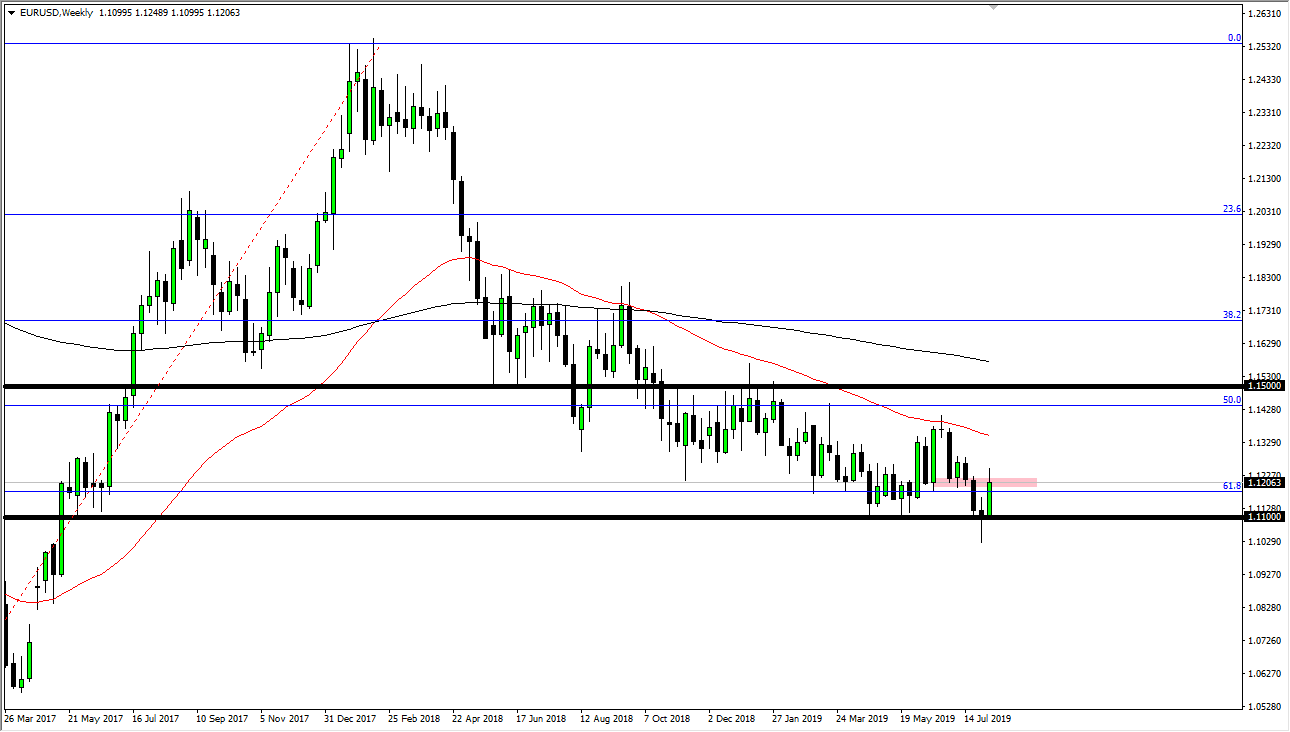

EUR/USD

The Euro has had a strong week initially, but on Wednesday, Thursday, and Friday we stalled near the 1.12 handle. There is a significant amount of resistance between the 1.12 level and the 1.13 level, so I think at this point what we are likely to see is a continued “sell the rallies” type of scenario. Market participants continue to view both of the central banks is very soft, and I think that will continue to be the case. There is a serious argument to be made for US dollar strength due to global concerns more than anything else.

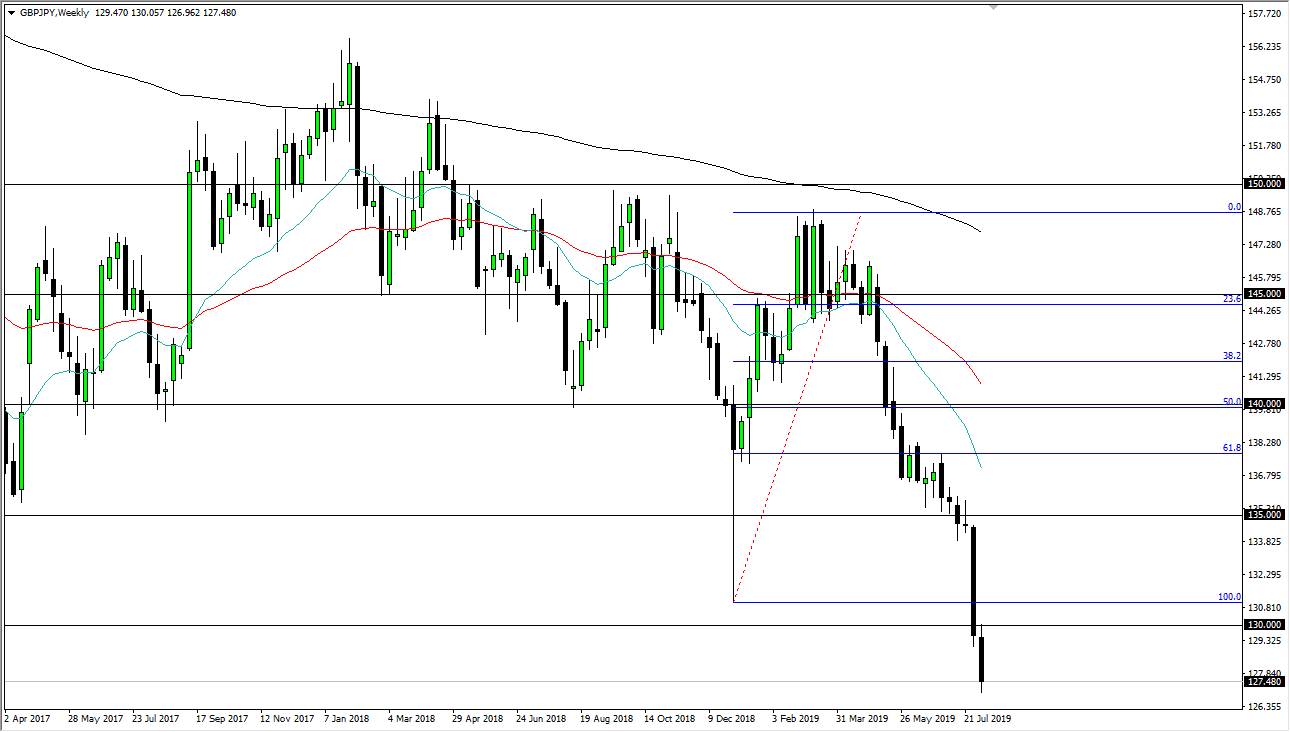

GBP/JPY

The British pound has fallen again after initially trying to recover this week, finding the ¥130 level be far too expensive. The resistance there to turn the market back down towards the ¥127 level on Friday, where we bounced slightly. However, this is a scenario where I find it difficult to imagine that the British pound continues to pick up, quite frankly because the Brexit still is a major mess. Look at short-term rallies as selling opportunities. If we break down below the ¥127 level, then we will go looking towards the ¥125 level.

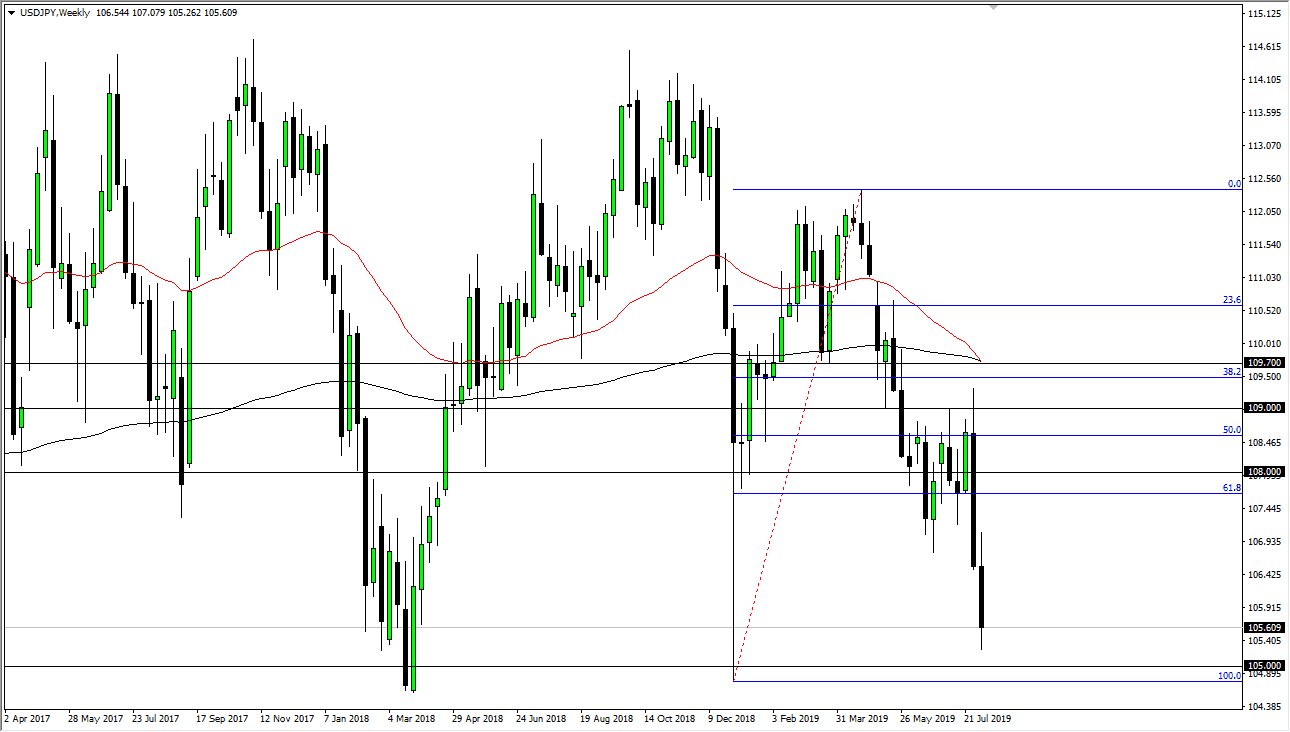

USD/JPY

The US dollar struggled against the Japanese yen after initially trying to recover during the week. This is a market that is extraordinarily bearish now, as it is so highly tethered to global risk appetite. The ¥105 level underneath seems to be an area of significant support, mainly due to the 100% Fibonacci retracement level and of course the large, round, psychologically significant figure. As risk continues to be a major issue out there when it comes to all things market related, I suspect that rallies will continue to be sold.

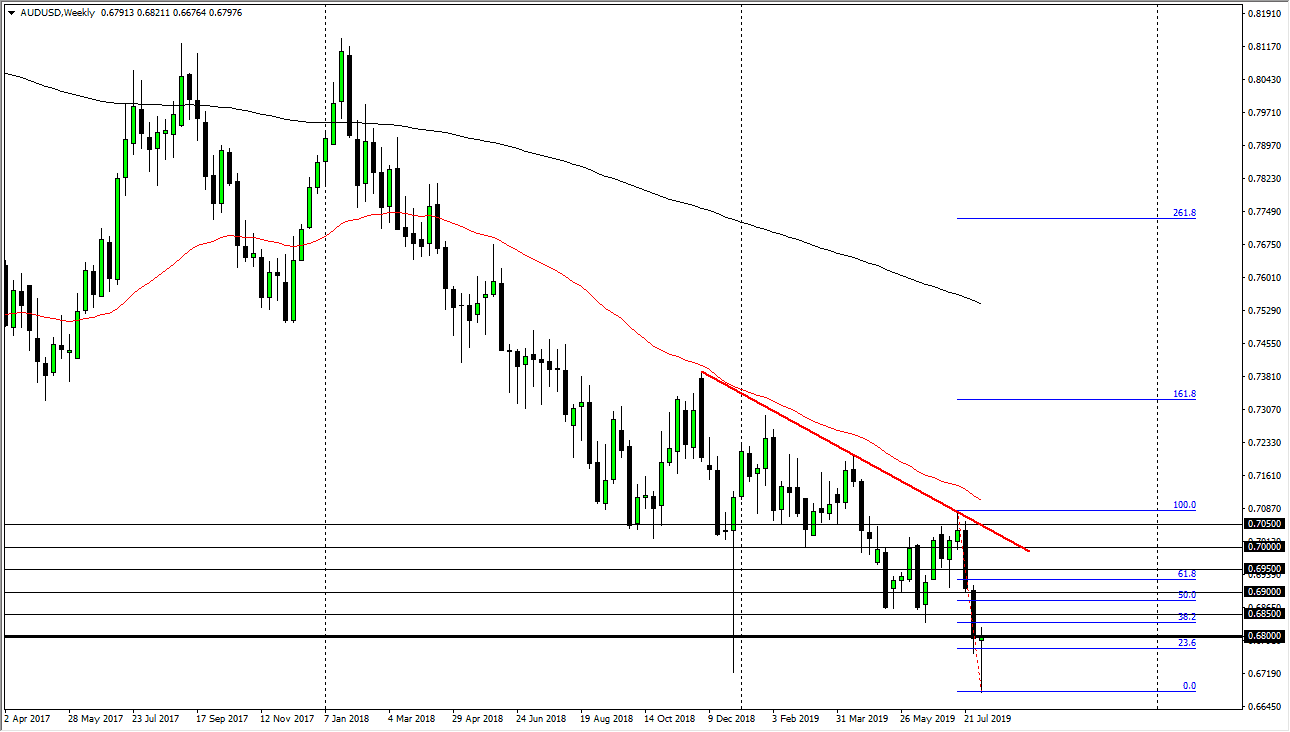

AUD/USD

The Australian dollar has fallen during the week only to turn around and recover quite nicely. It ended up forming a hammer for the week, which of course is a very bullish sign, and as the hammer is hanging about the 0.68 level, it’s likely that the bounce that’s coming will probably be sold into as we are in such a strong downtrend. The 0.69 level above is an area where I would expect to see traders come in and push this market lower. There’s a lot of risk out there and that doesn’t favor the Aussie dollar.