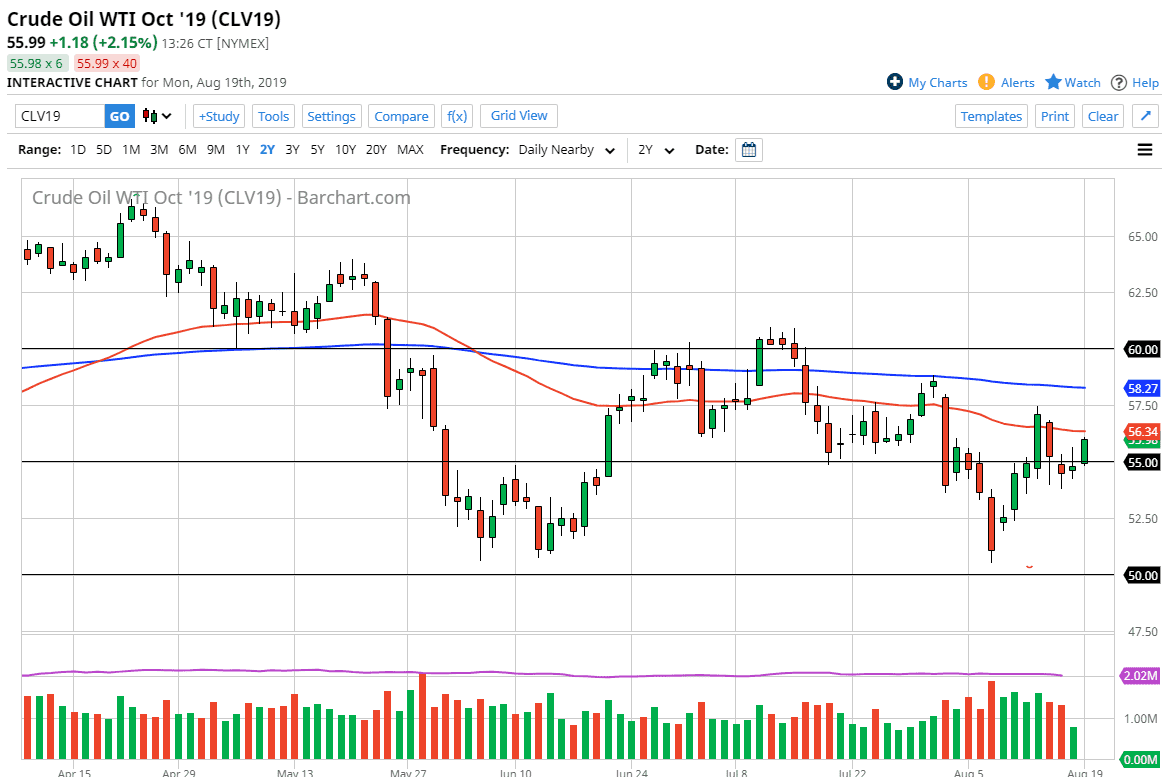

The West Texas Intermediate crude oil market has rallied quite nicely during the trading session on Monday, and even broke above the top of an inverted hammer from Friday. That being said, even though it’s a very bullish sign there are a lot of places where we could see a lot of resistance above, so at this point I’m waiting for an opportunity to sell this market yet again.

Although the candlestick is very strong looking, we are testing the 50-day EMA. The 50-day EMA is colored in red on the chart and has offered a certain amount of psychological resistance. Above that, the 200 day EMA is painted in blue, and it is the top of the resistance barrier. At this point, I believe that it’s only a matter of time before sellers will come back into this market and punish exhaustion. I expect that exhaustion is imminent because the fundamental picture for crude oil isn’t that strong and therefore it’s likely that the demand concerns continue to weigh upon this market. Beyond that, we are in a bit of a small downtrend lately, and I think with so many global concerns, it’s difficult to imagine a scenario where crude oil will suddenly get a huge boost.

Keep in mind that part of the boost that we did get on Monday is probably due to the headline noise overnight that the United States is starting to soften its stance against China. However, we have seen that happen more than once, and then headlines will come out that suggests more tariffs are coming. Honestly speaking, this is a volatile market and I think it will continue to be due to the fact that there is a lack of demand, which supersedes any of the US-China noise. However, the trade situation getting resolved could at least help the idea of more global demand.

With the Russians and the Saudis unlikely to be able to come to an agreement on production cuts, it’s very likely that we will continue to see a massive oversupply of crude oil anyway. At the first signs of exhaustion above the 50-day EMA, I am more than willing to short this market. That being said, I do recognize that the area between $55 and $54 underneath could offer a bit of support.