The pace of USD/JPY losses stalled on the threshold of 105.00 psychological support, the pair's lowest price in seven months, and stabled around 105.45 support at the time of writing, awaiting fresh news after two consecutive weeks of record losses. The pair is expected to move quietly at the beginning of this week, as the economic calendar today has no significant data from both the US and Japan. By the end of last week's trading, markets were affected by US President Trump's remarks that he was not ready to conclude an agreement with China soon, and that even expressed his doubts about meetings between the two sides next month. The prolonged trade dispute between the world two largest economies will lead the world economy into recession, and the two sides may stall until the results of the US elections in 2020. This conflict and growing investor fears will support further gains for the Japanese yen as one of the most important safe havens.

The recent actions by the United States and China have deepened global market concerns and bolstered the global central banks' approach to easing monetary policy to stimulate the economy and counter the consequences of this war, which is expected to be prolonged. The US Federal Reserve will come under new “Trump” pressure after China's recent decision to devalue the Chinese Yuan against the dollar in retaliation for further US tariffs, following another retaliatory response to completely stop importing US agricultural products. But the independence of the US central bank may prevent Trump from wanting to soften the bank's policy at will.

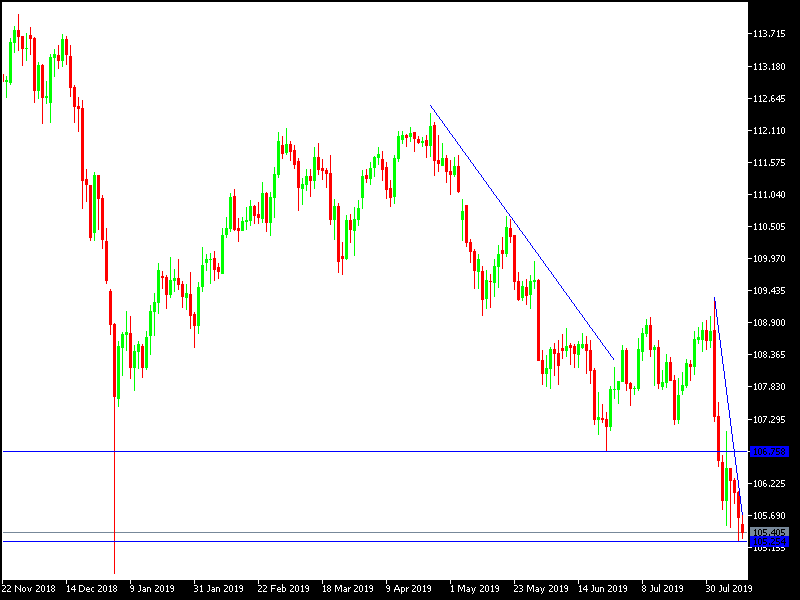

Technically: the general trend of USD / JPY is still bearish and a break below 105.00 psychological support will increase the bearish momentum to move towards support areas at 104.55, 103.90 and 102.80 respectively, which will consolidate the strength of the current downtrend. In case of a correction to the upside, the resistance levels will closest to the performance of the pair will be 106.30, 107.00 and 108.50 respectively. The recent performance will support selling the pair from each bullish correction.

On the economic data front today: The economic calendar today has no important economic data from the United States or from Japan.