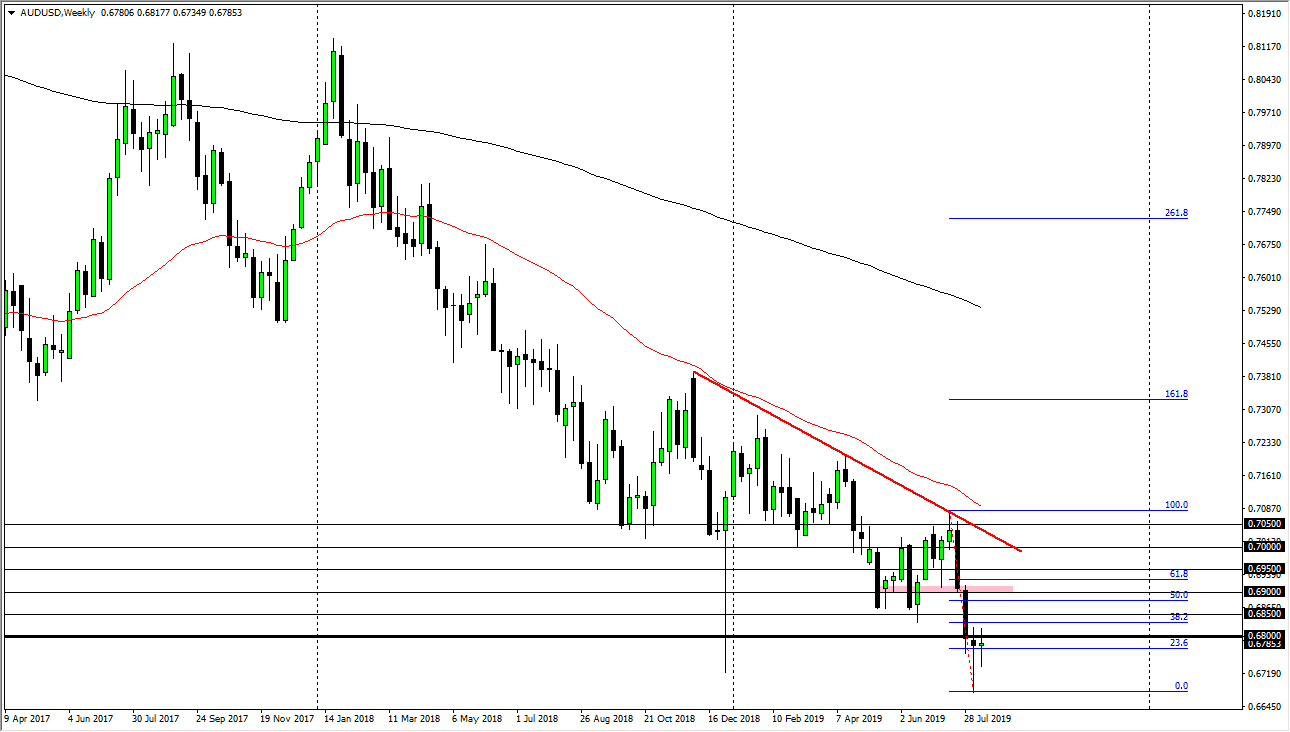

AUD/USD

The Australian dollar has gone back and forth over the last couple of days, forming a very neutral candle. At this point it looks as if the 0.68 level will continue to cause issues, but if we were to break above there it’s likely that we will find quite a bit of resistance at the 0.69 handle. All things being equal, I think that the market is still going to struggle to hang on to any gain so I’m looking for signs of exhaustion in order to start selling.

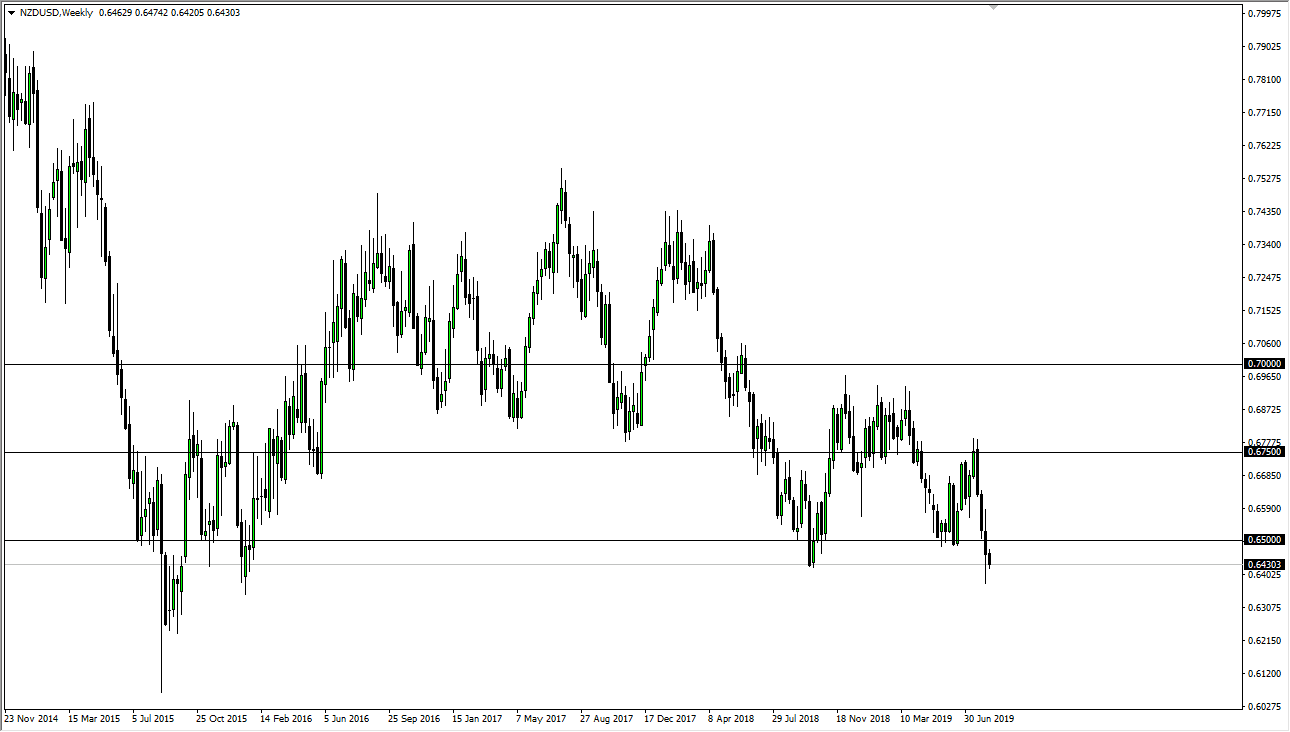

NZD/USD

The New Zealand dollar has fallen a bit during the week, as we stay well below the 0.65 handle. At this point, I think we are going to test the 0.64 level and then eventually break down through there. It makes quite a bit of sense as there is a lot of “risk off” attitude out there, which works against the value of commodity currencies such as the New Zealand dollar. I believe in selling short-term rallies as long as we stay below the 0.65 handle which I look at as a ceiling.

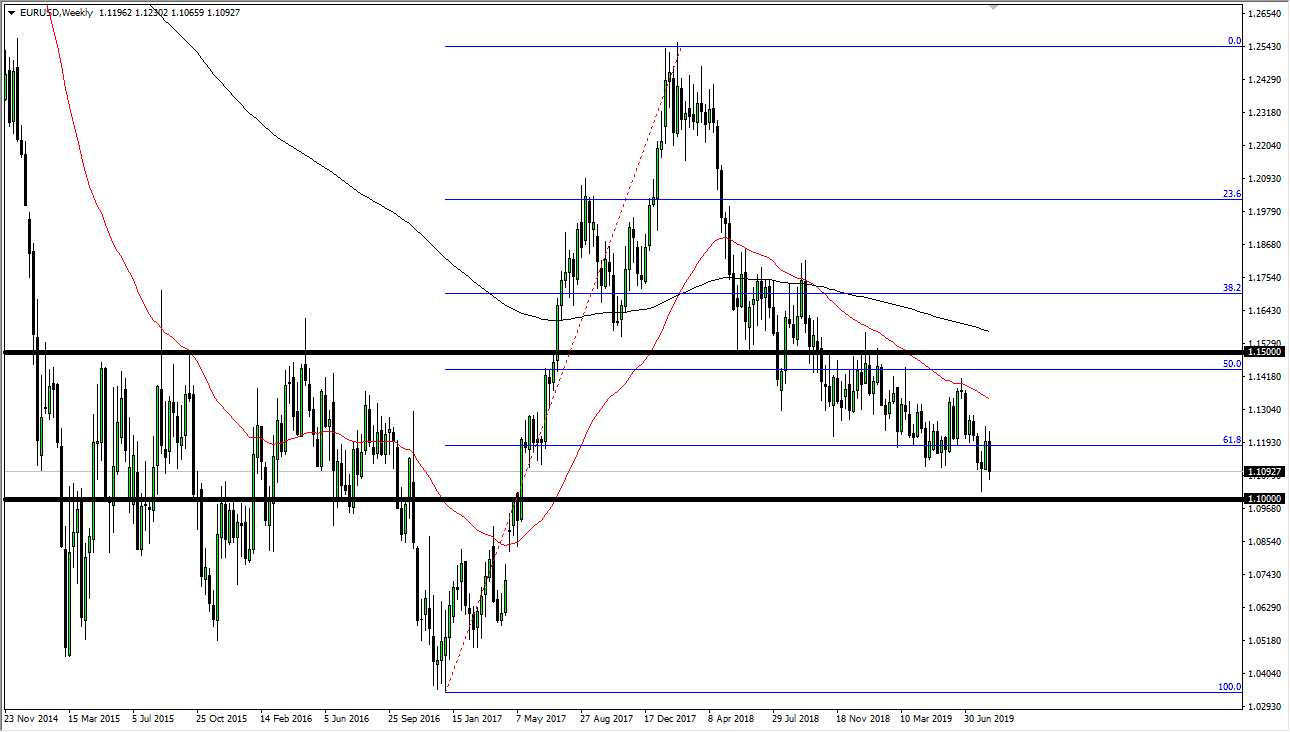

EUR/USD

The Euro initially tried to rally during the week but then broke down rather significantly. As economic numbers continue to deteriorate in the European Union, I believe that this pair will continue to drift towards the 1.10 level underneath. At this point, the market is probably one you should be looking for short-term rallies, as although there is noise in this pair, it’s obvious that the downtrend continues. Eventually I believe that this market will probably break down through the 1.10 level and go looking towards the 100% Fibonacci retracement level, but that’s a longer-term call obviously. In the short term I’m looking for exhaustion to take advantage of.

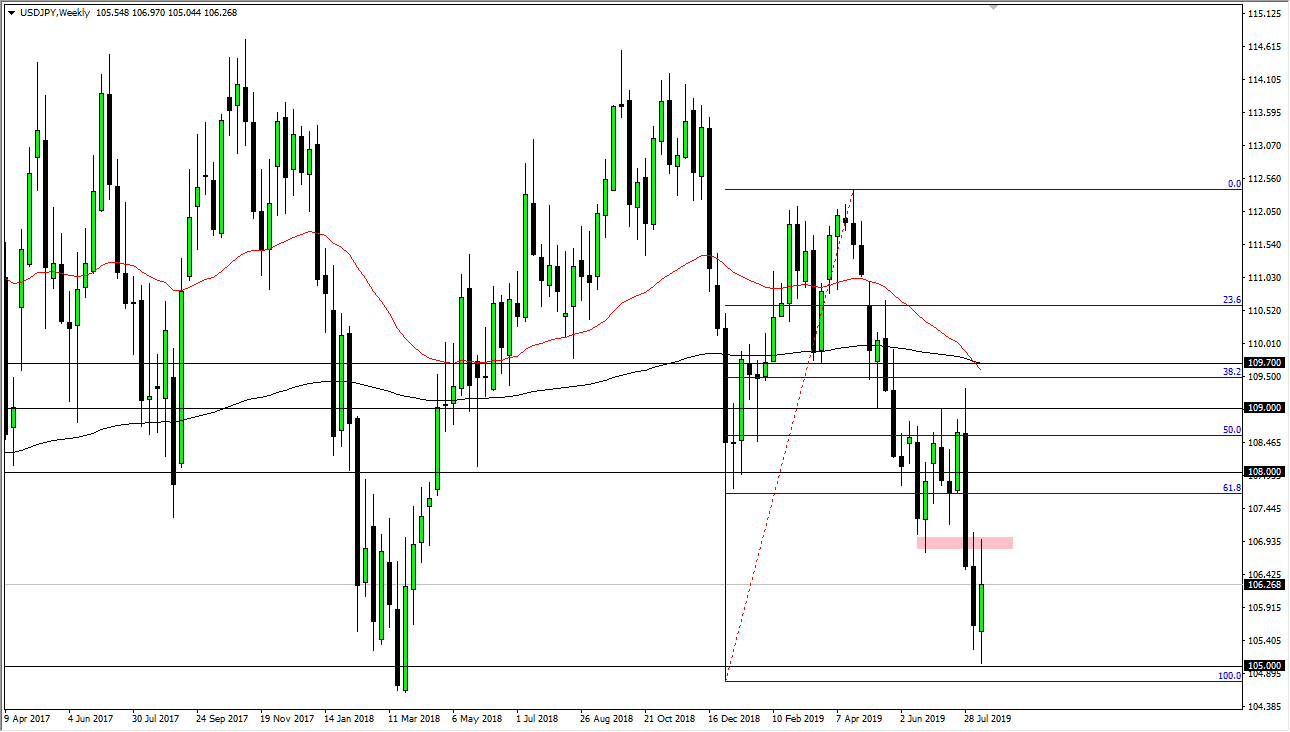

USD/JPY

The US dollar has been back and forth during most of the week, forming a slightly positive candle stick, but at this point it looks likely that we will continue to see the ¥107 level above offer resistance, while the ¥105 level underneath offer support. Ultimately, expect the lot of back-and-forth range bound trading.