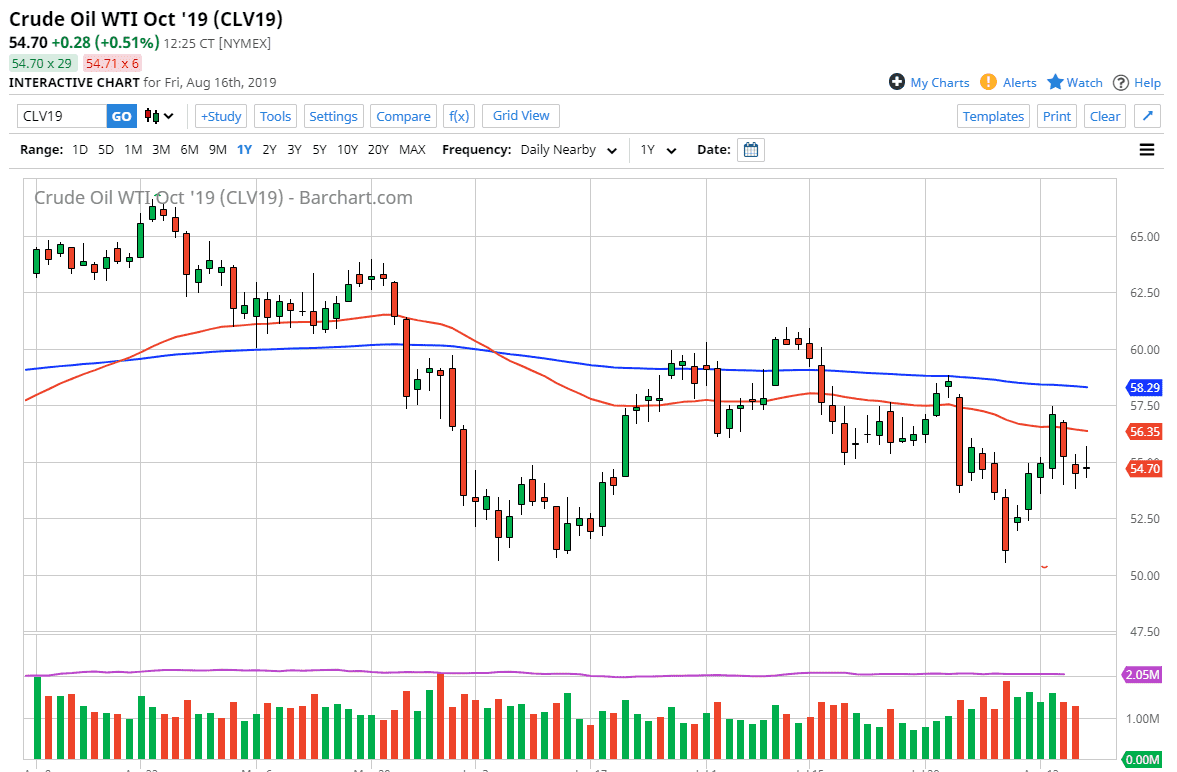

The WTI Crude Oil market initially tried to rally during the trading session on Friday but then turned around to form a bit of a shooting star. I find it very interesting that the shooting star is forming right at the $55 level, an area that will attract a lot of attention due to the psychological importance of this round figure. Beyond that, we had pulled back from the 50-day EMA so that shows even more negativity.

When you look at the weekly charts, we had formed a hammer from the previous week, and now are forming a bit of a shooting star for this one. This tells me that the market is going to continue to struggle, and furthermore when you look at the Brent market you can see that the Brent market looks even worse. With this, and the fact that these markets tend to move in the same direction, I believe that there will be a bit of a knock on effect over here.

Short-term rallies are to be sold, and I believe that the 50-day EMA will continue to be massive resistance. If we can break above there then obviously that’s a good sign but I do not anticipate that as the highs continue to get lower going along. We are in fact in a downtrend, but that doesn’t mean we will get the occasional pop. Longer-term, I anticipate that this market is going to go down to the $52.50 level, possibly even the $50 level after that. Crude oil is in a lot of trouble, not only because of the strengthening US dollar, but also the slowing down of global growth and therefore by extension the slowing down of global demand. At this point, I personally am not interested in going long for this asset.