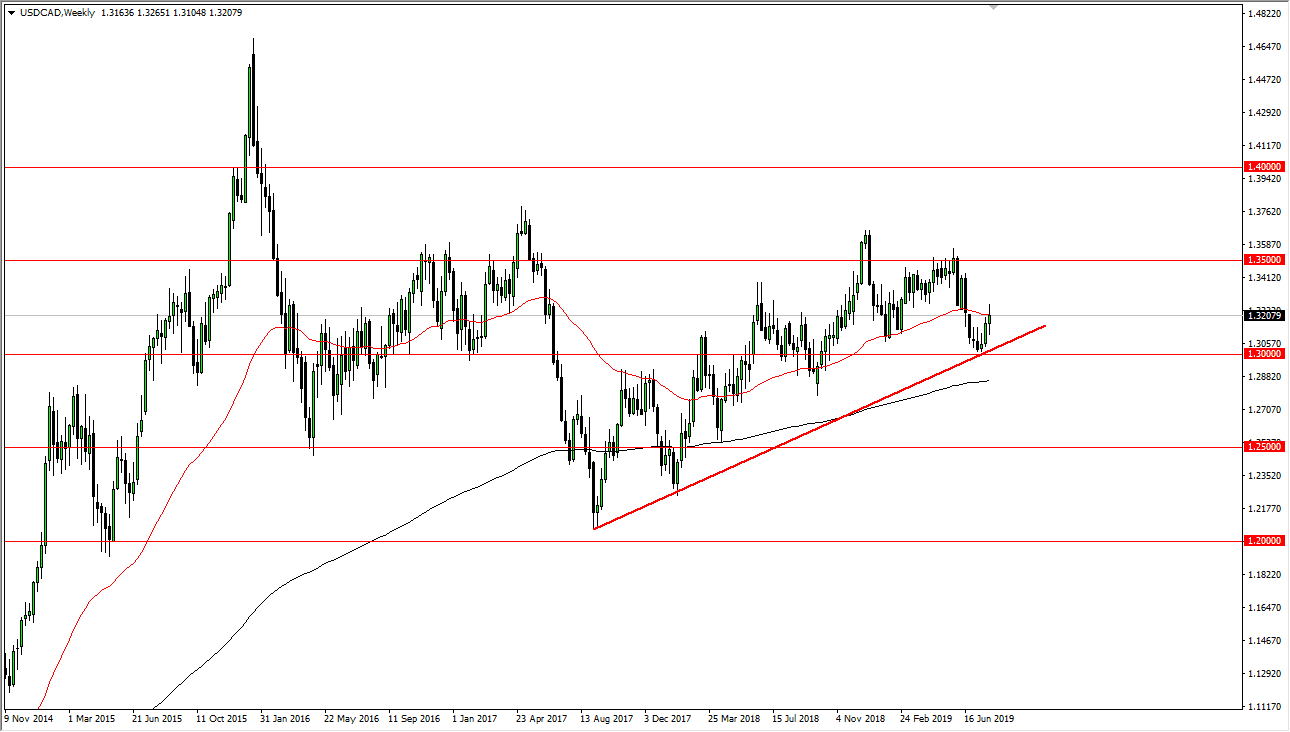

USD/CAD

The US dollar has gone back and forth during the course of the week, showing signs of confusion. What this weekly chart doesn’t show is that we have formed a couple of shooting stars in a row, but I think it’s more like we are going to see a little bit of a pullback from here. The uptrend line should continue to hold this market so I would expect a bit of a pullback, but then buyers coming back in to pick up a bit of value.

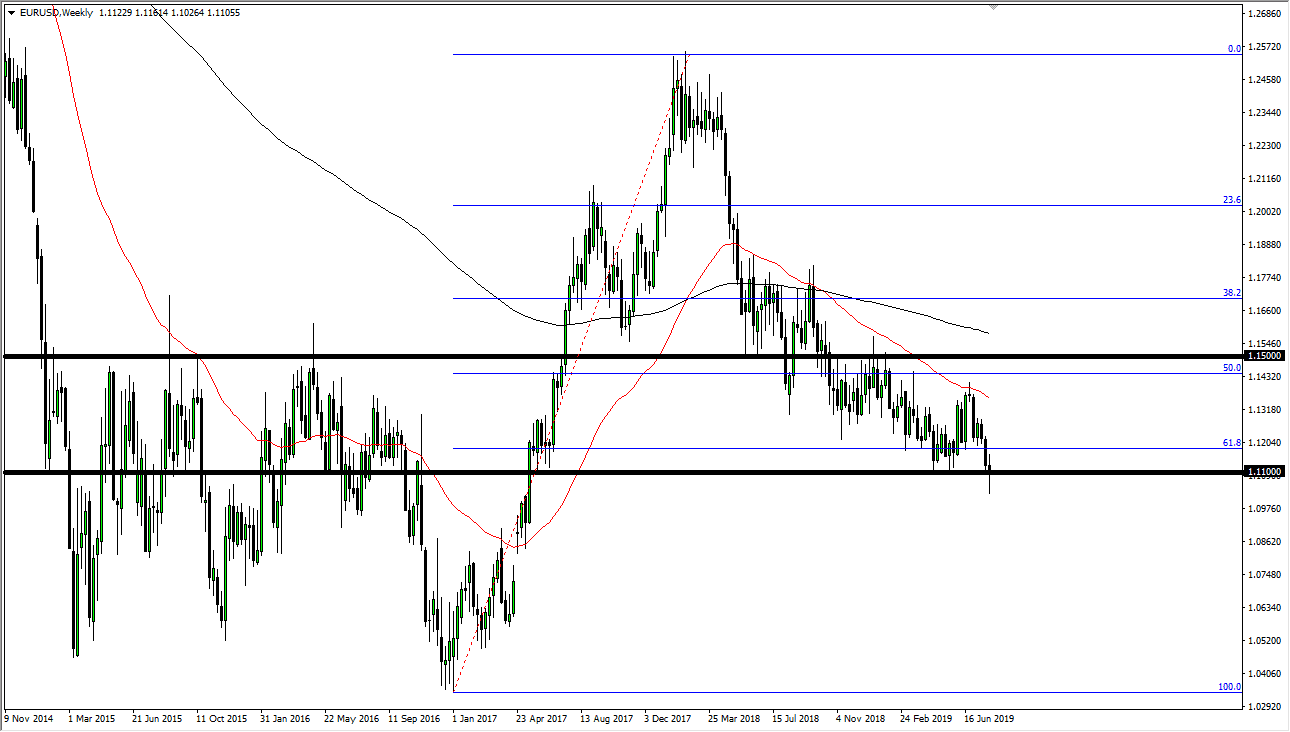

EUR/USD

The Euro broke down below the 1.11 handle underneath, and then turned right back around to reach towards that level. I think though that the market probably has an opportunity to make a bigger move if we can break above the top of the candle stick or perhaps even the bottom of the candle stick. Either way should open up an opportunity for 100 pips or so. Between the top and bottom of the weekly candle stick, I think it’s far too difficult to trade at this point.

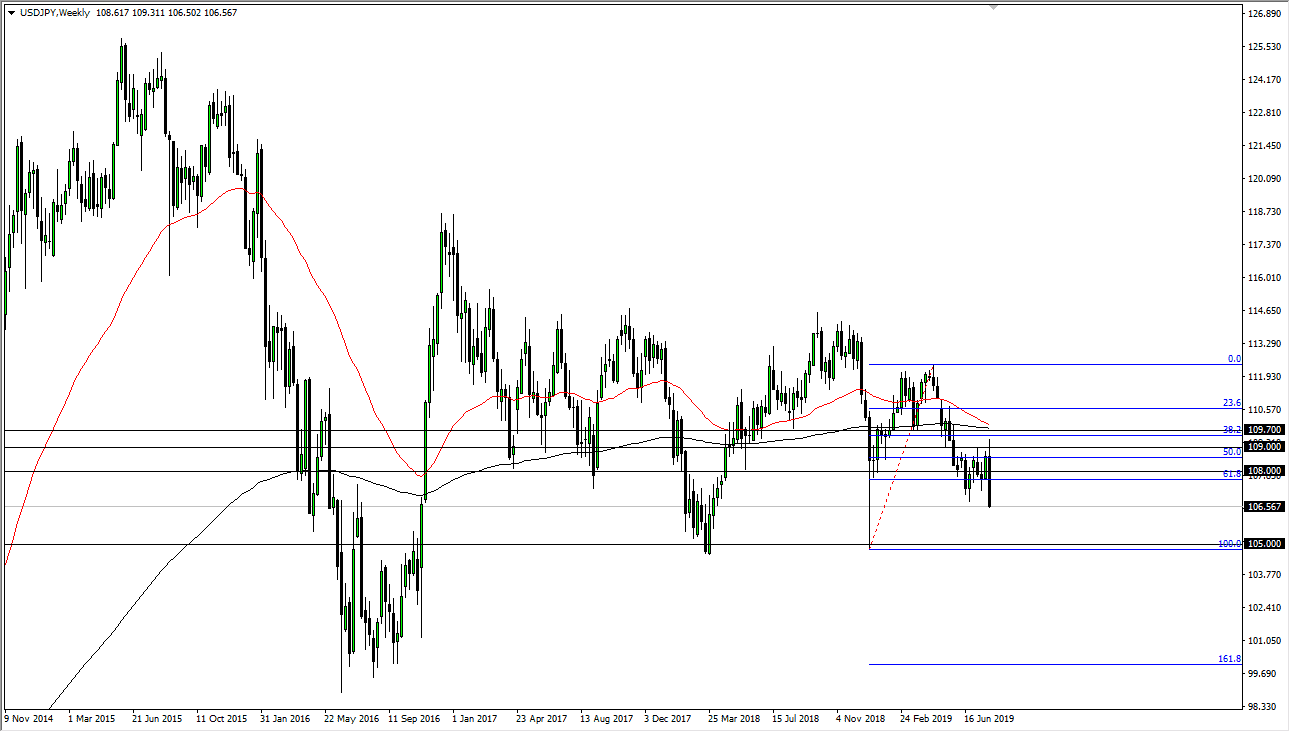

USD/JPY

The US dollar broke down significantly during the week against the Japanese yen, and even closed below the ¥107 level. Because of this, the market is likely to break down towards the 100% Fibonacci retracement level, which is closer to the ¥105 level. Overall, short-term rally should be selling opportunities, and therefore I think that the market is one that is essentially a “two speed market”, offering selling opportunities on short-term charts, and a simple “sell and hold” situation on the longer-term chart.

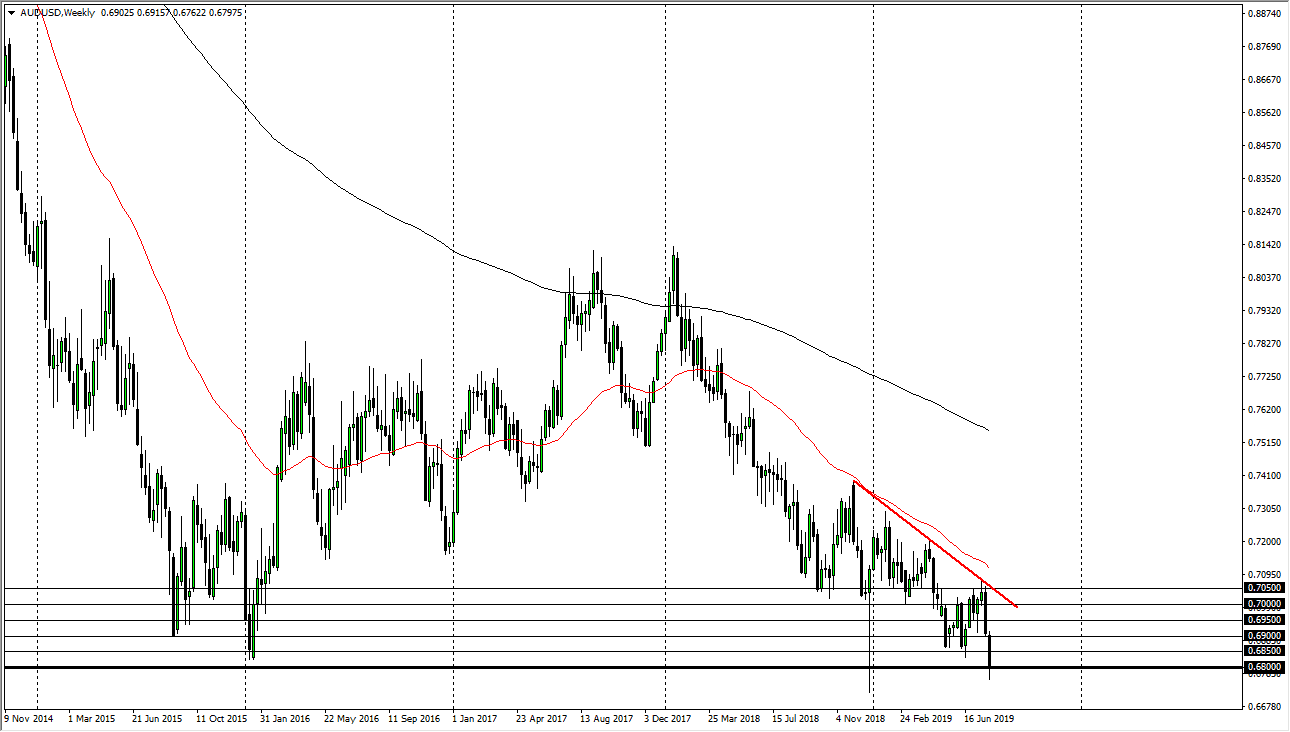

AUD/USD

The Australian dollar has broken down below the 0.68 handle, which of course is an area that has been important more than once. I think that the Australian dollar is one that you should be selling on rallies, and we should have a bit of a bounce between now and then looking for entries every 50 pips or so.