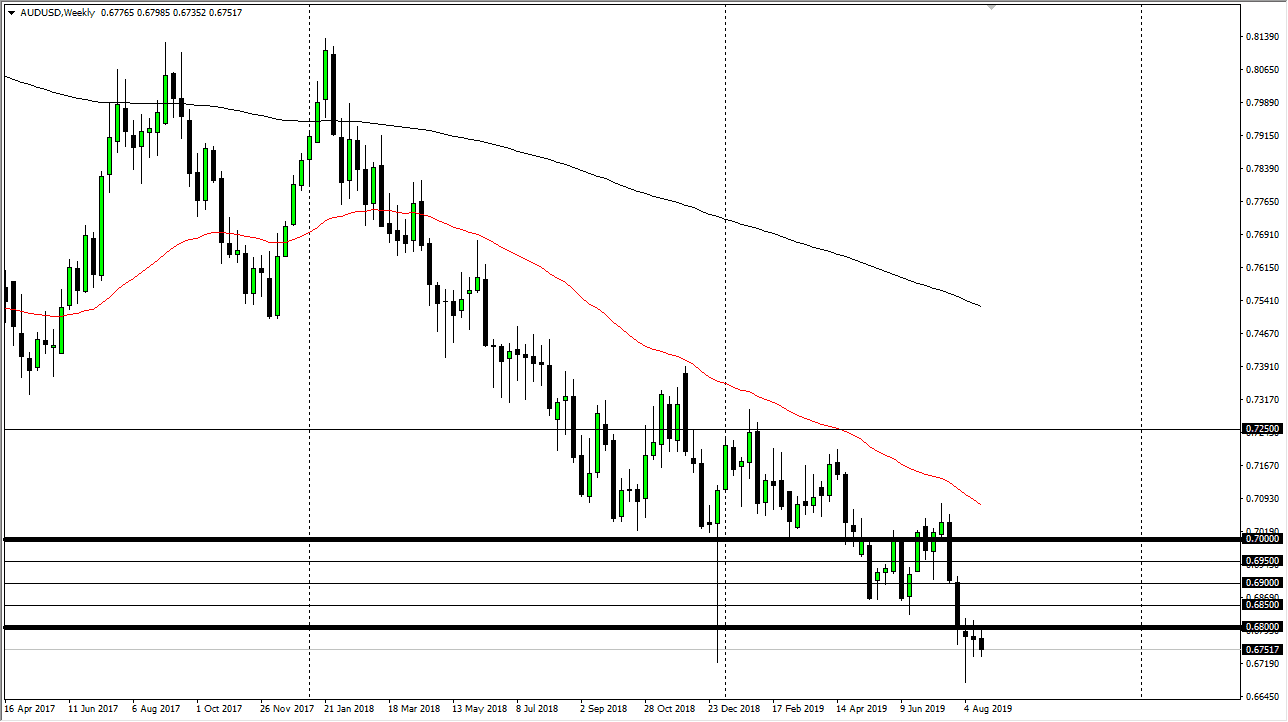

AUD/USD

The Australian dollar initially tried to rally during past week, but then broke down from the 0.68 level. At this point, the market looks as if it is continuing to push lower. The Australian dollar is highly levered to the US-China trade situation which of course hasn’t made and progress and will likely get worse before it gets better. Friday, the Chinese announced a retaliatory measures which is likely to aggravate issues. With that, I would anticipate that short-term rallies continue to be selling opportunities with a ceiling near the 0.68 handle.

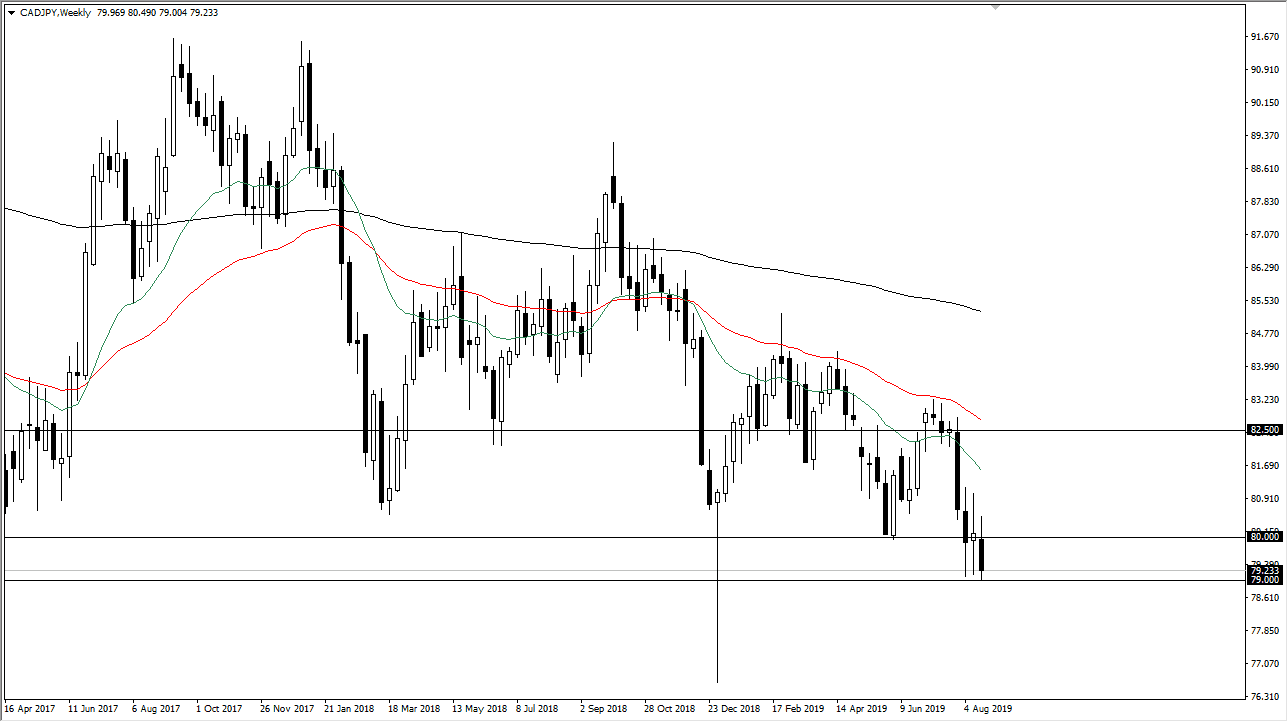

CAD/JPY

The Canadian dollar initially tried to rally against the Japanese yen last week, but as all risk appetite-based markets have shown, we had a very poor close to the week. At this point, if the Canadian dollar drops down below the ¥79 level, it’s likely that we will continue to go lower, perhaps reaching down to the ¥77 level. If we rally at this point, I suspect that it’s going to be very difficult to break above the ¥80 level, as it looks to be massive resistance. Ultimately, this is a market that continues to show a lot of weakness and with the oil markets falling, that should provide even more bearish pressure here.

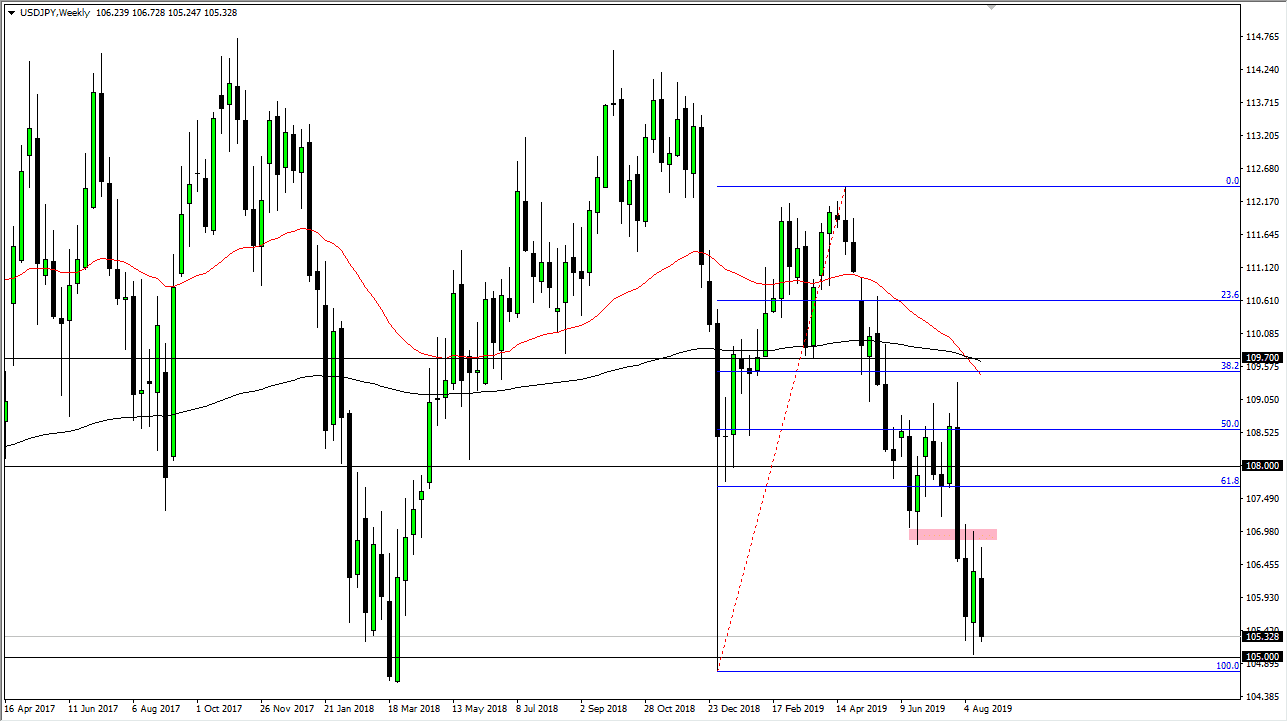

USD/JPY

The US dollar initially tried to rally during the past week but continues to find plenty of resistance near the ¥107 level. However, we continue to see negative news out there and it has sent this market down to the ¥105 level. At this point, if we break down below that level and then perhaps even the ¥104.75 level, we would then break the 100% Fibonacci retracement level and that could send this market much lower. At that point I would be looking for the ¥102.50 level, and then possibly even the ¥100 level. This would be a major “risk off” move, which looks very likely at this point.

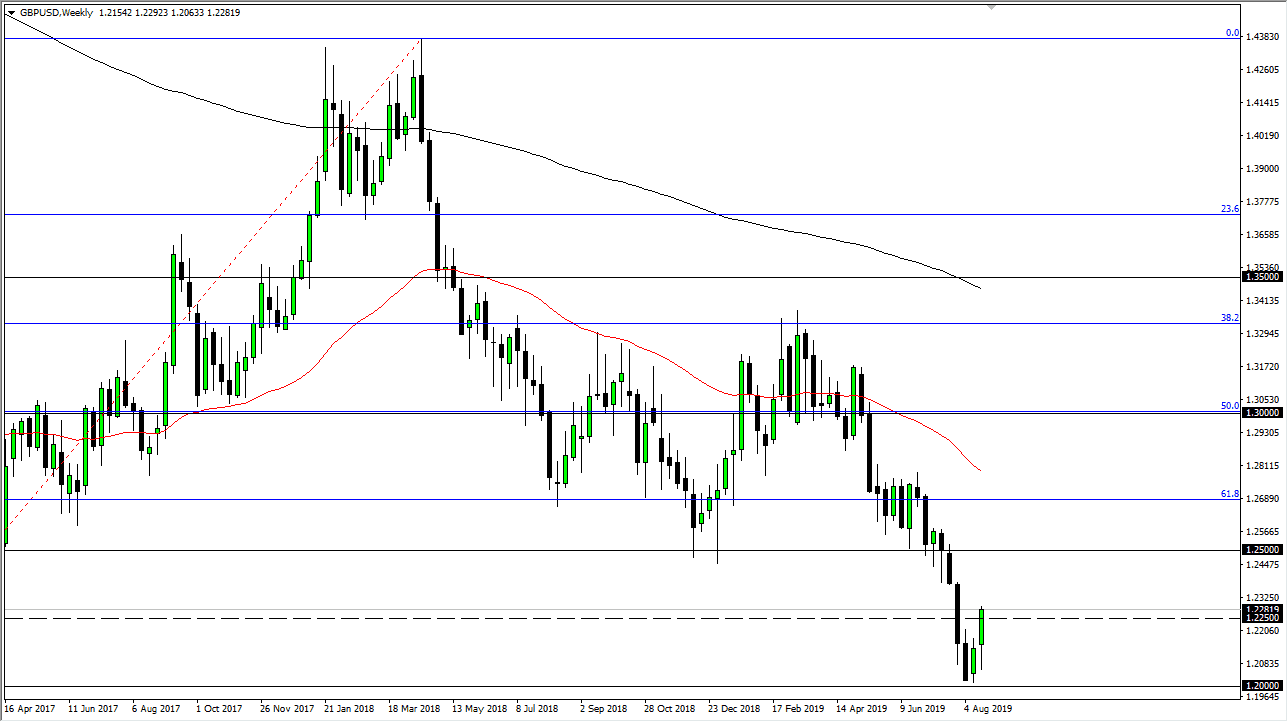

GBP/USD

The British pound initially fell during last week but then turned around as it seems we are getting a bit of a short-covering rally. At this point, I think that the 1.2350 level will be the beginning of resistance based upon the daily charts, and then after that the 1.25 handle. I think it’s only a matter of time before we start selling off yet again. After all, the Brexit hasn’t gotten any better, but we may have been a bit overdone and of course, the 1.20 level has attracted a lot of attention. I’m looking for signs of exhaustion and then I will jump in and start shorting yet again.