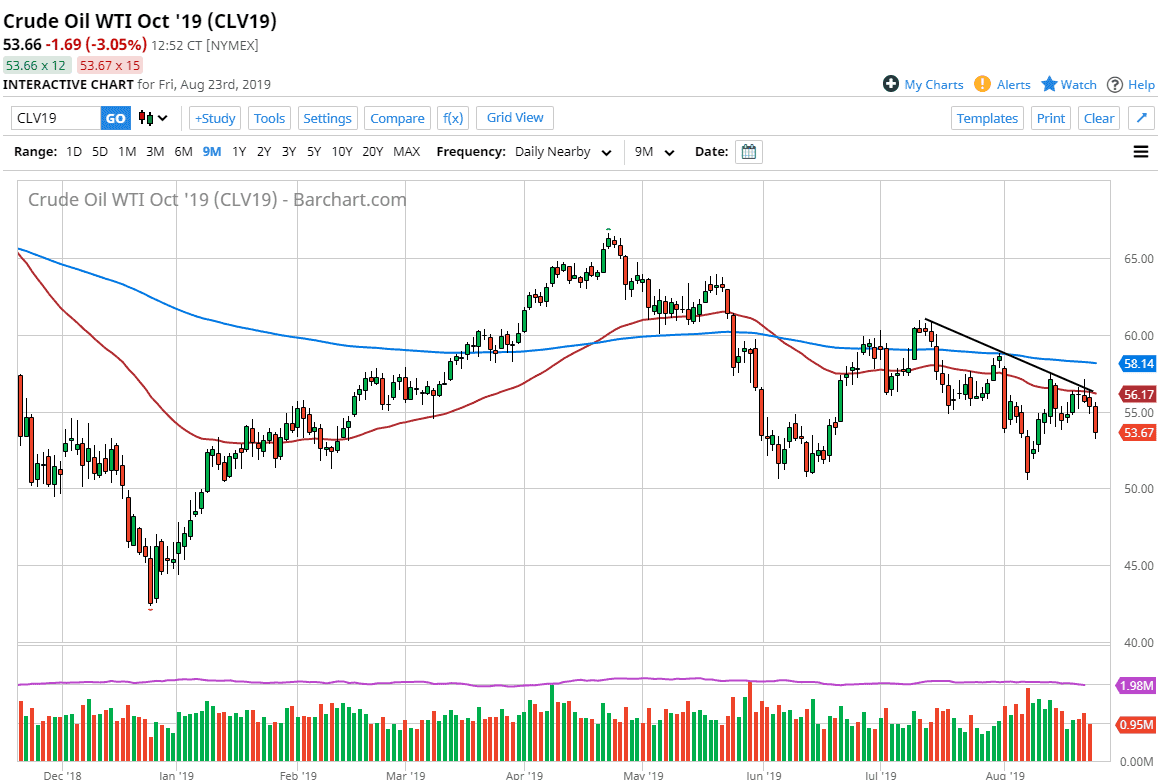

The WTI markets have broken down significantly during the trading session on Friday, slicing through the $55 level. By doing so we not only broke down through that round figure, but we also have reached below the $54 level, which I looked at as a “support zone” underneath. Now that we are through the end zone it’s only a matter of time we could continue to reach much lower, perhaps down to the $50 level.

Keep in mind that the markets will continue to pay attention to the global growth situation, which of course is very weak at this point. Ultimately, I think that the downtrend line that had held this week should continue to push this market to the downside. The 50 day EMA is just above there as well, so I think at this point any rally should be a nice selling opportunity near that area, but quite frankly I don’t think we get there anymore. The breakdown that we have seen show signs of weakness as the moving averages are tilting lower, and it’s very likely that we will go looking towards the major support level underneath at the $50 handle. That’s an area that has been massive support, so I think at this point it’s likely that you are going to see a bounce from there.

The main reason I see crude oil falling is that we not only have an oversupply issue, but we also have a global demand issue. While the Americans continue to pump out massive amounts of crude oil from the Dakotas and Texas, the rest of the world is slowing down in general, driving down the previously mentioned demand. It’s hard to imagine a scenario where the US and China continue to escalate the trade war where we will get a huge demand for energy. Quite frankly, as exports shrink in China, it’s very likely that we won’t see much demand for petroleum via shipping or trucking. Ultimately, I think feeding the rallies on short-term charts will probably continue to work. I think that the $55 level will be the first major barrier above, and then of course the downtrend line and the 50 day EMA as I had mentioned previously. If we were to break down below the $50 level, that would be a massively negative turn of events in this market, leading to a collapse.