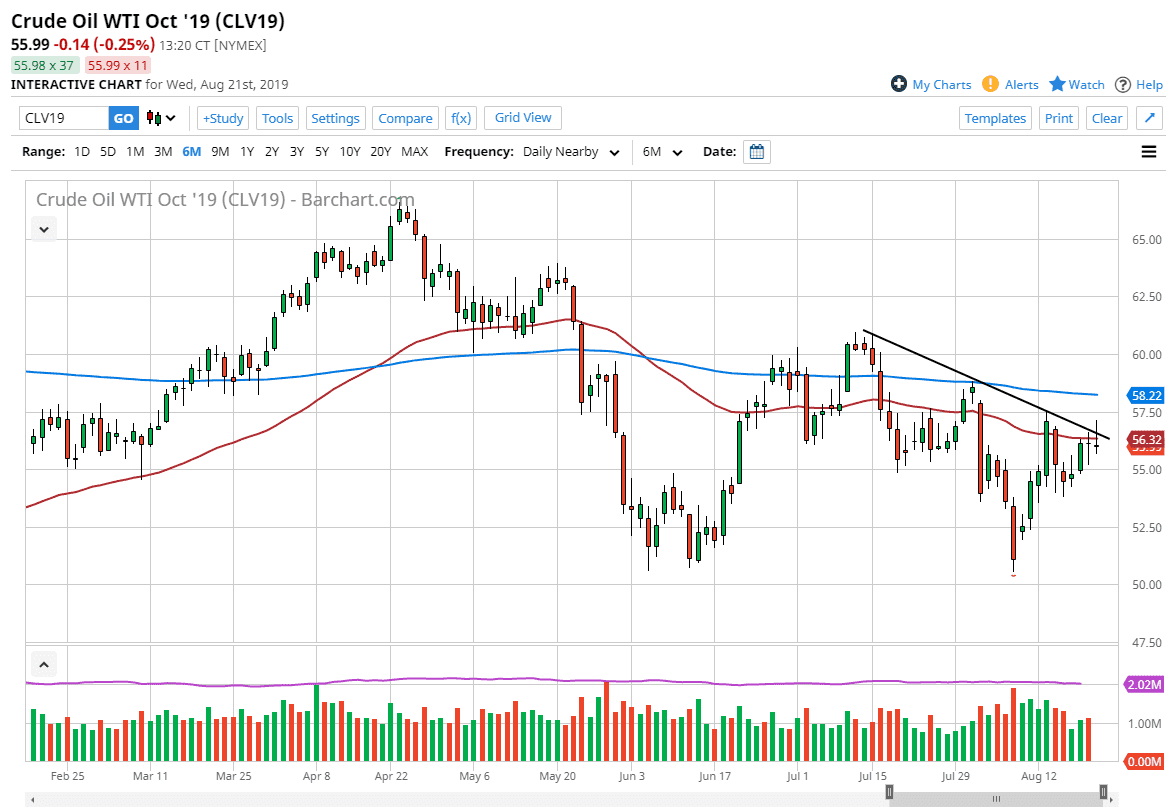

The West Texas Intermediate crude oil market initially tried to rally during the New York trading session on Wednesday but found enough resistance above the downtrend line and the 50 day EMA to turn around and form a somewhat resistive candlestick. By doing so, it looks as if we are ready to roll over and that could spell quite a bit of trouble for this market. Granted, we did form a hammer during the previous session but a smaller than expected draw on inventories has put the question of whether or not there’s going to be enough demand out there in the forefront yet again.

The candlestick is very poor looking at the moment, and it should not be much of a surprise to see this market go to the $55 level next. Alternatively, if we were to break above the top of the candle stick, breaking above the $57.50 level could send this market much higher. Looking at this chart, I think it’s only a matter time before the sellers come in and punish any type of rally based upon the action that I have seen over the last couple of days.

At one point, I did suggest that perhaps we were going to continue to bounce around between $50 on the bottom and $60 on the top, and that a move above the downtrend line could send this market towards the $60 level. However, we couldn’t close above there on the daily candle stick and it’s obvious that it is a little bit of a false breakout. With the conflicting hammer, it shows just how noisy this is going to be, and that makes quite a bit of sense as central bankers are meeting in Jackson Hole over the next couple of days, and I think that it’s going to come down to what kind of stimulative measures a lot of the “big guys” are willing to put together. The idea of course is that if they stimulate economies around the world, that should send demand for crude oil higher. That being said, I think any rally at this point is probably going to be somewhat short-lived based upon the continuing trade war and to be honest, we are late in the business cycle regardless of what central banks try to do. I am much more comfortable shorting oil that I am buying it right now.