The recent violent bearish correction pushed the USD / JPY pair to move towards the 105.51 support level in early trading on Tuesday, its lowest level in seven months, before trying to bounce back to 107.08 and settling back around 106.48 support at the time of writing. The pair is trying hard to stop the pace of decline and investors want to return to buy the pair after reaching those attractive levels. The recent record gains of the Japanese yen supported by investors' flight to safe havens, and risk aversion, as the situation in the trade war between the world's two largest economies worsened with the United States imposing more tariffs on China's imports and the latter retaliated by announcing the devaluation of the Yuan below the $7 level for the first time in 10 years, reducing the appetite for US exports in world markets and strongly support Chinese exports, which have been severely affected by the trade dispute with the United States.

The announcement of the divergence in US job numbers came after the US Federal Reserve cut US interest rates for the first time in 10 years and despite the announcement, the bank did not confirm its monetary policy shift towards more interest rate cuts, which wasn’t to the liking of investors in US and global stock markets. The US Central Bank believes in the strength of the US economy with the support of standard jobs.

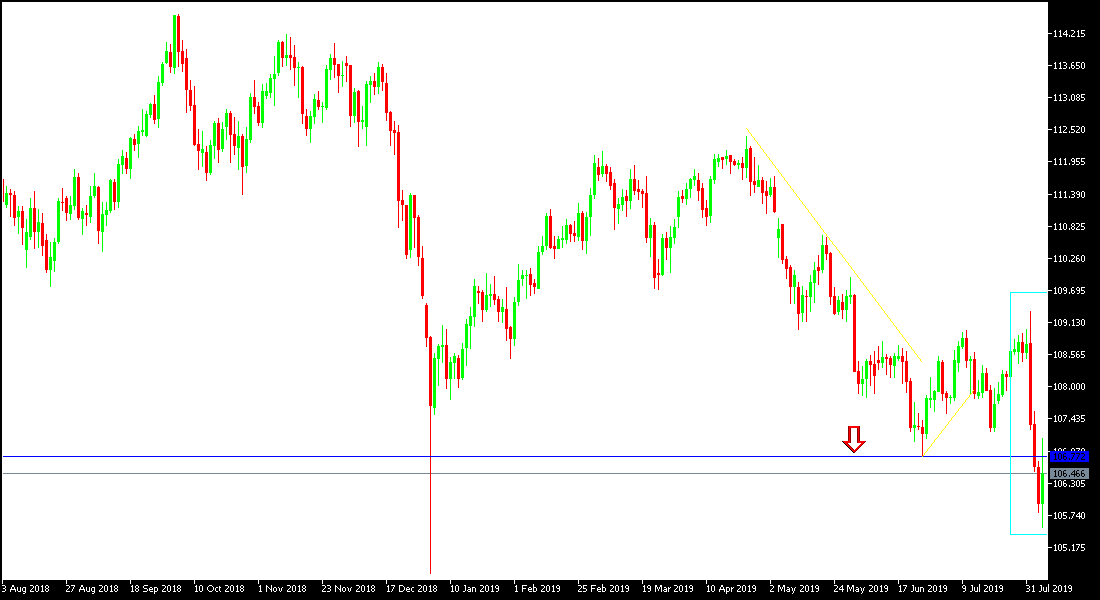

Technically: The general trend of the USD / JPY pair is still bearish and recent support levels of 105.50, 104.80 and 104.00 respectively will support further investor interest to return to buy the pair. Technical indicators have generally reached oversold areas. On the upside, the nearest resistance levels are 106.45, 107.20 and 108.00 respectively. As we have confirmed in the recent technical analysis, the bullish correction will not have a stronger opportunity without the pair moving towards the 110 psychological top. Otherwise, the drop will remain the stronger possibility.

On the economic data front: The economic calendar today has no important data from the United States or Japan.