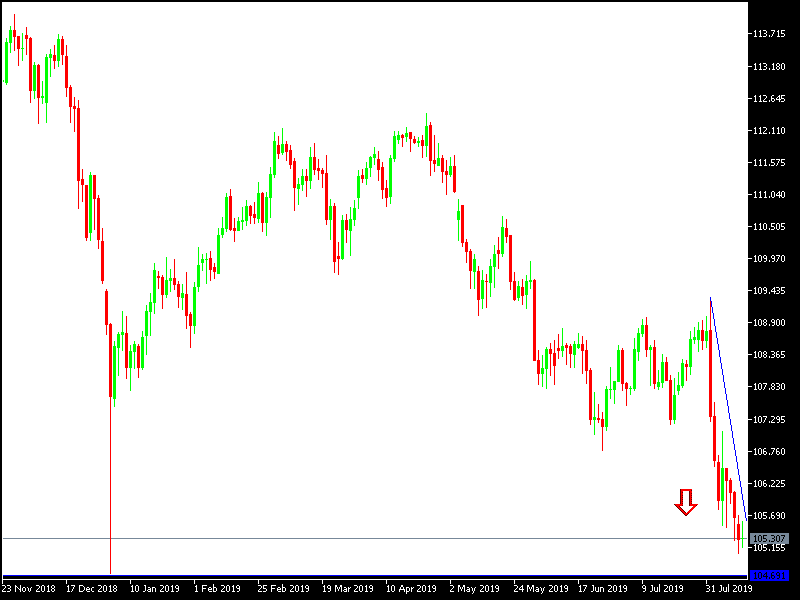

Ahead of the release of important and influential US inflation figures, USD/JPY continues its strongest losses, reaching the 105.04 support level and a seven-month low, before stabilizing around 105.27 at time of writing. Breaking below the 105.00 psychological support 105.00 will give the pair enough momentum to test new record support levels. . Morgan Stanley, Goldman Sachs and several global investment banks have joined in predicting that the US economy may be in recession in the coming months, so the US central bank may be forced to cut interest rates to revive the US economy. The bank expects to cut interest rates at its September and October meetings, with expectations of rapid multiple cuts during next year, especially if the trade dispute between the United States and China will continue beyond the 2020 elections in the United States and a new victory for US President Trump.

The US Federal Reserve is monitoring economic developments to determine the appropriate monetary policy and did not comment on China's recent decision to devalue the Chinese Yuan to an 11-year low against the US dollar. The bank also ignored Trump's comments that followed China's decision that the US central bank should do something about what is happening. Last week, we noticed a general trend for global central banks to cut interest rates and ease monetary policy. The most prominent was the Reserve Bank of New Zealand's decision to cut rates by 50 points at once to revive the country's economy.

Technically: The bearish momentum of USD/JPY continues and supports a bearish move below the 105 psychological support, and therefore the pair is ready to test stronger support areas that may reach 140.60, 103.90 and 102.75, respectively, the pair ignores the arrival of technical indicators to oversold areas with increased demand for the Yen. In case of a bullish correction, resistance levels 105.90, 106.40 and 107.30 will be the closest to the pair's performance.

On the economic data front: The economic calendar today will focus on the release of the US consumer price index and despite expectations of rising prices, the US inflation rate is still far from the Federal Reserve's goal.