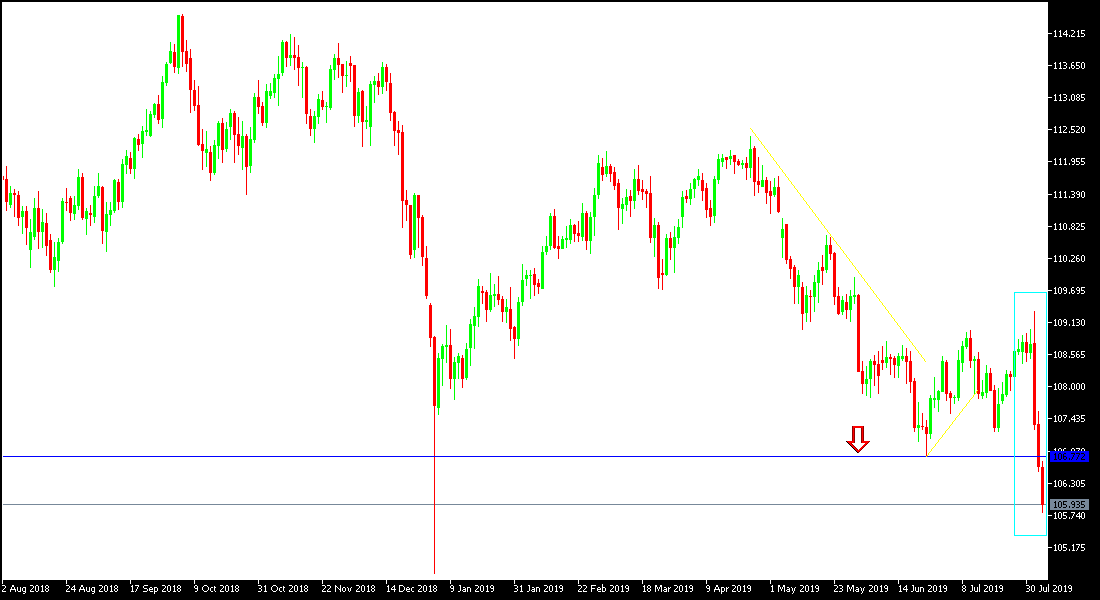

Over the course of three trading sessions, the USD/JPY pair has lost ground and its losses have reached its 105.78 support, the lowest in seven months. In Thursday's trading session, the pair recorded its worst daily performance in seven months, with the pair losing close to 200 pips. The pair ignored the release of the US jobs report and continued its losses. The Japanese yen gained strong momentum after US President Trump approved new tariffs on Chinese imports as a new pressure card from Trump after the recent round of talks between the two sides failed in Shanghai. China wants to stall until the end of the US elections, as Trump claims, and the latter wants to win America's policy first. This situation is in favor of the Japanese yen as investors flee to safe havens.

Earlier, the US Federal Reserve cut US interest rates for the first time since 2008 as strongly expected, but the bank made another surprise to financial markets after the announcement by suggesting that the cut was just an update of the bank's policy and not the new approach to be followed, increasing disappointment for investors in the US and global stock markets. The US Central Bank remains confident in the performance of the US economy despite the recent divergence in US economic data, mainly jobs.

Technically: the USD / JPY pair is growing weaker, and at the same time, reached buying levels, with the most notable being currently 105.50, 104.80 and 104.00 respectively. The bearish momentum pushing technical indicators to move towards oversold areas in less time. On the upside, the nearest resistance levels are 106.45, 107.20 and 108.00 respectively. As we mentioned earlier in the latest technical analysis, we confirm that the bullish correction opportunity will not be stronger without the pair moving towards the 110 psychological top. Otherwise, the drop will remain the closest to the pair’s performance.

On the economic front, we can only find the ISM Non-Manufacturing Index in the United States.