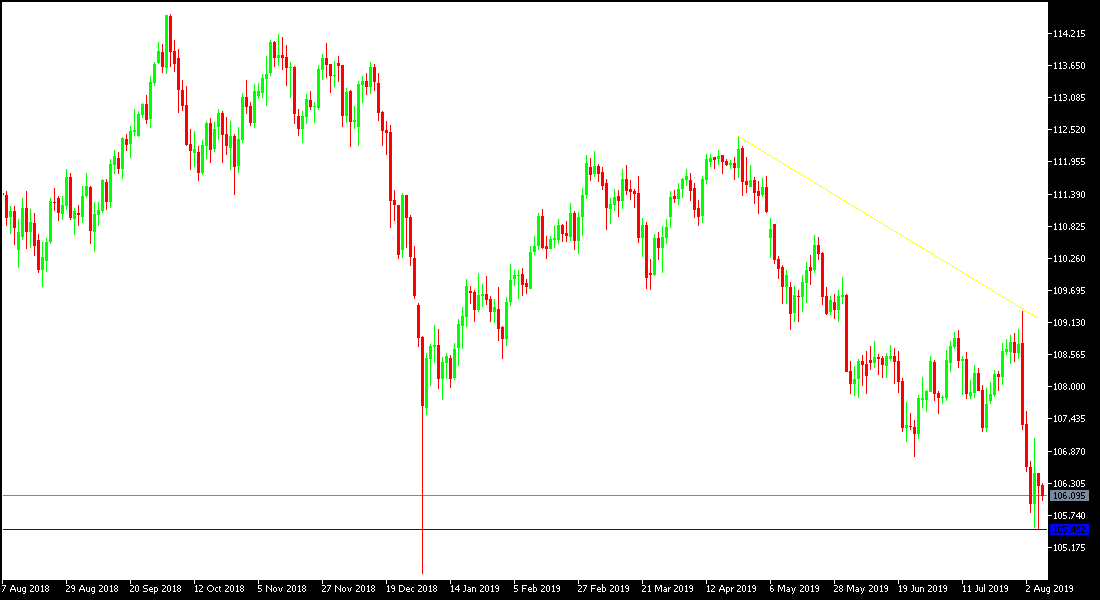

On the USD / JPY daily chart below, it seems clear that the price of the pair is exposed to test new support levels in the event of moving around and below the 105 psychological support, the lowest in seven months. Attempts for a bullish correction are still weak and lack momentum to make this work. For the last two trading sessions the pair has attempted to break below 105.50 support and stabilized around 106.12 at the time of writing, awaiting any developments. The Japanese yen remains the strongest as investor rush to it as a safe haven amid growing global trade and geopolitical tensions. The developments of the global trade war have reached a currency war that could lead to a severe global economic crisis if the United States considers responding to China's recent step to weaken the Chinese Yuan below the level of 7 dollars to crush US exports at world markets and weaken the competitiveness of these products vs less expensive Chinese products.

China's move towards the Chinese currency was a retaliation for the continued imposition of US tariffs on imports from China. The move could reinforce Trump's position on continued pressure on the US Federal Reserve to further cut US interest rates to weaken the US dollar and revive the US economy. This is a predicament to Trump. But the bank reiterated that they would monitor future economic developments to determine the appropriate policy situation.

Technically: The bearish trend is still stronger for USD / JPY, and testing the 105.00 psychological support will bring up the opportunity for the pair to test stronger support areas that could reach 104.60, 103.90 and 103.00 levels respectively, while at the same time, buying levels will attract the attention of investors, as all technical indicators have reached oversold areas. On the upside, the nearest resistance levels are 106.85, 107.40 and 108.30 respectively.

On the economic data front: The economic calendar highlight today will be the announcement of the Chinese trade balance and the US weekly jobless claims.